|

Welcome to the IADI's e-Newsletter

The International Association of Deposit

Insurers (IADI) is pleased to provide the latest issue of its

e-Newsletter.

The e-Newsletter keeps you up-to-date on

information about IADI activities from August to December 2022, as

well as on upcoming IADI activities.

|

|

|

This issue includes:

|

|

|

|

|

New Years greetings from the IADI Secretariat

Message from David Walker, IADI Secretary General

|

Let

me express my sincere appreciation to all IADI Members, Associates

and Partners for your support in the furtherance of IADI’s mission

during the second part of 2022. We continue to work with our

membership in adapting to the ongoing impacts of the pandemic as

well as adjusting to international crises and a rapidly changing

macroeconomic landscape. IADI is facing these challenges by

continuing to leverage technology and moving forward with an

ambitious agenda for training, capacity building, research and

guidance. Let

me express my sincere appreciation to all IADI Members, Associates

and Partners for your support in the furtherance of IADI’s mission

during the second part of 2022. We continue to work with our

membership in adapting to the ongoing impacts of the pandemic as

well as adjusting to international crises and a rapidly changing

macroeconomic landscape. IADI is facing these challenges by

continuing to leverage technology and moving forward with an

ambitious agenda for training, capacity building, research and

guidance.

The second part of 2022 has been a time of significant

accomplishments and changes for Members. The Association held its

20th Anniversary International Conference in hybrid format, in

Basel, Switzerland in September, and its 21st Annual General Meeting

of Members (AGM) & Annual Conference in person in Buenos Aires,

Argentina in October 2022. In the AGM, IADI President and the Chair

of Executive Council (EXCO) and 13 new Executive Councilmembers were

elected. In addition, three Chairpersons of the four Council

Committees (CCs) were newly elected in December 2022.

Reviewing and updating the IADI Core Principles (CPs) is

ongoing. During the period, working groups (WGs) established by the

IADI CPs Review and Update Steering Committee (SC), which includes

23 participants from the IADI membership and is well-balanced in

terms of IADI regions and mandates, submitted their consensus views

to the SC. The SC has discussed the proposed changes at a series of

the virtual meetings. In addition, the IADI Research Unit (RU) has

developed a tool to enable Members to analyse a significant volume

of rich survey data that IADI has collected for more than a decade.

Furthermore, important initiatives for providing Members

with technical support to modernise and upgrade their systems have

been carried out. This includes the finalisation of the materials

for the second stage of the IADI CPs expert training program, which

is expected to commence in January 2023. The enhanced roster of CP

Experts will help support the Self-Assessment Technical Assistance

Program (SATAP), as well as various other IADI training initiatives,

including IADI workshops, conferences, and other capacity building

activities.

Farewell message

As we enter into in to the first quarter of 2023, my time

as Secretary General will be coming to an end. It has been an honour

and a privilege to serve the Association and to have played a role

in strengthening IADI’s capacity to deliver services to the

membership. I wish to thank the entire IADI community and, in

particular, the Secretariat staff, secondee-sponsoring

organisations, and the IADI President and Executive Council. I look

forward to working with the incoming Secretary General during the

upcoming year to ensure a smooth transition.

David Walker

Secretary General

International

Association of Deposit Insurers

|

|

|

Highlights

from the 2022 Annual General Meeting

and the Annual Conference

|

.png) IADI held its 21st Annual

General Meeting of Members (AGM) and Annual Conference, 74th Executive

Council (EXCO) and 74th bis EXCO Meetings on 24 – 28 October 2022.

Two hundred and sixty (260) participants from approximately 80

jurisdictions worldwide attended the events. IADI held its 21st Annual

General Meeting of Members (AGM) and Annual Conference, 74th Executive

Council (EXCO) and 74th bis EXCO Meetings on 24 – 28 October 2022.

Two hundred and sixty (260) participants from approximately 80

jurisdictions worldwide attended the events.

Chair of the EXCO and President

Election Result

Chair of the EXCO and President

Election Result

During the elections held during IADI 21st Annual General Meeting of

Members (AGM) on 28 October 2022, Alejandro López, Chief Executive

Officer (CEO), Seguro de Depósitos Sociedad Anónima, Argentina

(SEDESA), was elected to serve as its President and as the Chairman of

its Executive Council (EXCO) for a three-year term.

CEO López thanked the Members for their support of IADI and he looked

forward to working with the membership for IADI to continue to meet

its strategic goals; promoting the IADI Core Principles for Effective

Deposit Insurance Systems (the CPs) and deposit insurance compliance,

advancing deposit insurance research and policy development,

providing Members

with technical support to modernise and upgrade their systems, and

enhancing IADI’s governance by improving efficiency and transparency.

EXCO Election Results

EXCO Election Results

The Members elected 13 Members’

Designated Representatives to the Executive Council to fill the

vacancies that had arisen, as follows:

|

|

|

.jpg) |

|

Julia Clare Olima Oyet

Deposit Protection Fund of Uganda |

Christa Walker

Canada Deposit

Insurance Corporation |

Mu’taz I Barbour

Jordan Deposit

Insurance Corporation |

Michel Cadelano

Fonds de Garantie

des Dépôts et de Résolution(France) |

Daniel Oscar Dominioni Ghiggia

Corporación de Protección del Ahorro Bancario(Uruguay) |

|

|

|

|

|

Yvonne Y. Fan

Central Deposit Insurance Corporation(Chinese

Taipei) |

Bello Hassan

Nigeria Deposit Insurance Corporation |

Loay Said Hawash

Palestine Deposit Insurance Corporation |

Deepak Kumar

Deposit Insurance and Credit Guarantee

Corporation, Reserve Bank of India |

Daniel Lima

Fundo Garantidor de

Créditos,Brazil |

|

|

|

|

|

|

|

|

|

Arthur J Murton

Federal Deposit Insurance Corporation

(FDIC), United States |

Adil Utembayev

Kazakhstan

Deposit Insurance Fund |

Chayong Yoon*

Korea Deposit

Insurance Corporation,

1year

*Mr. JaeHoon Yoo replaced Mr. Chayong Yoon in

December |

|

|

The newly newly

elected EXCO Members shall act in the best interests of the

Association, and shall each serve for a three-year term (unless noted

otherwise above).

The remaining Council members are:

|

|

|

|

|

|

|

|

|

José María Fernández Real

Fondo de Garantía de Depósitos de Entidades de

Crédito (Spain) |

Gregor Frey

esisuisse

(Switzerland) |

Karen Gibbons

Financial Services

Compensation

Scheme (UK) |

Marija Hrebac

Croatian Deposit

Insurance Agency |

Fatin Rüştü Karakaş

Savings Deposit

Insurance Fund (Turkey) |

|

|

|

|

|

|

|

|

|

Hidenori Mitsui

Deposit

Insurance Corporation of Japan |

Alfredo Pallini

Interbank Deposit Protection Fund

(Italy) |

Purbaya Yudhi

Sadewa

Indonesia Deposit

Insurance

Corporation |

Piotr

Tomaszewski

Bank Guarantee

Fund (Poland) |

Eloise

Williams-Dunkley

Jamaica Deposit

Insurance

Corporation |

| |

|

|

|

|

|

The following have retired from their respective positions on the EXCO

during the past year. The Association thanks them for their

contributions to the leadership of IADI.

|

|

.png) |

|

|

|

|

|

|

Tae-hyun Kim

Korea Deposit

Insurance Corporation |

Gabriel Limon

Instituto para la

Protección

al

Ahorro Bancario

(Mexico) |

Sonja Myklebust

The Norwegian

Banks'

Guarantee Fund |

ZaherHammuz

Palestine Deposit

Insurance

Corporation |

Diane Ellis

Federal Deposit

Insurance

Corporation (USA) |

|

|

|

|

|

|

|

|

|

Patrick Mitchell

Federal

Deposit Insurance Corporation (FDIC), United States |

Chantal Richer

Canada Deposit Insurance Corporation |

Yury Isaev

Deposit Insurance

Agency

(Russian Federation) |

Mohamud Ahmed

Kenya Deposit Insurance Corporation |

Patrick Déry

Autorité des

marchés

financiers

(Québec, Canada |

|

|

A link to the Press Release

on the subject of the AGM including its elections, may be

found

here |

|

|

|

Save the Date:

Februay &

September 2023 – CP Review Steering

Committee & 75th

EXCO, 2023 AGM and Annual Conference

|

|

|

|

|

The Core Principles Review Steering Committee &

The 75th

EXCO and Council Committee Meetings

Meetings of the IADI Core Principles Review Steering

Committee and the 75th EXCO and Council Committee Meetings will be

held on 21- 24 February 2023 in hybrid format, in Basel, Switzerland.

Registration

details and Programme information is available

here.

|

|

|

|

|

|

The

2023 AGM and Annual Conference

The 2023 AGM and Annual Conference will be hosted

by the Massachusetts Credit Union in Massachusetts, United States in

25-29 September 2023.

Registration details and Programme information

will be available as of early summer 2023.

|

|

|

|

|

Announcement regarding Secretariat member

|

New Secretariat Member

Mr Seunghoo Lee joined the IADI Secretariat in October

2022 from the Korea Deposit Insurance Corporation (KDIC).

Prior to joining the secretariat, He worked at the

Office of International Cooperation of the KDIC. He was

responsible for capacity-building programs such as KDIC Global

Training Program. He contributed to the KDIC’s sharing of

experiences with nearly 20 countries around the world by

planning and moderating the programs.

Before he joined the Office of International

Cooperation, He worked in various positions at the KDIC

related to savings bank sector. In the Corporation

Investigation Bureau of the KDIC, he planned and directed the

investigation of default debtor corporations of failed savings

banks. Before that, he conducted due diligence and

participated in negotiations regarding the acquisition of

troubled assets from failed savings banks by the KR&C, an

asset management company owned by the KDIC, through purchase

and assumption (P&A) transactions. He also contributed to the

amendment of the Regulations Concerning the Supervision of

Savings Banks for strengthening safety and soundness standards

for savings banks as a secondee to the Financial Services

Commission.

Farewell to former Secretariat member

Mr

Keehyun Park finished his secondment to the IADI Secretariat

and returned to the Korea Deposit Insurance Corporation (KDIC)

in December 2022. Keehyun joined the Secretariat in August

2020 as Senior Policy Analyst. Mr

Keehyun Park finished his secondment to the IADI Secretariat

and returned to the Korea Deposit Insurance Corporation (KDIC)

in December 2022. Keehyun joined the Secretariat in August

2020 as Senior Policy Analyst.

Among his diverse responsibilities, Keehyun played a

key role in organising and coordinating IADI events with high

level of expertise and versatility in dealing with many

professional BIS in-house applications such as CEM Portal and

eBIS. What is noteworthy is, in response to the extraordinary

circumstances after the COVID-19 pandemic, he played a leading

role in establishing a solid set of procedures for virtual and

hybrid meetings of IADI and in organising innumerable

meetings.

He was also responsible for the management of IADI

public and Members only websites as well as for providing IADI

Members with technical assistance and guidance on various

matters through active and flexible communication.

Mr Seunghoo Lee, also of the KDIC, has taken over his

role to continue these critical activities of the Secretariat

and Association.

We wish to thank Keehyun for his great efforts and

wish him the very best in his future endeavours.

|

|

|

|

Executive Council approval of new Chairperson for

the Council Committee

|

|

EXCO approved the appointment of new

Chairpersons for the committees, as follows:

|

|

|

|

Hightlights from the

the IADI 20th Anniversary International

Conference

|

|

|

|

|

The International Association of Deposit Insurers (IADI) held

its 20th Anniversary International Conference on 6 - 7 September

2022 in hybrid format, in Basel, Switzerland, titled “Enhancing

deposit insurance and promoting financial stability around the

world: building on the past, preparing for the future…” with 260

participants from more than 75 institutions worldwide attending the

event. The International Association of Deposit Insurers (IADI) held

its 20th Anniversary International Conference on 6 - 7 September

2022 in hybrid format, in Basel, Switzerland, titled “Enhancing

deposit insurance and promoting financial stability around the

world: building on the past, preparing for the future…” with 260

participants from more than 75 institutions worldwide attending the

event.

|

|

Key

achievements and updates from the

Council Committees and their Technical

Committees

|

| |

|

|

|

|

Audit and Risk Council Committee (ARCC)

Audit and Risk Council Committee (ARCC) |

|

|

|

-

Audited

Financial Statements and Auditor’s Report for FY 2021/22 ending

31 March 2022: Approved at the AGM held October 28, 2022, in

Buenos Aires, Argentina.

-

Secretariat Report on the

Financial Statements including the Cash Management Report for FY

2022/23 Q2: Review completed and the report was approved by

EXCO.

-

Appointment of External

Auditor to conduct annual audit of the financial statements for

FY 2022/23 ending 31 March 2023: Recommended to EXCO that AGM

appoint PricewaterhouseCoopers (PwC) as External Auditor to

conduct the audit and it was approved at the AGM held October

28, 2022, in Buenos Aires, Argentina.

-

The IADI Enterprise Risk

Management (ERM) and Internal Control Framework: Continued to

provide recommendations to the IADI Secretariat to improve and

update the risk assessment methodology and reporting for the

implementation of the IADI ERM and Internal Control Framework

guided by the COSO ERM Framework.

|

|

|

|

|

Core Principles and

Research Council Committee (CPRC)

Core Principles and

Research Council Committee (CPRC) |

|

|

|

-

The title of the Resolution Issues for

Financial Cooperatives Technical Committee (RIFCTC) was changed to

the Financial Cooperatives Technical Committee (FCTC) and its

workplan including to develop a series of briefing notes on

specific topics of interest for DIs having FCs in their

jurisdictions was approved by the CPRC in March 2022.

-

The Periodical Review of IADI Guidance Papers

Technical Committee (PRTC) conducted a comprehensive review on

guidance papers previously issued by IADI, and submitted a report

with a list of priority and recommendations on the update of these

papers. The report was approved by the CPRC in October 2022.

-

The Reimbursement Technical Committee (RTC)

developed the first draft of the paper titled Reimbursing

Depositors Now and in the Future: Challenges and Trends. Key

findings were shared with the CPRC and Executive Council (EXCO) in

October 2022. The RTC is planning to submit the final draft to the

EXCO in the first quarter of 2023.

-

The Islamic Deposit Insurance Technical

Committee (IDITC) is in the process of developing the Handbook of

the Core Principles for Effective Islamic Deposit Insurance

Systems. The draft discussion paper on the Resolution of Islamic

Banks is under IDITC members’ review and will be shared with the

CPRC.

-

The CPRC Chairperson and the Secretariat

Research Unit will prepare the draft Annual Policy and Research

Plan for FY2023-2024 for the CPRC review by February 2023. The

Plan will combine conventional and emerging topics, accommodating

CPRC Members main interest.

|

|

|

Member Relations Council Committee (MRC)

Member Relations Council Committee (MRC) |

|

|

|

- Membership: Continued to follow up the potential members in

close cooperation with Regional Committees and the IADI

Secretariat.

The EXCO approved the following

applications during the period covered:

- Bank

Deposits Insurance Scheme (Oman) as a Member

(January 2022)

-

The Secretariat Website Working Group completed the

following “Short-term” action items: i) reviewed overall website

structure and the Main Menu, ii) introduced homepage banner and

Podcast, and iii) enhanced the Research, Training and Capacity

Building, and Secretariat sections.

|

|

|

|

|

|

Training and Technical Assistance Council Committee (TTAC)

Training and Technical Assistance Council Committee (TTAC)

|

|

|

|

The TTAC in coordination with the

Capacity Building Technical Committee (CBTC) and the Training and

Capacity Building Unit (TCBU), reports the following activities:

-

Expert Training: The Expert Training

Strategy (Strategy) is a proposal to develop a structured

program for training IADI Members and their staffs in the Core

Principles. The Strategy outlines a four-staged process for an

IADI Member to gain expertise in the Core Principles and

become capable of leading Self-Assessment Technical Assistance

Program (SATAP) reviews, supporting Technical Assistance

Workshops (TAWs), and supporting or participating in the

IMF/World Bank FSAP reviews.

IADI held the first Core Principles

Practitioners Workshop, the first stage of the expert training

program, in-person in July 2022 in Basel, Switzerland.

The materials for the second stage of the

expert training program, the Expert Training Working Group,

were finalised and submitted to the CBTC and TTAC.

The materials for the second stage of the

expert training program, the Expert Training Working Group,

were finalised and submitted to the CBTC and TTAC.

The Experts Workshop Task Force was

established to develop the third stage of the expert training

program. The EWTF is chaired by the IADI Senior Training and

Technical Assistance Advisor, Eugenia Alamillo, and has begun

the process for preparing materials. Task Force members

include Galo Cevallos (Federal Deposit Insurance Corporation),

Pearl Esua-Mensah (Ghana Deposit Protection Corporation), Ria

Badree (Deposit Insurance Corporation of Trinidad and Tobago),

Vilma Leon-York (US Treasury’s Office of Technical Assistance)

and the IADI Secretariat TCBU.

|

|

|

Update from the IADI

Secretariat

|

|

Reaseach Unit

Reaseach Unit

IADI Core Principles Thematic Review Programme

IADI Core Principles Thematic Review Programme

Compliance with and implementation of the Core Principles by IADI

Members helps to enhance the effectiveness of deposit insurance

systems, facilitates greater protection of depositors, and promotes

financial stability. The IADI Thematic Review of the Core Principles

Programme is a desk-based approach designed to survey Members on their

adherence with the Core Principles and to gain a global picture on

Member’s compliance levels.

o

Round 1: IADI

Core Principles Thematic Review on Organisational Structure

In October 2022, IADI finished the first

thematic review on organisational structure. This covered IADI Core

Principle 1 (Public Policy Objectives), Core Principle 2 (Mandate and

Powers), Core Principle 3 (Governance) and Core Principle 11 (Legal

Protection). Sixty-three IADI Members participated in the survey,

representing 70% of the IADI membership. A report on the thematic

review was prepared by Carole Lin of the IADI Research Unit and the

Review Team on Organisational Structure. The report provides

observations on implementation of the reviewed Core Principles as well

as suggestions for areas of the Core Principles that may require

revisions or guidance. IADI Members can access the report via the IADI

website:

www.iadi.org/en/research/other-papers/

o

Round

2: IADI Thematic Review on External Relations

In the second half of 2022, IADI has started working on the

second round of the thematic review. It covers external relations,

i.e. Core Principle 4 (Relationships with Other Safety-Net

Participants), Core Principle 5 (Cross-border Issues), Core

Principle 6 (Contingency Planning and Crisis Management), and Core

Principle 12 (Dealing with Parties at Fault in a Bank Failure). The

review team has been working closely to develop a questionnaire

that, following review by CPRC, has been distributed to IADI Members

in early December 2022. The report should be available to members by

the third quarter of 2023

Research Initiatives

Research Initiatives

In

August 2022, IADI Fintech Brief No. 9 –

E-Money in Ghana: A Case Study was published. This paper by Samuel

Senyo (Bank of Ghana) and Eugene Yarboi Mensah (Ghana Deposit

Protection Corporation) provides a description of the key features of

e-money in the Ghanaian context. It discusses the factors influencing

the protection of e-money wallets and the float kept with commercial

banks. It presents options to be considered for the possible

protection of these wallets in case of bank liquidation

In October 2022, IADI Fintech Brief

No. 10 –

Prepaid Cards: A Case Study of Japan, the United States and the

European Union was published. This paper by Hiroaki Kuwahara and

Kazuaki Hara (both from the Deposit Insurance Corporation of Japan)

presents a case study in Japan on prepaid payment instruments

stipulated in the Payment Services Act. The brief also looks into

prepaid-type payment instruments issued under the legal frameworks of

the United States and European Union.

Also in October 2022, IADI Fintech

Brief No. 11 –

Islamic Fintech: Nascent and on the Rise was published. This paper

by Mohamad Hud Saleh Huddin, Mark Lee and Mohd Sobri Mansor (all from

Perbadanan Insurans Deposit Malaysia) provides an overview of the

global state of play of Islamic Fintech, and explores Malaysia’s

experience in the regulation and development of Islamic fintech. It

also highlights potential uses of Islamic fintech for deposit

insurance and bank resolution.

In November 2022, IADI Fintech

Brief No. 12 –

Misdirected Money Transfers in Korea was made

available to IADI Members. This paper by Sangjae Lee and Jeongeun Park

(both from the Korea Deposit Insurance Corporation) discusses the risk

of misdirected money transfers and recent legislative changes in Korea

mandating the Korea Deposit Insurance Corporation (KDIC) to assist in

recovering such misdirected payments.

In December 2022, IADI Fintech

Brief No. 13 –

Central Bank Digital Currencies: A Review of Operating Models and

Design Issues was made available to IADI Members.

This paper by Bert Van Roosebeke and Ryan Defina (both from the IADI

Research Unit) reviews key issues relevant to deposit insurers

regarding operating models and design features for CBDC, and links

these to early global policy standards.

In

August 2022, IADI Policy Brief No. 6 –

How Inflation Impacts Deposit Insurance: Real Coverage and Coverage

Ratio was published. This Policy Brief by Bert Van Roosebeke and

Ryan Defina (both from the IADI Research Unit) considers how inflation

may impact on two key concepts of deposit insurance: coverage levels

and coverage ratios. In

August 2022, IADI Policy Brief No. 6 –

How Inflation Impacts Deposit Insurance: Real Coverage and Coverage

Ratio was published. This Policy Brief by Bert Van Roosebeke and

Ryan Defina (both from the IADI Research Unit) considers how inflation

may impact on two key concepts of deposit insurance: coverage levels

and coverage ratios.

In November 2022, IADI Policy Brief

No. 7 -

How Deposit Insurers Account for Inflation: Practices and Existing

Guidance - November 2022 was published. This paper by Bert Van

Roosebeke and Ryan Defina (both from the IADI Research Unit) offers an

overview on how inflation is taken into consideration by international

standards and procedures relevant to deposit insurers. It sets out how

standards guide deposit insurers in incorporating inflation in their

activities and looks at how inflation impacts on coverage review and

change processes applied by deposit insurers. The paper also

distinguishes between a set of decision-making arrangements by deposit

insurers in dealing with inflation.

IADI

VIDA – the new data visualisation and data analysis platform

IADI

has collected a significant volume of rich survey data for more than a

decade. The IADI Research Unit has developed a tool to generate

insights quickly and intuitively from this information, enabling

members to analyse data for the IADI Annual Survey more effectively

via dynamic dashboards. VIDA (Visualisation for IADI Data Analysis)

was created using Tableau® (proprietary software) to offer a dynamic

representation of IADI survey data that improves analytical and

reporting opportunities through interactive dashboards. The dashboards

are now available to members via the

IADI Data Warehouse.

I

I ADI

Policy and Research Newsletter

The IADI Research Unit has

initiated a quarterly newsletter designed to become the central source

of information on policy and research issues of relevance to deposit

insurers. Latest editions:

The

2022Q3 edition was released in October 2022 and is available

here.

The

2022Q3 edition was released in October 2022 and is available

here.

The next newsletter edition is

scheduled for release in 2023Q1.

IADI Podcast Series

IADI Podcast Series

The IADI Research Unit has initiated an IADI Podcast

Series, using a new channel for disseminating and communicating IADI’s

research as well as other output of interest to the deposit insurance

community. The following podcasts have been made available:

Podcast No. 6 with Ruth Walters, Rastko Vrbaski (both of the Financial

Stability Institute), Bert Van Roosebeke and Ryan Defina (both of the

IADI Research Unit)

o on constraints for deposit

insurers in funding bank failure management. Podcast No. 6 with Ruth Walters, Rastko Vrbaski (both of the Financial

Stability Institute), Bert Van Roosebeke and Ryan Defina (both of the

IADI Research Unit)

o on constraints for deposit

insurers in funding bank failure management.

Podcast No. 5 with Danilo Palermo (World Bank), Bruno

Meyerhof Salama (UC Berkeley Law School) and Bert Van Roosebeke

(IADI Senior Policy and Research Advisor) on Resolution of

State-Owned Banks Podcast No. 5 with Danilo Palermo (World Bank), Bruno

Meyerhof Salama (UC Berkeley Law School) and Bert Van Roosebeke

(IADI Senior Policy and Research Advisor) on Resolution of

State-Owned Banks

The

IADI Podcast Series

is now available on Spotify, Apple Podcasts and all other major

providers. Further episodes will follow on a regular basis.

Research Webinars

10 October 2022

Dalvinder

Singh from the University of Warwick and a member of the IADI Advisory

Panel presented the impact of COVID-related public support on banks

and states in the EU Banking Union

15 November 2022

The IADI Research Unit presented on

the background of VIDA, its key features, how best to utilise these

via real life examples, and plans for future enhancements.

21 November 2022

Hiroaki Kuwahara and Kazuaki Hara

(both from the Deposit Insurance Corporation of Japan) provided a case

study of deposit insurance treatment of prepaid payment instruments in

Japan, the United States and European Union.

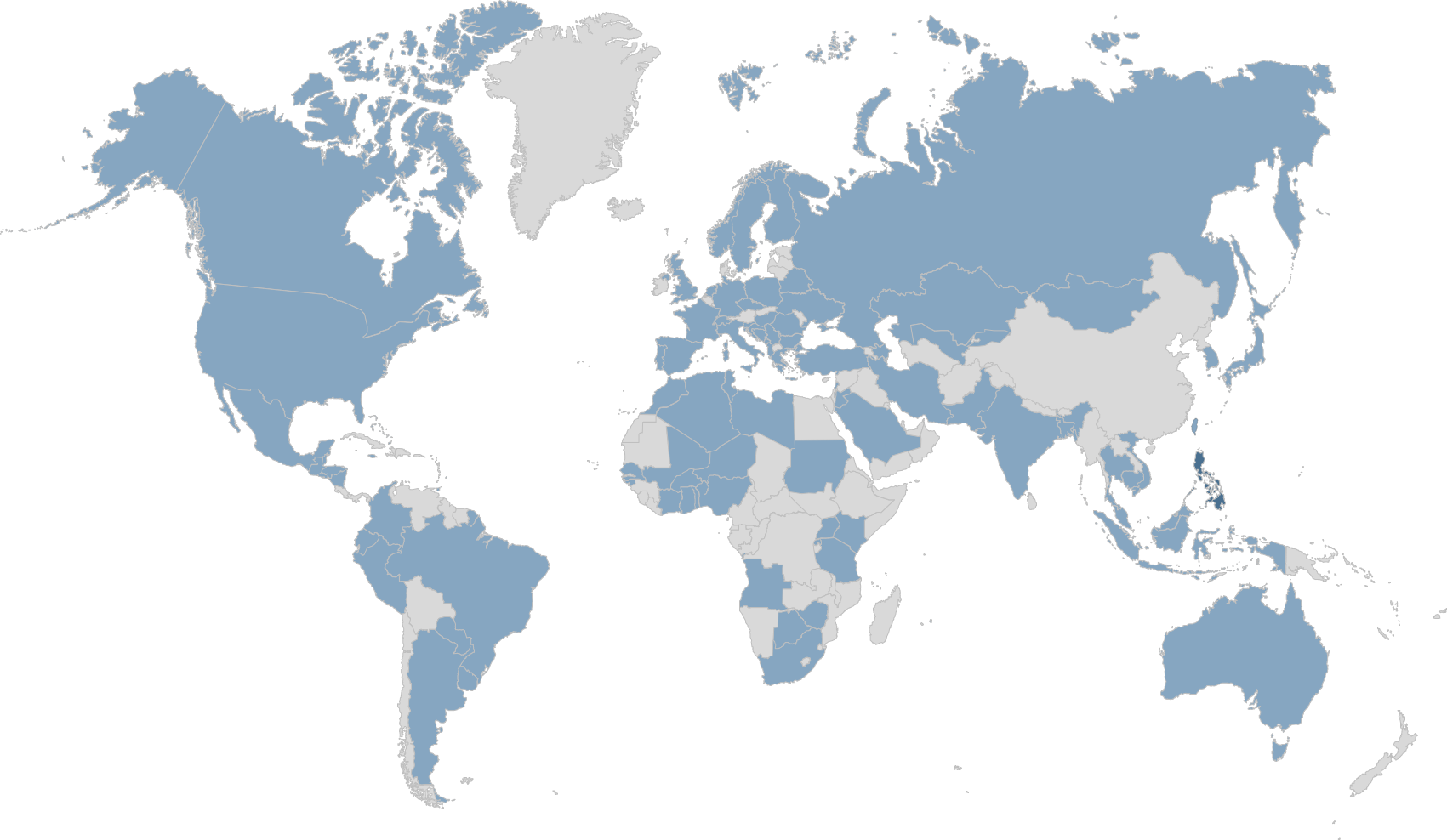

2022 IADI Annual Survey

2022 IADI Annual Survey

The 2022 Annual Survey results were

published in November 2022. The IADI Annual Survey forms the most

comprehensive source of deposit insurance information globally and is

utilised extensively for research initiatives and policy decision

making. We extend our appreciation to IADI Members, Associates and

Partners who participated in the survey and for their continued

support to the IADI data and research initiatives.

Survey results

from the 2022 Annual Survey showed that jurisdictions continue to

strengthen their deposit insurance systems and are moving towards

greater compliance with the IADI Core Principles for Effective Deposit

Insurance Systems.

To find the details, please visit

IADI’s Data Warehouse Section, where you can find data on 15 Key features and

an updated Chart Pack. The full data is available to members only on

eBIS (sign-in is required).

IADI also conducted

numerous surveys among stakeholders to gauge perspectives on member

engagement and seeking input to the ongoing IADI Core Principles

review process, along with topics domain-specific topics such as

Fintech organisational management, reimbursement and liquidation

activities, and consideration of ESG issues.

Training and Capacity Building Unit

Training and Capacity Building Unit

The Training and Capacity Building

Unit (TCBU) continued to cater to the training needs of the IADI

community through virtual platforms and in-person workshops. In

collaboration with the TTAC and CBTC, the TCBU developed various

capacity-building activities and made progress in the development and

implementation of the Expert Training Strategy, all key components of

the IADI Strategic Goals.

Capacity Building

Capacity Building

Financial Stability Institute (FSI) Connect Licenses

As part of the strategy to increase

the use of this valuable membership benefit, the TCBU reached out to

each IADI Member jurisdiction to provide an update on the usage of

their IADI-sponsored FSI Connect licenses for 2022.

FSI Connect Tutorial Update

The

TCBU updated the tutorial on Public Awareness of Deposit Insurance

Systems. The updated suite of 6 tutorials will be available to

all FSI Connect users in 2023. The

TCBU updated the tutorial on Public Awareness of Deposit Insurance

Systems. The updated suite of 6 tutorials will be available to

all FSI Connect users in 2023.

Expert Training Strategy

Expert Training Strategy

Expert Training Working Group

The materials for the second stage

of the expert training program were finalised and submitted to the

CBTC and TTAC. The second round of the ETWG virtual training is

expected to kick off in January 2023. The TCBU solicited expressions

of interest from the 30 participants that completed the Core

Principles Practitioners Workshop in July 2022.

The expanded roster of CP Experts

will help support the Self-Assessment Technical Assistance Program

(SATAP), as well as various other IADI training initiatives, including

IADI workshops, conferences, and other capacity building activities.

Core Principles Experts Workshop

The process for preparing materials

for the third stage of the Expert Training Strategy is underway with

the Experts Workshop Task Force meeting every two weeks. The process

is expected to be completed in Q2/Q3 with the CP Experts Workshop

scheduled to take place in Q4 of 2023.

Self-Assessment

Technical Assistance Program (SATAP)

Self-Assessment

Technical Assistance Program (SATAP)

Work is ongoing for SATAP reviews

in PDIC (Palestine) and DPC (Zimbabwe). The PDIC review team is led by

the IADI Senior Training and Technical Assistance Advisor, Eugenia

Alamillo, and includes Silvana Sejko (ADIA) and Juan Carlos Lopez

(TACBA, IADI Secretariat). The review team completed the offsite work

and, since it was determined that an onsite visit was not feasible, is

concluding the report following various virtual meetings with key

stakeholders.

The TTAC Chairperson and IADI

Secretary General approved the DPC Zimbabwe request in September 2021

and the SATAP review officially kicked off in January 2022. Tony

Sinopole (FDIC) is leading the review team, which includes Juan Carlos

Lopez (TACBA, IADI Secretariat), Taurai Togarepi (TAA, IADI

Secretariat), Riccardo de Lisa (FITD), Shilpa Shah (FDIC) and Galo

Cevallos (FDIC). The review team meets bi-weekly to complete the

off-site review of the DPC self-assessment. The team has projected the

on-site review for Q1 2023.

Technical Assistance

Technical Assistance

Technical Assistance Framework

The TCBU created the Technical

Assistance Framework (TAF) to establish a collaborative platform for

delivering peer-to-peer assistance and optimizing the matching process

between Members requesting technical assistance and potential

providers in the IADI community. The TAF, including the related

communications plan, was approved by the CBTC in August 2021. The TCBU

released the 2022 Annual Call in February 2022 to identify IADI

Members and Partners willing to provide bilateral assistance.

The 2022 Annual Call increased the

number of deposit insurers who can provide technical assistance by

65%, resulting in a total of 19 providers.

Bilateral Technical Assistance

By December 2022, seven bilateral

technical assistance requests were completed (ADIA-Albania,

DPA-Thailand, CDIC-Chinese Taipei, BDIS-Oman, DPC-Pakistan (3

requests), and DPC-Zimbabwe). The bilateral assistance process

included the coordination of 35 peer-to-peer assistance sessions.

Virtual

Training Events

Virtual

Training Events

The TCBU facilitated and

coordinated virtual events with IADI Regional Committees and IADI

Partner organisations mentioned throughout the newsletter. The TCBU

also supported two (2) IADI Latin America Regional Committee Webinars.

In total twelve (12) training events were delivered with a total of

1,731 participating in these events from IADI Member, Associate and

Partner Organisations.

IADI Insights

The TCBU organized and hosted the

fifth IADI Insights webinar series on Single Customer View: An

Essential Tool for Effective Depositor Reimbursement on 13 October

2022. Ivy Jeuken, Policy Officer for Resolution and DGS of the

De Nederlandsche Bank highlighted the legal framework put in place to

allow the deposit insurer to collect this information and minimum

requirements to be fulfilled by member banks when submitting customer

information for the SCV file.

Blerta Koci, Head of Information

Technology of the Albania Deposit Insurance Agency (ADIA) focused on

Information Technology infrastructure and systems in place for data

storage and data validation processes. Gerardo Suarez, Planning,

Control and On-site Inspection Visits Manager of the Institute for the

Protection of Bank Savings (IPAB) Mexico’s presentation focused on

testing and usability for pay-out and other deposit insurance related

purposes (simulation, public awareness, among others). The webinar was

attended by 215 participants.

The sixth IADI Insights webinar

series on “Banking on Bridges: Lessons from the BFG experience using

the bridge institution tool” was held on 13 December 2022.

The webinar was attended by 126

participants.

Regional Events

|

IADI Africa Regional

Committee Annual General Meeting and Conference

|

|

|

The Deposit Protection Corporation

(DPC), Zimbabwe, on behalf of the Africa Regional Committee (ARC),

hosted the ARC Conference and Annual General Meeting from 29 August

2022 to 2 September 2022. The theme of the conference was “Building

Resilience for Deposit Insurance Systems: The New Normal”. |

The conference was held in a hybrid

format over four days and began with presentations focusing on

emerging issues for deposit insurers, regulatory framework for mobile

money and fintech products and climate change and its impact on

deposit insurance. On the second day, discussions were centred on the

key features of Core Principle 9, backstop and emergency funding

arrangements or mechanisms in the face of systemic failure risk in the

Covid-19 aftermath, optimal fund size and differential premium

systems.

Discussions concluded on day three

with presentations on dealing with parties at fault in a bank failure,

effective legal frameworks for dealing with parties at fault and

country experiences on dealing with parties at fault. The conference

was attended by a total of 134 delegates, with 83 attending in person

and 51 attending via Microsoft Teams.

|

IADI ERC

and EFDI Joint Webinar

|

|

|

The Fondo Interbancario di Tutela

dei Depositi, on behalf of the IADI Europe Regional Committee, hosted

the IADI ERC and European Forum of Deposit Insurers (EFDI) joint

webinar on "Green" Deposit Guarantee Schemes and Non-Financial

Reporting: New Challenges for Deposit Guarantee Schemes. |

The joint webinar discussions began

with a keynote address on green DIS and non-financial disclosure. This

was followed by a round table on financial versus non-financial

reporting by deposit guarantee schemes. The joint webinar was attended

by 93 participants.

|

IADI

Africa Regional Committee Workshop

|

|

|

The Nigeria Deposit Insurance

Corporation (NDIC) hosted the IADI Africa Regional Committee (ARC)

Workshop from 3 - 7 October 2022, on behalf of the ARC Regional

Committee. The theme of the conference was “Normality in Turbulent

Periods: The Stabilizing Role of Deposit Insurance.” |

The workshop began with a

presentation on the Central Bank of Nigeria’s eNaira and implications

for the banking system, as well as an overview of IADI Core Principle

13 (Early Detection and Timely Intervention) and the role of the

deposit insurer in early detection and timely intervention. There were

also presentations on designing and implementing a systemic banking

crisis management simulation, technical and operational aspects of

simulation exercise design and implementation and case studies of

crisis simulation exercises or contingency planning framework. The

workshop concluded with a presentation on how inflation impacts

deposit insurance, real coverage and coverage ratio. The workshop was

attended by a total of 111 delegates with 73 attending in person and

38 attending via Microsoft Teams.

|

IADI Asia

Pacific Regional Committee (APRC) Study Visit

|

|

|

The Indonesia Deposit Insurance

Corporation (IDIC) hosted the IADI APRC Study Visit on 7 and 8

November 2022 on “Cybersecurity and Enterprise Risk Management for

Deposit Insurers”. |

Discussions on the first day focused on

current practices on enterprise risk management frameworks and

cybersecurity applications in deposit insurance. The second day

centred on case studies and discussion exercises around enterprise

risk management, cybersecurity application and digital transformation.

The study visit concluded with presentations of various crisis

simulation exercises. The event was attended by a total of 228

delegates with 158 attending in person and 70 attending virtually.

|

IADI Asia

Pacific Regional Committee Workshop

|

|

|

The Philippine Deposit Insurance

Corporation (PDIC), on behalf of the IADI APRC, held a virtual

workshop and exhibit on “Boosting Depositor Confidence During

Uncertain Times”. The virtual workshop and exhibit were held from 21 –

23 November 2022. |

The virtual exhibit on day one,

exclusively for APRC members, included exhibitors from APRC and the

IADI Secretariat. The second day focused on an overview of Core

Principle 10, a regional perspective of public awareness, and

discussion on increasing depositor confidence through effective public

awareness programs. The third day centred on Core Principle 15, a

regional perspective on reimbursing depositors, and presentations on

reducing uncertainty through efficient payout processes. The virtual

workshop was attended by 235 participants.

|

IADI

Europe Regional Committee Workshop

|

|

|

The Fondo Interbancario di Tutela

dei Depositi, on behalf of the IADI Europe Regional Committee, hosted

the IADI ERC webinar on Core Principle 9: Sources and Uses of Funds

for Deposit Insurers..

|

The webinar covered the key

elements of Core Principle 9, the European framework, setting the

target fund level and emergency/backup/alternative funding

arrangements. The webinar was attended by 129 participants.

|

Latin

America Regional Committee Webinars

|

|

|

The Fundo Garantidor de

Créditos (FGC), Brazil hosted the Latin America Regional Committee

Webinar “Aplicación móvil para el pago del seguro de depósitos” on 24

August 2022. The webinar was attended by 41 participants.

|

The Fondo de Garantía de

Depósitos de Entidades de Crédito (FGD), Spain hosted the Latin

America Regional Committee Webinar “Intervenciones del FGD para usos

distintos al pago de depósitos: los Esquemas de Protección de Activos”

on 1 December 2022. The webinar was attended by 26 participants.

Events with

Partner Organisations

Events with

Partner Organisations

|

IADI MEFMI Joint Webinar

|

| |

The first IADI - Macroeconomic and

Financial Management Institute of Eastern and Southern Africa

(MEFMI) joint event took place on 15-17 August 2022. The

three-day event was on Fund Investment Management for Deposit

Insurance Systems. MEFMI is a potential IADI partner. |

|

|

| |

The three-day virtual workshop

began with an overview of the key features of Core Principle 9

(sources and uses of funds). This was followed by three

presentations on deposit insurance funding, including back-up

funding, premium fees, and target fund size. Day two

discussions centred on deposit insurance fund investment, risk

management and creating investment strategies for a deposit

insurance system. The virtual workshop on day three concluded

with a panel discussion on investment management practices in

the IADI Africa Regional Committee and MEFMI regions. The

joint webinar was attended by 150 participants.

|

|

|

|

FSI – IADI Virtual Workshop |

|

|

|

| |

The Financial Stability Institute

(FSI) of the Bank of International Settlements (BIS) and IADI

virtual workshop “One Size Does Not Fit All: Tailoring Failure

Resolution Frameworks for all Banks” took place on 29 and 30

November 2022. |

|

|

| |

The virtual meeting focused on

exploring the challenges of designing resolution regimes and

operational approaches that are appropriate for different

types of banking institution and the structure of local

banking markets. The two sessions covered proportionality and

implementation challenges in designing resolution frameworks

and managing the failures of small banks, financial

cooperatives, and state-owned banks. The virtual workshop was

attended by 369 participants with 212 from the IADI community. |

| |

|

|

|

|

New IADI Participants

|

|

|

Bank

of Ghana –

New

Associate

We thank the Bank for its applications and

look forward to working more closely with the Bank as

part of the global IADI community. As of December

2022, IADI's membership includes 119 participants,

including 92 Members, 10 Associates and 17 Partners. |

|

|

|

|

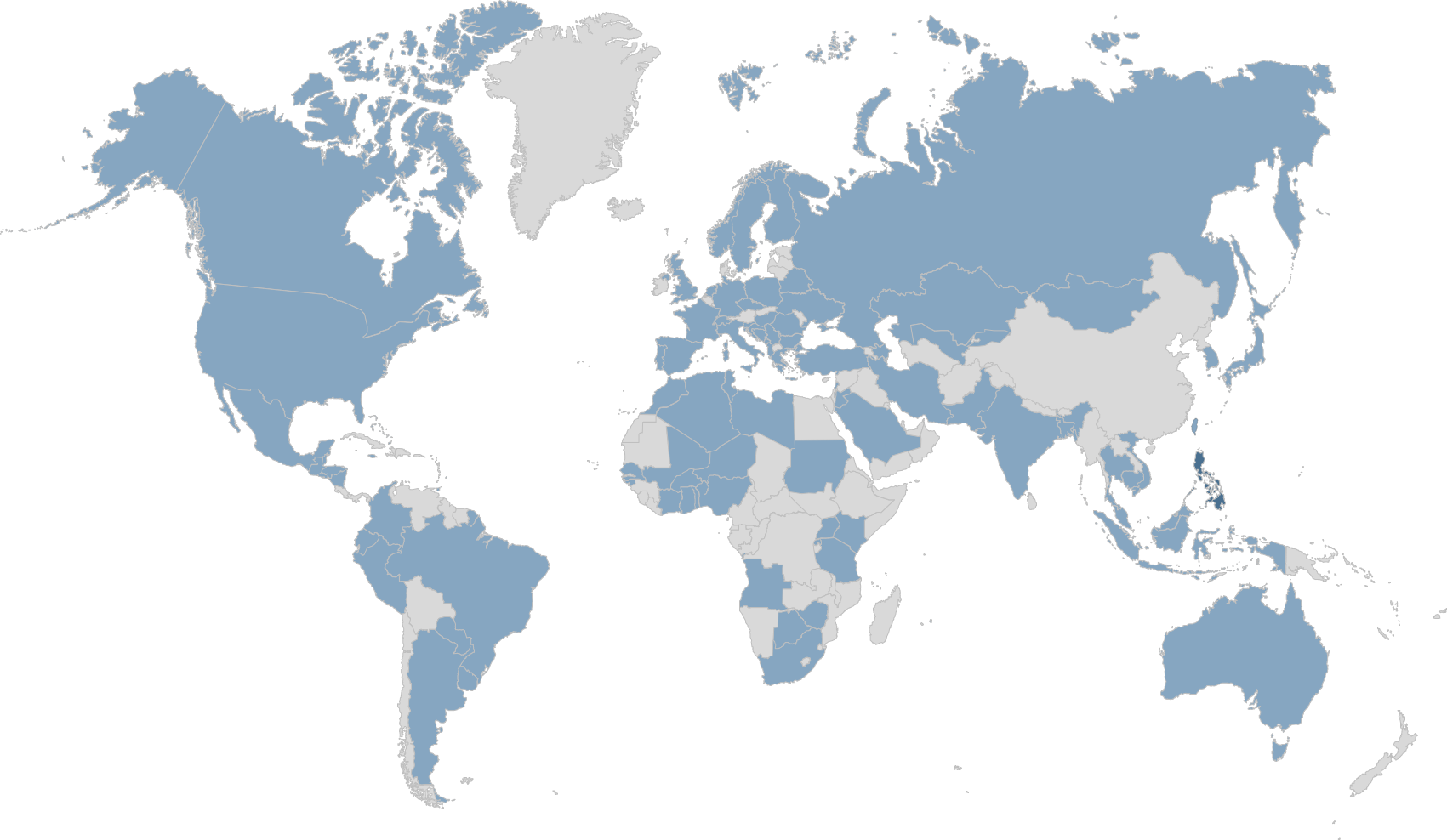

The International Association of Deposit

Insurers (IADI) was formed in May 2002 to enhance the effectiveness of

deposit insurance systems by promoting guidance and international

cooperation. Members of the IADI conduct research and produce guidance

for the benefit of those jurisdictions seeking to establish or improve

a deposit insurance system. Members also share their knowledge and

expertise through participation in international conferences and other

forums. The IADI currently represents 92

deposit insurers, 10 Associates

and 17 Partners (as of December

2022). The IADI is a non-profit organisation constituted under Swiss

Law and is domiciled at the Bank for International Settlements in

Basel, Switzerland

|

|

|

Let

me express my sincere appreciation to all IADI Members, Associates

and Partners for your support in the furtherance of IADI’s mission

during the second part of 2022. We continue to work with our

membership in adapting to the ongoing impacts of the pandemic as

well as adjusting to international crises and a rapidly changing

macroeconomic landscape. IADI is facing these challenges by

continuing to leverage technology and moving forward with an

ambitious agenda for training, capacity building, research and

guidance.

Let

me express my sincere appreciation to all IADI Members, Associates

and Partners for your support in the furtherance of IADI’s mission

during the second part of 2022. We continue to work with our

membership in adapting to the ongoing impacts of the pandemic as

well as adjusting to international crises and a rapidly changing

macroeconomic landscape. IADI is facing these challenges by

continuing to leverage technology and moving forward with an

ambitious agenda for training, capacity building, research and

guidance.

.png)

_r.jpg)

_r.jpg)

.jpg)

.png)

Mr

Keehyun Park finished his secondment to the IADI Secretariat

and returned to the Korea Deposit Insurance Corporation (KDIC)

in December 2022. Keehyun joined the Secretariat in August

2020 as Senior Policy Analyst.

Mr

Keehyun Park finished his secondment to the IADI Secretariat

and returned to the Korea Deposit Insurance Corporation (KDIC)

in December 2022. Keehyun joined the Secretariat in August

2020 as Senior Policy Analyst.  The International Association of Deposit Insurers (IADI) held

its 20th Anniversary International Conference on 6 - 7 September

2022 in hybrid format, in Basel, Switzerland, titled “Enhancing

deposit insurance and promoting financial stability around the

world: building on the past, preparing for the future…” with 260

participants from more than 75 institutions worldwide attending the

event.

The International Association of Deposit Insurers (IADI) held

its 20th Anniversary International Conference on 6 - 7 September

2022 in hybrid format, in Basel, Switzerland, titled “Enhancing

deposit insurance and promoting financial stability around the

world: building on the past, preparing for the future…” with 260

participants from more than 75 institutions worldwide attending the

event.