|

Welcome to the IADI's e-Newsletter

The International Association of Deposit Insurers (IADI) is pleased to provide the latest issue of its e-Newsletter.

The e-Newsletter keeps you up-to-date on information about IADI activities from

January

to June 2020, as well as on upcoming IADI activities. |

|

|

This issue includes:

|

|

|

|

|

Message from David Walker, IADI Secretary General

|

|

|

|

|

|

|

Let me express my sincere appreciation to all IADI Members, Associates and Partners for your efforts, and support, in the furtherance of IADI’s mission over the past six months. The past six months have seen a profound period of adjustment for deposit insurers in dealing with the global Covid-19 pandemic. I believe that in our experience there has been no greater change that has impacted our workplaces as quickly as Covid-19.

IADI has been quick to adapt its services to the needs of Members, particularly in adjusting to a more virtual work environment. We held our first virtual Executive Council (EXCO) Meetings on 29 May and 12 June. Although it was a very different format from our usual EXCO Meetings, I am happy to report that it worked well.

|

|

|

|

Through IADI Surveys beginning in the spring of 2020 we have been collecting and sharing the experiences of Members on the impact of the pandemic on their deposit insurance and financial systems. The full reports are available here but some of the key highlights reported have been:

| |

1) The initial impacts of the pandemic on financial systems were severe but mitigated to a degree by intervention from central banks, governments, supervisors and deposit insurers. |

| |

2) Extensive health controls were introduced, and are still in place, in many jurisdictions and these have had an ongoing impact on deposit insurance system operations. |

| |

3) Most deposit insurers were quick to implement their Business Continuity Plans (BCPs) and crisis management frameworks to ensure key functions and operations are maintained (e.g. premium collection and reimbursement systems). |

| |

4) Enhanced information sharing with other safety-net participants took precedence in the majority of systems surveyed. |

| |

5) Greater efforts were made to keep the public aware and informed about deposit insurance. |

| |

6) Numerous deposit insurers acted to temporarily suspend or reduce some requirements, delay previously planned stress testing, and reduce data collection to critical items. |

| |

7) Monitoring of member institutions has been heightened including updating and revising periodic risk assessments. |

| |

8) Unlike the financial crisis of 2008, most deposit insurers have not opted to increase deposit insurance coverage. |

As we take stock of the current situation and work going forward, we will continue to leverage technology to deliver training and capacity building to our members considering the various limitations on international travel and gatherings we continue to experience.

In other news, following the approval of the IADI Business Plan and Budget for FY 2019/20-21 at the 18th Annual General Meeting in October 2019, work has progressed on its implementation. This has included initiating the recruitment of additional staff dedicated to enhancing IADI’s training and capacity building resources. Meanwhile, other important areas where work has continued included the Training and Technical Assistance Council Committee (TTAC), supported by the IADI Secretariat, has moved further to establish a Core Curriculum for workshops designed for differing audiences and establishing an Expert Training Strategy. This Strategy seeks to create a structured programme for training IADI Members interested in developing an in-depth knowledge of the IADI Core Principles, becoming capable of leading Self-Assessment and Technical Assistance Program (SATAP) reviews, supporting Technical Assistance Workshops (TAW), and supporting or participating in the IMF/World Bank FSAP reviews.

In other areas, IADI’s Core Principles and Research Council Committee (CPRC) and the Secretariat’s Research Unit (RU) have been working in numerous areas such as the publishing of papers on deposit insurance and financial inclusion, guidance on public policy objectives, a research paper on the evaluation of differential premium systems and the posting for public consultation of a paper on risk management and internal control systems for deposit insurers. IADI has also been intensifying its emerging issues initiatives through its newly established Financial Technology Technical Committee.

Looking further afield, the EXCO came to an agreement to establish a Strategic Planning Working Group (SPWG) during the 62nd and 63rd EXCO Meetings held on 29 May and 12 June. The objective of the SPWG will be to develop a new IADI Strategic Plan for the FY 2021/22 to 25/26 period and to review and seek improvements to IADI’s Differentiated Fee Model (DFM).

During the coming months we look forward to working to support you in dealing with the impact of the Covid-19 pandemic, implementing the IADI Business Plan and moving forward in developing a new Strategic Plan for the Association.

We also look forward to engaging with you at our meetings, including the 19th Annual General Meeting and Annual Conference which is scheduled in Basel, Switzerland, the week of Monday 30 November to Friday 4 December 2020.

The entire IADI Secretariat Team wishes you the very best of success in these challenging times.

David Walker

Secretary General

International Association of Deposit Insurers

|

|

|

|

|

|

|

Change of Date and Location: 30 November - 4 December 2020 / Basel,

Switzerland

-

19th IADI Annual General Meeting and Annual Conference

|

|

|

|

|

The IADI Annual General Meeting (AGM) originally scheduled for the week of 26 October 2020 in Buenos Aires, Argentina has been cancelled.

The 2020 AGM and Annual Conference week will be held instead at the Bank for International Settlements (BIS) in Basel, Switzerland the week of 30 November to 4 December 2020.

IADI Members are kindly requested to take note that the 2020 AGM is scheduled for Thursday 3 December 2020.

Due to ongoing developments around the Covid-19 pandemic situation the IADI Secretariat will be monitoring the situation going forward for all IADI Members and if there are any further changes related to the 2020 AGM and Annual Conference week, we will be communicating this to the IADI Membership on a timely basis.

|

|

|

|

|

|

Short summary of Executive Council Meetings

|

|

|

|

|

|

61st Executive Council Meeting – Basel, Switzerland 61st Executive Council Meeting – Basel, Switzerland

The 61st Executive Council (EXCO) Meeting and associated Committee Meetings were hosted by IADI on 11-13 February 2020 in Basel, Switzerland.

During the EXCO Meeting, the Secretary General gave a presentation on the 2020 EXCO Chair and IADI President succession procedure including the election process expected to commence in August 2020. The EXCO Members had an active discussion on developing IADI’s new strategic plan for the 2022-26, and there was a broad consensus to expedite this work as soon as possible by a proposed working group.

The EXCO approved new EXCO Vice Chair, Chairpersons of the Asia-Pacific Regional Committee and the Regional Committee of North America. New Member application from Tunisia was also approved.

| |

|

|

62nd and 63rd EXCO Meeting – held virtually 62nd and 63rd EXCO Meeting – held virtually

The 62nd and 63rd EXCO Meetings were virtually held on 29 May and 12

June 2020.

During these virtual EXCO Meetings, the EXCO

Members focused their discussion mainly on the establishment of the

Strategic Plan Working Group (SPWG). As a result of two consecutive

meetings, the EXCO reached agreement on the establishment of the IADI

SPWG with the objective of developing a new IADI Strategic Plan for

2022-26 and review the Differentiated Fee Model (DFM) introduced in FY

2020/21.

At the 62nd EXCO Meeting, the Secretary General gave

a presentation on the impact of the Covid-19 pandemic on Deposit

Insurance, followed by updates from Regional Committee Chairpersons on

their experiences related to Covid-19.

|

|

|

Announcements regarding Secretariat Members

|

|

|

|

|

Farewell to former Secretariat members

The IADI Secretariat wishes to thank Senior Policy and Research Advisor (SPRA) Ms

Kumudini Hajra, upon completion of her term for her valuable service to the Association. Kumudini has been instrumental in leading the Secretariat Research Unit’s development and articulation of deposit insurance and financial stability policy and research during the past four years. She provided key support to the IADI Core Principles and Research Council Committee.

She chaired the IADI Technical Committee tasked with developing the 2019 IADI Guidance Paper on the "Deposit Insurers' Role in Contingency Planning and System-wide Crisis Preparedness and Management”. Her contribution in this area has provided a relevant framework for deposit insurers to respond to the recent Covid-19 pandemic. She has authored policy papers on subjects such as digital finance, resolution funding, least cost analysis and depositor preference. She also authored a joint paper with the Financial Stability Institute (BIS) titled “Bank failure management – the role of deposit insurance” and has worked on a joint paper with the Alliance for Financial Inclusion (AFI) titled “E-money and Deposit Insurance” (to be published soon).

As IADI’s representative to the Financial Stability Board (FSB), Kumudini made a significant contribution to the work of the FSB Resolution Steering Group and Cross-border Crisis Management group as well as representing IADI in a recent FSB South Africa Peer Review. She also worked extensively on partnering with organisations such as the International Monetary Fund, World Bank as a team member for financial sector assessment of Azerbaijan, the Alliance for Financial Inclusion (AFI), and various other international organisations such as the Islamic Financial Services Board (IFSB). She also worked closely with the BIS and other standard setting bodies.

The success of the IADI Biennial Research Conferences in 2017 and 2019 was a testament to the efforts of Kumudini, who led their development, organisation and implementation. Kumudini was instrumental in the selection, development and successful implementation of the IADI Survey Data Management System and enhancement of IADI surveys. Similarly, she has worked extensively with the Financial Stability Institute (FSI) in conducting a series of joint IADI-FSI conferences and policy implementation meetings over the years. She also provided support in conducting several IADI Technical Assistance Workshops (TAWs) and made presentations at several IADI and non-IADI events.

We thank Kumudini for her valuable contributions to IADI and wish her the very best in her future endeavours.

|

|

Mr Ramadhian (Rama) Moetomo finished his secondment to the IADI Secretariat in May 2020 after two years as the Senior Policy Analyst. He has returned to the Indonesia Deposit Insurance Corporation. Rama’s contribution to the Secretariat was initially focused on external communications, including editing the IADI Newsletter and coordinating the production of the IADI Business Plan and Annual Report Publications.

More recently he joined the RU and contributed to various research initiatives, including the SPRA’s development of papers on least cost analysis and depositor preference. Rama also served as the Secretary of the IADI Member Relations Council Committee and provided considerable support to the Committee including to its task force on membership and communications. Finally, he has offered his expertise to the IADI Islamic Deposit Insurance Technical Committee, liaising effectively with the IFSB, and being instrumental in the preparation of draft IADI Core Principles for Islamic Deposit Insurance Systems.

We wish to thank Rama for his great efforts and wish him the very best in his future endeavours.

|

|

|

Recruitment of new Secretariat positions

The IADI started a recruitment process for the positions of Senior Policy and Research Advisor (SPRA), Training Assistance Analyst (TAA), Technical Assistance and Capacity Building Analyst (TACBA) and Core Principles and Compliance Assessment Advisor (CPCAA). The Secretariat has been conducting interviews for these positions, and expects to complete the recruitment process in the second half of this year.

|

|

|

|

|

|

|

Executive Council approval of new Vice Chair and Chairpersons for the two Regional Committees

|

|

|

|

|

Election of Mr Patrick Déry as the Vice Chair of the IADI Executive Council

Election of Mr Patrick Déry as the Vice Chair of the IADI Executive Council

|

The IADI Executive Council elected Mr Patrick Déry as Vice Chair of the Executive Council (EXCO) of IADI on 13 February 2020 until the next 2020 AGM, at its 61st EXCO Meeting held in Basel, Switzerland.

Mr Patrick Déry has been Superintendent, Solvency of the Autorité des marchés financiers of Québec, Canada, since February 2013. Supported by a team of close to 100 people with diverse and specialised expertise, Mr Déry is responsible for the oversight and regulation of all financial institutions licensed by the AMF to carry on business in Québec, which comprise the Resolution and Deposit Insurance mandate.

|

During his career, he has held several high-level positions within the Québec civil service, including some 12 years at the Québec Ministry of Finance, where, among other contributions, he helped manage the impacts of the 2007-2008 financial crisis on major financial institutions operating in Québec. Mr Déry also served as a member of the Board of Directors of Hydro-Québec from October 2012 to December 2014.

Mr Déry was also appointed as Chairperson of IADI’s Regional Committee of North America on 1st February 2020 for a three-year term. In addition, Mr Déry was recently appointed as Leader of a newly established working group which proceeds with the strategic planning of IADI and reviews the Differentiated Fee Model introduced in FY 2020/21.

The Vice Chair of the Executive Council will act for the Chair of the Executive Council in the event of the Chair's absence. When acting for the Chair, the Vice Chair is primarily responsible for the effective operation of the Executive Council, and for making presentations and representing the Executive Council as appropriate. The Vice Chair assists the Chair in ensuring that the relationship between the members of the Executive Council and the Secretary General facilitates IADI fulfilling its mandate.

Mr Déry stated that he would ensure his commitment and collaborative experience is dedicated in support of the Chair of the Executive Council, in the pursuit of IADI's objectives.

|

EXCO approval of new Chairpersons for two Regional Committees

EXCO approval of new Chairpersons for two Regional Committees

During the EXCO Meeting held on 13 February 2020, the IADI EXCO approved the appointment of new Chairpersons for two regions, as follows:

|

Asia-Pacific Regional Committee |

Regional Committee of North America |

|

|

Mr Seongbak Wi

Korea Deposit Insurance Corporation

for a three-year term |

Mr Patrick Déry

Autorité des marchés financiers

for a one-year term |

|

|

|

|

|

|

Executive Councilmembers' departures since January 2020

|

|

|

|

|

The Association wishes to show its appreciation to the former Executive Councilmembers below, who departed from the Executive Council (EXCO) since January 2020. |

|

|

Dean Cosman, former Executive Vice-President, Insurance and Risk and Chief Risk Officer of the Canada Deposit Insurance Corporation (CDIC), was first elected on EXCO in October 2018 and served on the Council until his departure from the CDIC in January 2020.

Mr Cosman, who first joined CDIC in 1995, had more than 20 years of experience with Crown corporations, and had leveraged his broad experience and expertise in risk assessment and insurance to the activities in IADI.

Within IADI, Mr Cosman served as Chairperson of the Regional Committee of North America and Vice Chairperson of the Audit and Risk Council Committee. More recently, he was a member of the Working Group on New Funding Options where he made a significant contribution in developing a new fee model.

|

|

|

|

|

Alex Kuczynski, former Chief Corporate Affairs Officer of the Financial Services Compensation Scheme (FSCS), was a long-standing member of EXCO, having served for two terms from 2010 to 2016, and was re-elected in October 2017 and served on the Council until his departure from the FSCS in April 2020.

Mr Kuczynski was Chairperson of the former Membership and Communications Committee, to its termination. The Committee’s output included the review and revision of applications for membership, a strategic assessment of communication strategy, updating the website, newsletter, profile and member communications, and establishing the deposit insurer award. During this time, he has been heavily involved in other projects, in particular support for the review of the IADI Core Principles, the development of the Handbook and Methodology, and many other research initiatives.

More recently, Mr Kuczynski was a member of the Training and Technical Assistance Council Committee. He tremendously contributed to IADI training and technical assistance initiatives through his chairmanship on the Technical Assistance Technical Committee.

|

|

|

|

|

Miroslaw Panek, former President of the Management Board, Bank Guarantee Fund (BFG), Poland, had been an Executive Councilmember since May 2019 (formally elected in October 2019) and served on the Council until his term in BFG came to an end in March 2020.

After serving as Executive Director of the International Monetary Fund, he became the BFG Management Board Member, and was appointed as the President of the BFG Management in April 2019.

Within IADI, Mr Panek was a member of the Core Principles and Research Council Committee and the Europe Regional Committee, and had been an active participant at a number of IADI events including IADI Conference.

|

|

|

|

|

|

|

|

Establishment of the IADI Strategic Planning Working Group

|

|

|

|

|

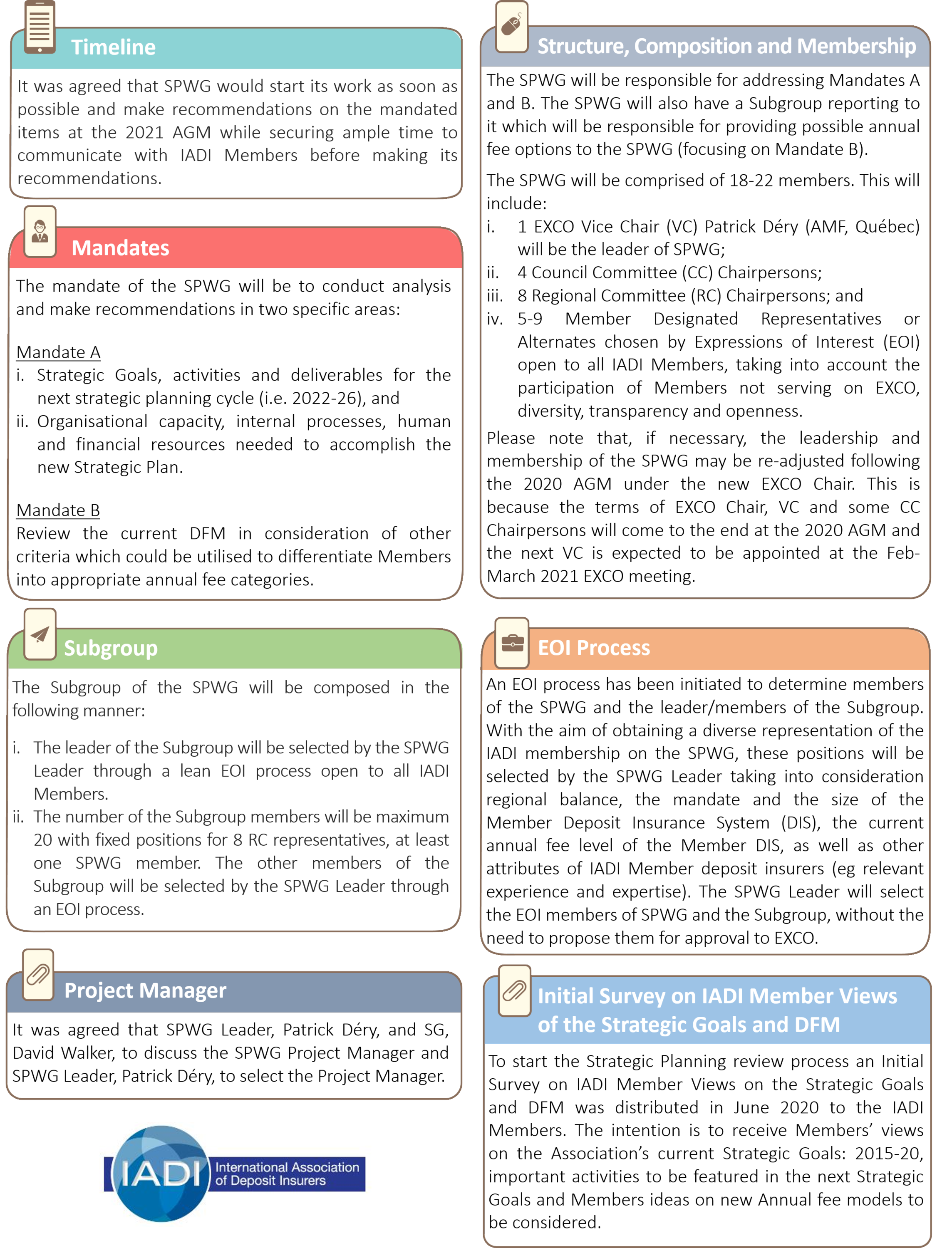

During the IADI Annual General Meeting (AGM) of 9 October 2019 in Istanbul, it was decided to extend the current Strategic Plan 2015-20 to 2021, to develop a new Strategic Plan for the 2022-26 period and that work would begin at the start of calendar year 2021. This work was planned to be undertaken by a Strategic Planning Working Group (SPWG). At the same time, it was decided to begin a review of the current fee model in consideration of other criteria in calendar year 2021.

At the 61st IADI Executive Council (EXCO) Meeting on 12 February 2020 held in Basel there was a broad consensus to expedite this work as soon as possible and EXCO started to discuss the establishment of a working group to undertake the preparatory work.

At the 62nd and 63rd EXCO Meetings held on 29 May and 12 June 2020, EXCO reached agreement on the establishment of the IADI SPWG with the objective of developing a new IADI Strategic Plan for 2022-26 and to review the Differentiated Fee Model (DFM) introduced in FY 2020/21.

|

|

|

|

|

|

|

|

|

|

Key

achievements and updates from the

Council Committees (CCs) and their

Technical Committees (TCs)

|

| |

|

|

|

|

Audit and Risk Council Committee (ARCC) - chaired by

Sonja Lill Flø Myklebust, Norway

Audit and Risk Council Committee (ARCC) - chaired by

Sonja Lill Flø Myklebust, Norway |

|

|

|

-

Secretariat Report on the Financial Statements for FY 2019/20: Review completed and submitted to EXCO for approval.

-

IADI Audited Financial Statements for FY 2019/20: Review completed and submitted to EXCO for approval. Audit process finalised in conjunction with Treasurer, MRC, Secretariat and PwC (External Auditor).

-

Investment Guidelines Report (including Investment Guidelines

for FY 2020/21) and Investment Policy: Review completed.

Investment Guidelines were approved by EXCO.

-

IADI Survey Data Management System (ISDMS) Project: Reviewed the progress report and the closing report of the project. Reviewed suggested budget for the enhancement of ISDMS database.

-

IADI Enterprise Risk Management and Internal Control Framework: Reviewed the framework paper and risk analysis performed by the Secretariat.

|

|

|

|

|

|

|

|

Core Principles and

Research Council Committee (CPRC) -

chaired by Yvonne Fan, Chinese Taipei

Core Principles and

Research Council Committee (CPRC) -

chaired by Yvonne Fan, Chinese Taipei

|

|

|

|

-

New CPRC Vice Chairperson: Mr Nikolay Evstratenko (DIA Russia) was appointed as the Vice Chairperson for a three-year term.

-

CPRC Annual Policy and Research Plan for 2020/21: The 2020/21 Annual Policy and Research Plan was approved by EXCO in February 2020.

-

Research Paper on

Deposit Insurance and Financial Inclusion: Current Trends in Insuring Digital Stored-Value Products was published in March 2020.

-

Guidance Paper on

Public Policy Objectives for Deposit Insurance Systems was published in March 2020.

-

Research Paper on

Evaluation of Differential Premium Systems for Deposit Insurance was published in June 2020.

-

Other papers are being developed at the following CPRC Technical Committees:

-

Risk Management and Internal Control System of Deposit Insurers Technical Committee: The draft guidance paper will seek for public consultation soon.

-

Islamic Deposit Insurance Technical Committee: The IADI-IFSB

Core Principles for Effective Islamic Deposit Insurance Systems (CPIDIS) is being reviewed by the CPIDIS joint working group.

-

Coverage Level and Scope Technical Committee: The research plan was approved by the CPRC in February 2020. A survey for the research has been circulated to IADI Members.

-

Financial Technology Technical Committee: The research plan is being drafted.

|

|

|

|

|

|

|

|

|

Member Relations Council Committee (MRC) - chaired

by Mohamud Ahmed Mohamud, Kenya

Member Relations Council Committee (MRC) - chaired

by Mohamud Ahmed Mohamud, Kenya |

|

|

|

-

Secretariat Report on the Financial Statements for FY 2019/20 and Cash Management Report per 31 March 2020: Review completed and approved at the MRC virtual meeting held in May 2020.

-

IADI Audited Financial Statements for FY 2019/20: Review completed and approved at the MRC meeting held in May 2020. Audit process finalised in conjunction with Treasurer, ARCC, IADI Secretariat and PwC (External Auditor).

-

Membership Application: In conjunction with the IADI Secretariat and Regional Chairpersons, the MRC coordinated recommendation for approval of membership application processing (in accordance with the Updated Policy for Membership and Partner Applications and Requirements).

The EXCO approved the following applications:

-

Task Force for Membership Benefits: The Task Force was established by the MRC Chairperson in May 2019 to assess Members’ level of satisfaction with the Association as a follow up on the prioritisation of Membership Benefits and Communications Initiatives. During the first half of 2020, MRC worked with IADI Secretariat to complete the development of a special survey instrument of measuring membership engagement and options for improving engagement. The draft survey has been prepared and submitted to MRC and EXCO Chair for review.

Due to the ongoing discussion on IADI’s strategic planning at EXCO, the draft survey will be reviewed for possible further amendment and its issuance reprioritised.

|

|

|

|

|

|

|

|

|

|

|

|

Training and Technical Assistance Council Committee (TTAC)

-

Chaired by Diane Ellis, United States

Training and Technical Assistance Council Committee (TTAC)

-

Chaired by Diane Ellis, United States

|

|

|

|

The TTAC in coordination with the Capacity Building Technical Committee (CBTC) and the Senior Training and Technical Assistance Advisor (STTAA), reports the following activities: |

|

|

|

IADI Self-Assessment Technical Assistance Program (SATAP): The SATAP provides IADI member jurisdictions with an opportunity for a review team to work closely with the DIA to identify gaps in compliance with the IADI Core Principles and outline possible steps to address those gaps. The CBTC received official requests for a SATAP review from three jurisdictions. The review teams are being formed for these SATAP reviews.

-

Strategy to Promote Self-Assessment: The TTAC approved the Terms of Reference (ToR) for a three-part strategy to encourage more Members to engage in self-assessments. The Promoting Self-Assessment Working Group completed the first deliverable, “Guidance on Conducting Self-Assessments of Compliance with IADI Core Principles”, approved by the CBTC.

-

Expert Training: The Expert Training Strategy, which was approved by the committee in February 2019, is a proposal to develop a structured program for training IADI Members and their staffs in the Core Principles. The CBTC and STTAA delivered Terms of Reference for the Practitioners Workshop Working Group (first stage) and for the Expert Training Working Group (second stage), both approved by the TTAC.

-

FSI-Connect Tutorials: The CBTC selected, and the TTAC approved, the Reimbursement tutorial as its second tutorial to review and update. CBTC members reviewed the tutorial and delivered a draft to the STTAA, who will be working with FSI to complete the update by December 2020.

|

|

|

|

|

|

|

|

Update from the IADI Secretariat Research Unit and the 2020 Annual Survey

|

|

|

|

|

Response to the Covid-19 crisis

|

The IADI Secretariat and Research Unit (RU) have worked on a number

of initiatives in response to recent developments in the global

economy relating to Covid-19. A

briefing note has been prepared

titled 'Ensuring Business Continuity and Effective Crisis Management

Activities for Deposit Insurers'.

And, on the 26th of March

2020, IADI distributed a survey to the membership on the impact of

the Covid-19 pandemic crisis on their financial sector and the

measures taken by regulatory authorities and deposit insurers to

address the crisis. A

summary of key results from the IADI Covid-19

survey is now available and the full set of Survey responses can be

found

here.

Additional Covid-19 statistical resources

available on the IADI eBIS website include: |

-

Results from the Bank Guarantee Fund (Poland) questionnaire to all IADI Members on policy responses to the Covid-19 pandemic crisis.

-

Results from the IADI Asia-Pacific Regional Committee survey of its Members on the topic of Covid-19 implications and responses.

|

|

|

Research initiatives

|

The Senior Policy and Research Advisor represents IADI in the team for conducting FSB peer review of South Africa. South Africa is the only FSB jurisdiction without an explicit framework for protection of small depositors and the authorities have been working to introduce an explicit deposit insurance system. The report has been finalised and is now available via the

Financial Stability Board website.

Other research and policy initiatives in progress by the RU, include draft papers on depositor preference, digital stored value products (developed jointly with the Alliance for Financial Inclusion), an IADI Working Paper on “The geographic dynamics of deposit insurance”, and worked with the CPRC and Islamic Financial Services Board on Core Principles for Islamic Deposit Insurance Systems.

|

|

|

ISDMS and 2020 Annual Survey

|

The IADI Survey Data Management System (ISDMS) Project has now been finalised. The RU has worked with Sitrox to design and implement a new tool for collecting, storing and managing information on deposit insurance systems worldwide. The RU has complemented this work through conducting a comprehensive data migration exercise. This enabled many years of historical IADI Annual Survey data to be migrated onto the new platform for use in the future construction of informative time series.

The 2020 Annual Survey is scheduled to go live in July 2020. This will include an amended questionnaire that is designed to better capture contemporary issues in global deposit insurance. All IADI Members, Associates, Partners and stakeholders are encouraged to participate in this important exercise. The IADI Annual Survey forms the most comprehensive source of deposit insurance information globally, and is utilised extensively for research initiatives and policy decision making. We extend our appreciation to IADI Members, Associates and Partners for their continued support to the IADI data and research initiatives. Results are expected to be published in November 2020.

|

|

|

2020 IADI Chart Pack

|

The IADI is pleased to publish the 2020 IADI Chart Pack. This new product offers a snapshot of the key characteristics of deposit insurance systems from around the world.

The

IADI Chart Pack is arranged into four themes focusing on deposit insurer structure, coverage and funding, reimbursement and resolution activities, public awareness and financial inclusion.

The full

IADI Chart Pack is available on IADI’s website. Any queries regarding the IADI Chart Pack and deposit insurance database can be addressed to Ryan Defina of the

IADI Secretariat Research Unit.

|

|

|

Call for Paper Proposals

|

|

The IADI will shortly be circulating a call for proposals for external research and policy papers. This provides an opportunity for academics and policy makers to submit their research proposals for topics relevant to deposit insurance and financial stability. Selected proposals will receive funding and support from IADI. |

|

|

Update on Training and Capacity building initiatives

|

|

|

|

|

Expert Training Strategy

|

|

The Training and Technical Assistance Council Committee (TTAC) approved the Terms of Reference for the Expert Training Working Group (ETWG), prepared by the STTAA in coordination with the CBTC. The ETWG comprises the second of the four stages proposed in the Expert Training Strategy – the first stage being the Core Principles Practitioners Workshop (Practitioners Workshop). During this stage, those with significant experience in conducting and evaluating self-assessments (termed Lead CP Experts) will lead Participants – those who have completed the Practitioners Workshop and agree to make a commitment to complete the Expert Training Program – in periodic conference calls. In accordance with the ToR, the STTAA will Chair the ETWG and lead a pilot test of the first cycle of training calls during the second semester of 2020.

The STTAA also assists the Practitioners Workshops Working Group and the Promoting Self-Assessment Working Group, as an observer.

|

|

|

FSI Connect

|

The STTAA worked with the Financial Stability Institute (FSI) to complete a major update of the “Deposit Insurance Core Principles Assessment” tutorial, published in March 2020. The update included content review, with assistance from the Capacity Building Technical Committee (CBTC), as well as restructuring the 90-minute tutorial into a suite of five stand-alone tutorials and conversion into the new format. The tutorials provide a step-by-step guide on how to plan and complete an assessment, as well as how to develop an action plan.

The conversion into the new format of three additional tutorials scheduled to be removed from the FSI library and archived was also completed. Two converted tutorials, “Deposit Insurance

- Liquidation of Failed Bank Assets” and “Deposit Insurance - Premiums and Fund Management” were published in May 2020, and a third, “Public Awareness of Deposit Insurance Systems” in June 2020. Converted tutorials can be accessed via the FSI Connect applications.

The STTAA is also working with the FSI to complete a major update and conversion of the “IADI Core Principles for Effective Deposit Insurance Systems” tutorial, to be included in the FSI Bank Resolution Course in 2021.

|

|

|

Technical Assistance Workshops and other events

|

The STTAA delivered the “2019 Summary Report on IADI Technical Assistance Workshops”, and will work with the CBTC to develop action items to address the suggestions for planning future TAWs.

During September 22 and 24 2020, IADI and the FSI are planning a Webinar looking at the ongoing and expected impact of the Covid-19 crisis on resolution authorities and deposit insurers. More details will be made available towards the end of July.

|

|

|

Additional events, seminars and conferences

(January to June2020)

|

|

|

|

|

IADI APRC Webinar: Preparing our Path to the New Normal

IADI APRC Webinar: Preparing our Path to the New Normal |

A webinar themed “Preparing Our Path to the New Normal” was held on 9 June 2020 among more than 160 senior officials and staff from 13 deposit insurers across the Asia-Pacific region. The webinar was jointly organised by the Korea Deposit Insurance Corporation (KDIC) and the Malaysia Deposit Insurance Corporation (PIDM), in collaboration with the International Association of Deposit Insurers (IADI) and The World Bank Group (World Bank).

Speakers including David Walker, the Secretary General of IADI, the World Bank, Bank for International Settlements (BIS) and deposit insurers from Asia-Pacific discussed current developments and new perspectives on the financial sector and implications on deposit insurers going forward.

Overall, the webinar examined the international policy responses by deposit insurers to the pandemic crisis and priority areas going forward such as crisis management, public awareness and depositor reimbursements. Emerging trends were also explored, including the new retail banking landscape and attendant policy options for deposit insurance.

The webinar is part of continuing efforts by the Research Technical Committee of the IADI Asia-Pacific Regional Committee (APRC RTC) to support deposit insurers across the Asia-Pacific region in promoting financial systems stability and maintaining public confidence.

|

|

|

|

NDIC Webinar: DIS POST COVID-19: Supervisory Imperatives

NDIC Webinar: DIS POST COVID-19: Supervisory Imperatives |

A webinar themed “DIS POST COVID-19: Supervisory Imperatives”, organised by the Nigeria Deposit Insurance Corporation (NDIC), was held on 26 May 2020. The webinar attracted three thousand and ninety (3,090) participants, with 54 of them coming from IADI Member jurisdictions such as: Uganda, Angola, Bahamas, Canada, France, Ghana, Indonesia, Kenya, UK, and USA amongst others.

Panelists selected for the webinar included current and former Directors of the NDIC, the Central Bank of Nigeria, Business School faculties, operators in the Micro-Finance Bank sub-sector and Consultants. They discussed a number of issues extensively and suggested policy directions for the NDIC and Deposit Insurance System (DIS) in general.

The presenters advised that there could be need for some regulatory forbearance amongst DIS in order to support the financial sector. In addition, DIS were encouraged to step-up their public awareness efforts in order keep the public calm and avert possible bank runs. In view of the envisaged impact on the financial sector, DIS were advised to prepare adequately in the event that pay-outs are triggered.

The NDIC Academy deployed several polls to gauged participants’ perception and understanding on various issues. The key take away for DIS was that most Bank Supervisory challenges now and post Covid-19 would be “onsite bank exam/data integrity”, “health issues” and “operator’s liquidity”. The most critical skills for pursuing DIS mandate post-Covid would be “digital, analytics, communication and cognitive” skills.

|

|

|

|

|

|

|

|

New

IADI Participants

|

|

|

|

Join us in welcoming newest participants, all of whom were approved by EXCO in the first half of this year. |

Fond de Garantie des Dépôts Bancaires (Tunisia) – new Member

Fond de Garantie des Dépôts Bancaires (Banking Deposits Guarantee Fund (Tunisia), FGDB) was established in 2018 by the Tunisian Banking Law N° 2016-48. In addition to the Banking Law, the FGDB’s intervention, operating rules, reimbursement conditions, etc are regulated by the government decree N° 2017-268. Its capital is worth 5 million dinars held equally by the Central Bank of Tunisia and the Ministry of Finance. The DIS membership is mandatory and there are 29 member banks at present. The maximum coverage limit is USD 22,000, and the system is funded ex-ante with a flat rate for premiums.

The Member application was represented by Jaafar Khatteche, Chief Executive Officer.

|

|

|

|

|

Eurasian Economic Commission (EEC) – new Partner

The

Eurasian Economic Commission (EEC) is a

permanent regulatory body of the Eurasian Economic Union (EAEU). The

Commission adopts decisions with regulatory and binding effect for the

Member States, organisational and administrative dispositions and

non-binding recommendations.

|

|

Decisions of the Commission form a part of the Union law and shall be directly applicable on the territories of the Member States. The basic objectives of the Commission are enabling the functioning and development of the Union, as well as developing proposals in the sphere of economic integration.

The Member application was represented by Timur Zhaksylykov, Member of the Board, Minister in charge of Economy and Financial Policy. |

|

|

|

Bank for International Settlements – 2020 Annual General Meeting and Annual Report 2019/20

|

|

|

|

|

The host organisation of IADI, the Bank for International Settlements (BIS), held its 90th Annual General Meeting (AGM) on 30 June 2020. More than 60 central banks worldwide participated in its first online AGM.

In his speech “In the face of an unexpected adversary: the crucial role for central banks” the BIS General Manager Mr Agustín Carstens spoke about the responses made by central banks against the backdrop of Covid-19 pandemic, while also pointed out many challenges ahead, and the importance of global cooperation. Following his speech, Mr Claudio Borio, Head of the Monetary and Economic Department, and Mr Hyun Song Shin, Economic Adviser and Head of Research delivered their speeches (“The prudential response to the Covid-19 crisis”, “Central banks and the new world of payments”) which elaborated on the issues indicated in Mr Carstens’s speech.

At the AGM, the

BIS Annual Report 2019/20 (BIS activities and financial performance) and the

BIS Annual Economic Report 2020 (commentary on the global economy) were released.

For all information related to the BIS 90th AGM, click

here.

|

|

|

|

|

|

|

Forthcoming

events

|

Other updates and forthcoming events

|

New

books and papers

|

-

European Cross-Border Banking and Banking Supervision,

Dalvinder Singh, April 2020

-

Promoting Global Monetary and Financial Stability – The Bank for International Settlements after Bretton Woods, 1973-2020

Edited by Claudio Borio, Stijn Claessens, Piet Clement, Robert N McCauley and Hyun Song Shin, June 2020

-

FSI Insights on policy implementation: Cross-border resolution cooperation and information-sharing: an overview of home and host authority experience, Patrizia Baudino, Tracy Richardson and Ruth Walters, January 2020

-

FSI Insights on policy implementation: Policy responses to fintech: a cross-country overview, Johannes Ehrentraud, Denise Garcia Ocampo, Lorena Garzoni, Mateo Piccolo, January 2020

-

BIS Working Papers: The economic forces driving fintech adoption across countries, Jon Frost, February 2020

-

Peer Review of South Africa, March 2020

-

Working Paper: Using the FSB Key Attributes to Design Bank Resolution Frameworks for Non-FSB Members: Proportionality and Implementation Challenges, Jan Nolte, David Hoelscher, June 2020

|

|

|

|

|

|

|

In Memoriam

|

|

|

|

|

|

It is with deep regret that we note the passing of Professor George G. Kaufman, who died of Parkinson’s disease on June 25 at age 87 at his home in Chicago.

Most recently until his retirement in 2017, Professor Kaufman was the John F. Smith Professor of Economics and Finance at Loyola University Chicago and a consultant to the Federal Reserve Bank of Chicago, prior to which he had been teaching at the University of Oregon for ten years. He had also been a visiting professor at Stanford University, University of California, Berkeley, and University of Southern California, as well as a visiting scholar at the Reserve Bank of New Zealand, Federal Reserve Bank of San Francisco, and Office of the Comptroller of the Currency. He also served as the deputy to the assistant secretary for economic policy at the U.S. Department of the Treasury. |

|

As one of the world’s leading experts on banking, monetary policy, and financial stability, Professor Kaufman authored over 200 scientific papers and wrote or edited numerous books. Best known for bringing research theory and empirical findings to the policy debate, he introduced the principles of Prompt Corrective Action (PCA) toward failing financial institutions, and Least Cost Resolution of failed banks. Both concepts were incorporated into legislation with the FDIC Improvement Act of 1991.

The Association would like to place on record our sincere gratitude to Professor Kaufman, who had been a committed and active member of IADI’s Advisory Panel since the beginning, and a long-time contributor to our Research Conferences and other events over the years. We would also like to offer our sincere condolences to Professor Kaufman’s wife, family and friends. |

|

|

|

|

|

|

|

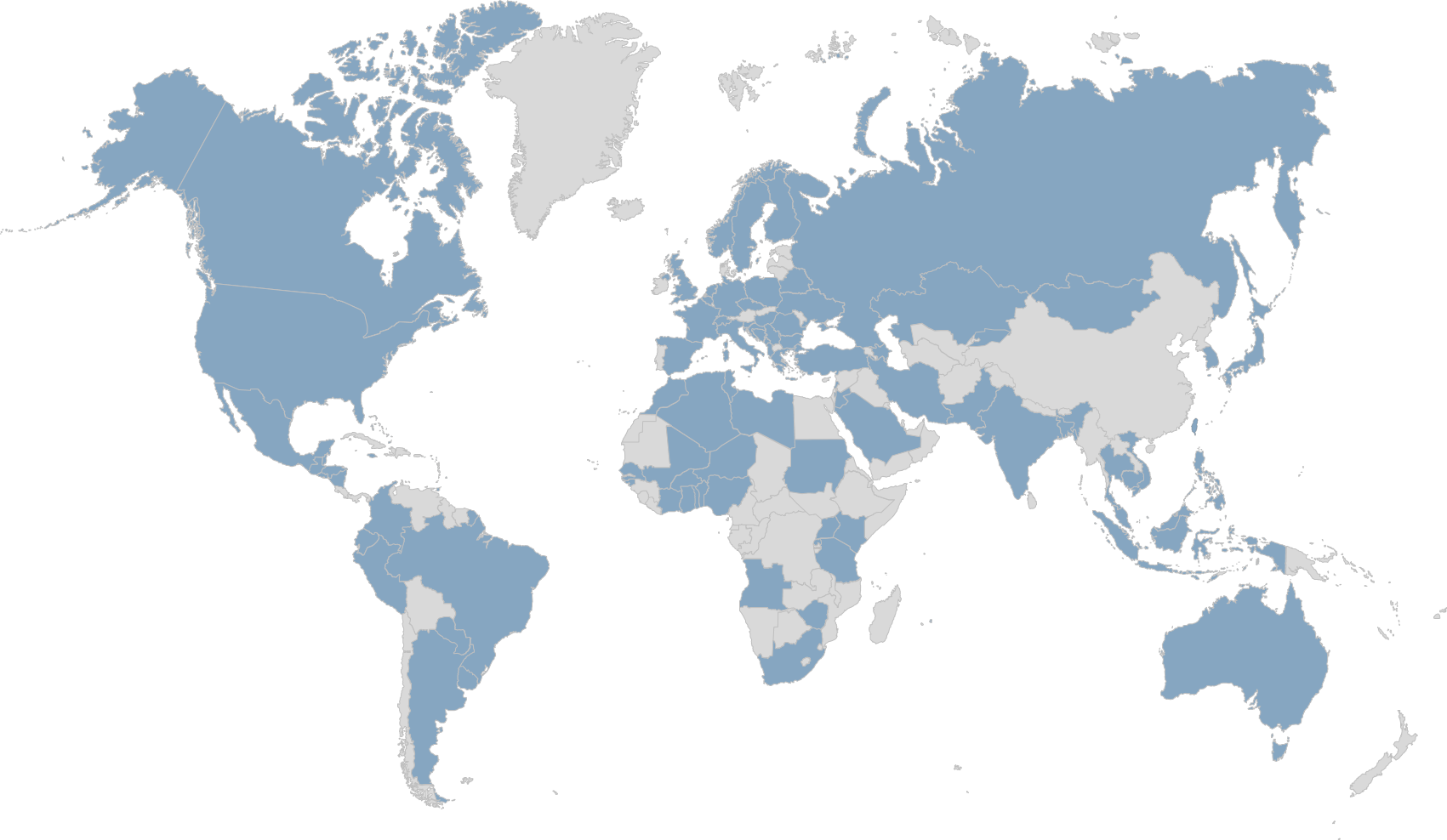

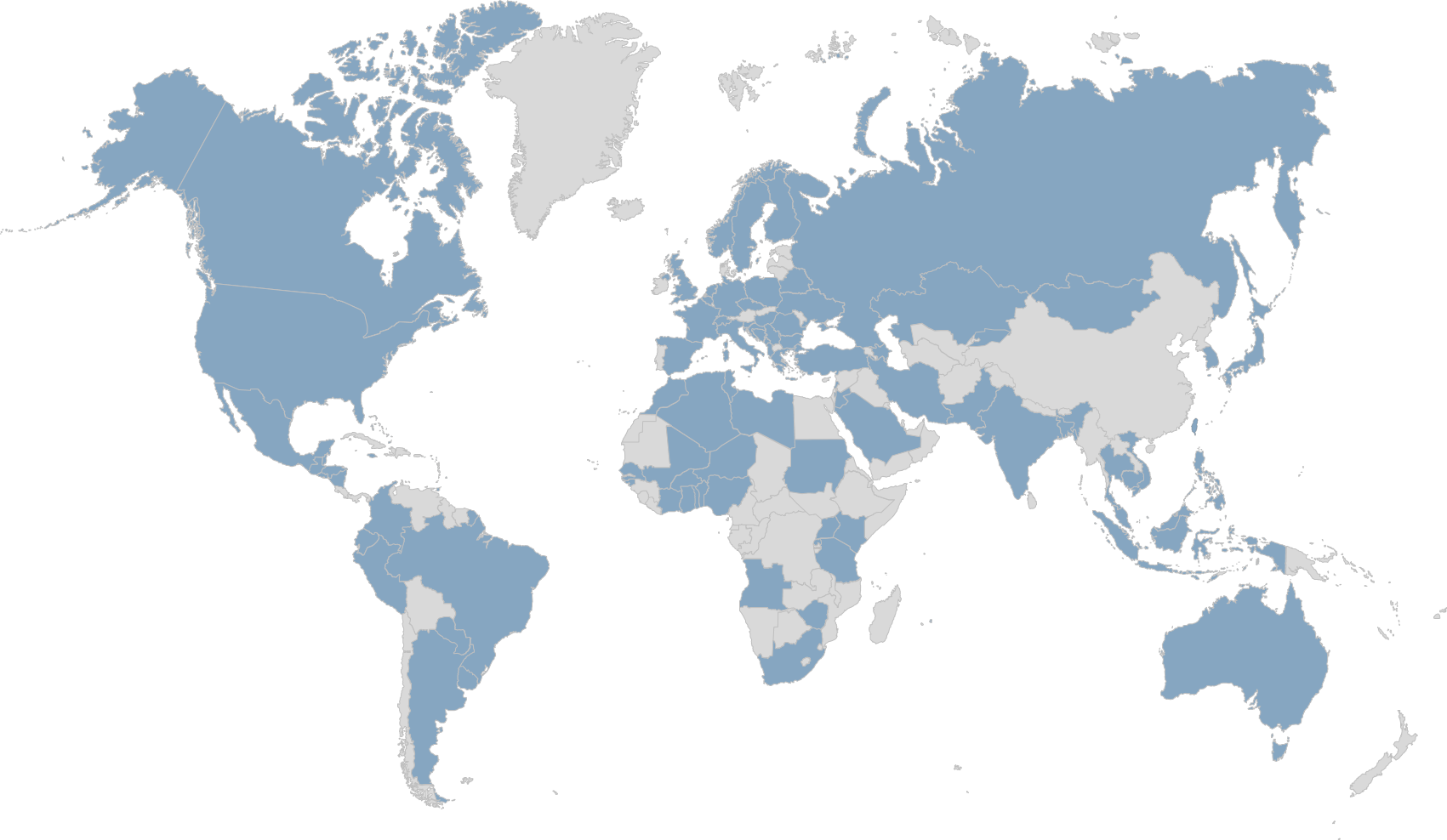

The International Association of Deposit Insurers (IADI) was formed in May 2002 to enhance the effectiveness of deposit insurance systems by promoting guidance and international cooperation. Members of the IADI conduct research and produce guidance for the benefit of those jurisdictions seeking to establish or improve a deposit insurance system. Members also share their knowledge and expertise through participation in international conferences and other forums. The IADI currently represents 87 deposit insurers, 8 Associates and 15 Partners. The IADI is a non-profit organisation constituted under Swiss Law and is domiciled at the Bank for International Settlements in Basel, Switzerland.

|

|

|

|

|

|

|

|

| |