|

Welcome to the IADI's e-Newsletter

The International Association of Deposit Insurers (IADI) is pleased to provide the latest issue of its e-Newsletter.

The e-Newsletter keeps you up-to-date on information about IADI activities from July

to December 2020, as well as on upcoming IADI activities.

|

|

|

This issue includes:

|

|

|

|

|

| |

Let me express my sincere appreciation to all IADI Members, Associates and Partners for their efforts and support in the furtherance of IADI’s mission over

the past six months. The IADI Secretariat looks forward to further contributing to the advancement of IADI in 2021.

We also look forward to seeing you virtually during our

scheduled meetings in 2021 and hope and pray that by this time next

year we will be able to all meet again.

Happy holidays and the very best for the new year! |

|

| |

David Walker

Secretary

General

International Association of Deposit Insurers |

Season’s greetings from the IADI Secretariat

Message from David Walker, IADI Secretary General

|

|

|

|

|

Let me express my sincere appreciation to all IADI Members,

Associates and Partners for your efforts, and support, in the

furtherance of IADI’s mission over the past six months. The year

2020 has been a difficult year for our membership who have

experienced a profound period of adjustment in dealing with the

global Covid-19 pandemic.

IADI has faced this challenge by continuing to adapt meet

to the needs of Members, particularly in establishing a virtual work

environment for the delivery of services. The Association has

been leveraging technology to deliver training and capacity building

considering the various limitations on travel and gatherings.

|

|

|

|

After holding our first virtual Executive Council (EXCO)

Meetings on 29 May and 12 June we have gone on to hold virtual EXCO

meetings on 14 and 15 September, 2 and 9 December and an Annual

General Meeting (AGM) and Extraordinary AGM on 8 December 2020.

For the first time in IADI’s history the Association held

elections entirely via correspondence voting during its AGM.

As a result, we are happy to congratulate the General Director of

the State Corporation “Deposit Insurance Agency” (DIA Russia), Yury

Isaev, who was elected to serve as the Association’s President and

as the Chair of its Executive Council for a two-year term. He

succeeds Katsunori Mikuniya, Governor of the Deposit Insurance

Corporation of Japan (DICJ), who served as President for a

three-year term. During his tenure, Governor Mikuniya promoted the

Association’s Strategy, including the extension of the current

Strategic Plan to 2021. He also enhanced the capacity of the IADI

Secretariat and introduced a Differentiated Fee Model (DFM) to

provide more substantial benefits to Members and facilitate the

implementation of many new programs and activities.

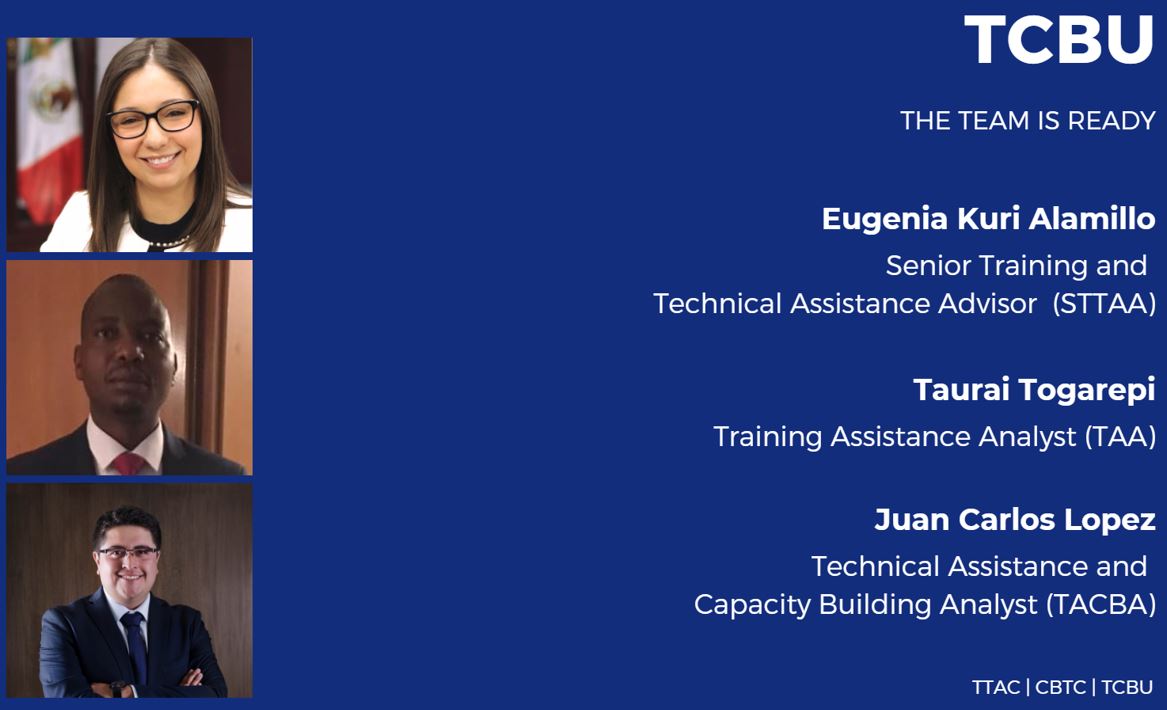

In terms of addressing the Strategic Goals of IADI

through the implementation of the current Business Plan, the

Secretariat has been joined by a number of additional staff members

to enhance IADI’s training and capacity building work, Core

Principles compliance assessment and in advancing the Association’s

research and policy agenda.

Other important areas where work has continued include

the Training and Technical Assistance Council Committee (TTAC),

supported by the Secretariat’s Training and Capacity Building Unit

(TCBU), which has moved further to establish a Core Curriculum for

workshops designed for differing audiences and establishing an

Expert Training Strategy. This Strategy seeks to create a structured

programme for training IADI Members interested in developing an

in-depth knowledge of the IADI Core Principles, becoming capable of

leading Self-Assessment and Technical Assistance Program (SATAP)

reviews, supporting Technical Assistance Workshops (TAW), and

supporting or participating in the IMF/World Bank FSAP reviews and

in conducting self-assessments of compliance with the Core

Principles.

In other areas, IADI’s Core Principles and Research Council

Committee (CPRC) and the Secretariat’s Research Unit (RU) have been

working in numerous areas such as the publishing of a Brief on

Depositor Preference and Implications for Deposit Insurance and a

guidance paper on Risk Management and Internal Control Systems of

Deposit Insurers. Meanwhile, the Financial Technology Technical

Committee completed its workplan and initiated the development of a

series of Policy Briefs.

With respect to IADI surveys, a major accomplishment over

the past few months was the completion of the IADI 2020 Annual

Survey on Deposit Insurance and Financial Safety-Net Frameworks.

Work was also initiated on developing options to enhance the

reporting features of the IADI Survey and Database Management System

for Members.

The IADI Strategic Planning Working Group (SPWG)

continued to work on the development of a new IADI Strategic Plan

for the FY 2021/22 to 25/26 period and to review and seek

improvements to IADI’s current DFM. The SPWG is now focusing on

constructing four pillars to help develop a strategic map for the

Association. The four pillars involve understanding IADI Member

expectations, gathering the contributions of SPWG members and IADI

Council Committees on improving the Association, analysing IADI’s

Strengths, Weaknesses, Opportunities and Threats (SWOT) and

benchmarking IADI with other standard setters. Meanwhile, the SPWG

Fee Subgroup made excellent progress on exploring modifying the

current DFM; and, looking at the possible inclusion of additional

parameters to the fee model, such as insured deposits.

Moving into the New Year, we look forward to engaging with

you at our next virtual EXCO meeting in March 2021, our 6th Biennial

IADI Research Conference to be held virtually in May 2021 and many

other events.

The entire IADI Secretariat Team wishes you the very best

of success in these challenging times and the new year ahead.

|

|

|

|

Highlights from the 19th Annual General Meeting

|

|

IADI held its 19th Annual General Meeting (AGM) by correspondence

in October-November 2020, and virtually held its Extraordinary General

Meeting (EGM), 65th EXCO and 65th bis EXCO Meetings on 2-9 December

2020. |

|

|

|

|

|

|

|

IADI Elected Yury Isaev as its New President and Chair of the

Executive Council

IADI Elected Yury Isaev as its New President and Chair of the

Executive Council

During the elections held during IADI’s

AGM, the General Director of the State Corporation “Deposit Insurance

Agency” (DIA Russia), Yury Isaev, was elected to serve as its

President and as the Chair of its Executive Council for a two-year

term. He succeeds Katsunori Mikuniya, Governor of the Deposit

Insurance Corporation of Japan (DICJ), who served as President for a

three-year term. During the elections held during IADI’s

AGM, the General Director of the State Corporation “Deposit Insurance

Agency” (DIA Russia), Yury Isaev, was elected to serve as its

President and as the Chair of its Executive Council for a two-year

term. He succeeds Katsunori Mikuniya, Governor of the Deposit

Insurance Corporation of Japan (DICJ), who served as President for a

three-year term.

General Director Isaev expressed

gratitude to the Members for his election, stating,

“IADI is an essential element of the global

financial safety net and plays an important role in enhancing the

effectiveness of deposit insurance systems and in contributing to the

maintenance of financial stability around the world. I am grateful to

IADI Members for their trust and the honor to serve as President of

the Association during the next two years. We will continue our joint

work on the implementation of our Strategic Goals to ensure the

further advancement of IADI as a standard setting body and in

promoting best practices, improving collaboration with other

international financial institutions and providing quality services to

the membership.”

He went on to recognise the outgoing

IADI President, Governor Mikuniya and the

DICJ team, for their tremendous contributions and dedication over the

past three years in leading the Association and in facilitating the

achievement of IADI’s Strategic Goals. During his tenure,

Governor Mikuniya took the initiative to promote the Association’s

Strategy, including the extension of the current Strategic Plan to

2021. He also received IADI Members’ broad support to enhance the

capacity of the IADI Secretariat through the additional hiring of IADI

Secretariat staff. Further, he made efforts to introduce a

Differentiated Fee Model, giving the Association relevant resources to

be able to provide more substantial benefits to Members and

facilitating implementation of many programs and activities.

General Director Isaev concluded his

remarks by emphasising the crucial role of the Executive Council,

Council and Regional Committees, indicating that we need to improve

our governance, streamline our decision making process and ensure our

focus on the achievement of the Strategic Goals.

2020 IADI Extraordinary General Meeting of Members on 8

December 2020

|

|

|

|

EXCO

Election Results EXCO

Election Results

In addition to the election of Mr

Isaev during the AGM, the Members elected 10 Members’ Designated

Representatives to the Executive Council to fill the vacancies that

had arisen, as follows:

|

|

|

|

|

Diane Ellis

Federal Deposit

Insurance Corporation

(USA) |

Gregor Frey

esisuisse

(Switzerland) |

Karen Gibbons

Financial Services

Compensation

Scheme (UK) |

Marija Hrebac

Croatian Agency for

Deposit

Insurance

and Bank Resolution |

Alejandro J. López

Seguro de

Depósitos Sociedad

Anónima

(Argentina) |

|

|

|

|

|

Katsunori Mikuniya

Deposit Insurance

Corporation

of Japan |

Chantal Richer

Canada Deposit

Insurance

Corporation |

Purbaya Yudhi

Sadewa

Indonesia Deposit

Insurance Corporation |

Piotr Tomaszewski

Bank Guarantee

Fund

(Poland) |

Eloise

Williams Dunkley

Jamaica Deposit

Insurance Corporation |

| |

|

|

|

|

| |

|

|

The newly elected EXCO Members shall act in the best interests of the Association, and shall

each serve for a three-year term.

The remaining Council members are:

|

|

|

|

|

|

|

|

|

Patrick Déry

Autorité des marchés

financiers

(Québec, Canada) |

Mohamud Ahmed

Kenya Deposit

Insurance

Corporation |

Mu’taz Barbour

Jordan Deposit

Insurance

Corporation |

Giuseppe Boccuzzi

Interbank Deposit

Protection Fund

(Italy) |

Michel Cadelano

Fonds de Garantie

des Dépôts

et de

Résolution (France) |

|

|

|

|

|

Daniel Dominioni

Corporación de

Protección del Ahorro

Bancario (Uruguay) |

Yvonne Fan

Central Deposit

Insurance

Corporation

(Chinese Taipei) |

Muhiddin Gülal

Savings Deposit

Insurance Fund

(Turkey)

|

Zaher Hammuz

Palestine Deposit

Insurance Corporation |

Mariano Herrera

Fondo de Garantía de

Depósitos de Entidades

de Crédito

(Spain) |

|

|

|

|

|

Daniel Lima

Fundo Garantidor de

Créditos (Brazil)

|

Gabriel Limon

Instituto para la Protección

al Ahorro

Bancario

(Mexico) |

Sonja Lill Flø Myklebust

The

Norwegian Banks'

Guarantee Fund |

Seongbak Wi

Korea Deposit

Insurance Corporation |

|

|

|

|

|

|

|

|

The following have retired from their respective positions on the EXCO since the previous edition of the

e-Newsletter. The Association thanks

them for their contributions to the leadership of IADI.

|

|

|

|

|

Rafiz Azuan Abdullah

Malaysia Deposit

Insurance

Corporation |

Michelle Rolingson-Pierre

Deposit Insurance Corporation

(Trinidad and Tobago) |

Fauzi Ichsan

Indonesia Deposit

Insurance Corporation |

Nikolay Evstratenko

Deposit

Insurance Agency

(Russian Federation) |

| |

A link to the Press Release on the subject of the Annual General Meeting including its elections, may be found

here.

d |

|

|

|

Save the Date: October 2021 (TBD) - 20th IADI Annual General Meeting and Annual Conference

|

|

|

|

|

Save the Date

The 20th IADI Annual General Meeting and Annual Conference will be hosted by the Seguro de Depósitos SA (SEDESA) in Buenos Aires, Argentina

in October 2021 (Tentative/TBD).

The schedule (date, host and venue)

is subject to change depending on the situation of Covid-19 pandemic

and related restrictions.

More details will be announced in February 2021.

|

|

|

|

|

|

|

Short summary of Executive Council Meetings

|

|

|

|

|

|

The 64th and 65th EXCO Meetings were virtually held

on 14 – 15 September and 2 December 2020, respectively.

The main agenda item of these two virtual EXCO

Meetings was the updates/reports from the Strategic Plan

Working Group (SPWG) and its Fee Subgroup. The analysis of the

SPWG survey results, and the work plan of the SPWG and the Fee

Subgroup were presented at the September EXCO Meeting.

Following the active discussion at the

monthly meetings of the SPWG and the Fee Subgroup, the

Executive Councilmembers had a lively exchange of views at the

December EXCO Meeting based on the various opinions provided

by respective group members during the past three months.

For more details about the SPWG and the

Fee Subgroup, please refer to the section on

“Update from the Strategic Planning Working Group”

described below.

|

|

|

Announcements regarding Secretariat members

|

|

|

|

|

New Secretariat Member

Mr Keehyun Park joined the IADI

Secretariat in August 2020 from the Korea Deposit Insurance

Corporation (KDIC).

Prior to joining the secretariat, his focus at the

KDIC was responding to the IMF’s Financial Sector Assessment

Program (FSAP) to Korea as one of the main contacts for the

crisis preparedness section. Before that, he was responsible

for managing and reviewing the adequacy of Deposit Insurance

Fund’s Reserve Ratio and liaising with the Korean government

as secondee to the Financial Services Commission to support

its deposit insurance policy making.

The KDIC’s massive mutual savings banking (MSB)

sector restructuring has been a big influence in formulating

his career. The tasks he participated in include the PCA

management and examination of failing MSBs, deposit

reimbursement to failed MSBs’ depositors, audits to their

bankruptcy estates and redeeming debts derived from the

failures.

He also cherishes the years he worked at the KDIC’s

International Affairs participating in the revision of the

Core Principles, contributing to the launch of the KDIC’s

technical assistance program and collaborating with wonderful

colleagues around the globe.

|

|

|

We are pleased to announce the recruitment of Ms

Yung-Chen Carole Lin for the Secretariat position of

Core Principles and Compliance Assessment

Advisor (CPCAA).

Before joining the IADI, Ms Lin worked at the

Insurance Bureau of the Financial Supervisory Commission in

Chinese Taipei on international affairs and supervision of a

reinsurance company. Prior to this, Ms Lin

worked as a Policy Advisor in the

Secretariat of the International Association of

Insurance Supervisors (IAIS) hosted by the BIS. During the

time, she was the primary support of the Implementation and

Assessment Committee and supported a wide range of the IAIS

implementation activities and strategies, including

assessments on Insurance Core Principles and other supervisory

materials, opportunities for supervisory capacity building and

mechanism for supervisory cooperation among insurance

supervisors.

Ms Lin joined the IADI Secretariat on 1 September

2020. With her previous in-depth experience in the involvement

of a formal core principle compliance assessment programme,

she will be responsible for creating a formal approach and

developing process and procedures for an assessment framework

to monitor compliance levels of the IADI’s Core Principles.

The assessment framework will support the Association’s

research and training functions to provide Members with

information on their gaps in compliance in order to assist in

developing action plans and programmes to modernise and

upgrade their deposit insurance systems.

|

|

|

We are pleased to announce the recruitment of

Mr Juan Carlos Lopez-Mora for the Secretariat

position of Technical Assistance and Capacity Building Analyst

(TACBA).

Mr Lopez-Mora joined the IADI from Fogafin, the

Deposit Guarantee Fund of Colombia, where he worked as Head of

Corporate Communications and Affairs. Here, he was responsible

for Fogafin’s institutional communications, along with the

foreign affairs initiatives, where he led the participation in

international forums and technical committees related to

deposit insurance, including the IADI.

With his experience in the development of previous

technical assistance and capacity building activities, he will

be responsible for creating a strategy to address the requests

raised by IADI Members and support them during the

implementation process. With this, IADI aims to support its

Members to strengthen its capacities and close the existing

gaps with the compliance of the Core Principles.

Mr Lopez-Mora holds a Master in Business

Administration from Carleton University, Ottawa, Canada, and a

Professional Degree in Finance and International Affairs from

Universidad Externado, Bogota, Colombia.

He became part of the IADI Secretariat team since

14 October 2020, for a three-year term.

|

|

|

We are pleased to announce the recruitment of

Mr Taurai Togarepi for the Secretariat position of

Training Assistance Analyst (TAA).

Mr Togarepi was appointed the TAA and joined the IADI

Secretariat team on 14 October 2020. Mr Togarepi was with the

Deposit Protection Corporation of Zimbabwe since February

2013. He worked in the Business Operations Department before

he was promoted to be Manager in charge of Policy, Research

and International Affairs in the Chief Executive’s Office in

January 2016. Before joining the Deposit Protection

Corporation, Mr Togarepi worked in the banking sector.

His duties included providing policy advice on

financial system, planning and coordinating all international

activities. Mr Togarepi has been active on most IADI

activities including being a member of the IADI Capacity

Building Technical Committee, member of the Core Principles

Practioner’s Working Group and Working Group member for

Promoting Self-Assessments.

He also worked extensively on IADI’s initiatives as

support staff to the former IADI Treasurer and Africa Regional

Committee Chairperson. He was the Working Group Coordinator

for various workshops and conferences held in the Africa

Regional Committee including Zimbabwe, Nigeria, Ghana, Uganda

and Tanzania-Zanzibar.

Mr Togarepi in his new role will be responsible for

assisting the Senior Training and Technical Assistance Advisor

(STTAA) to support the Association’s training functions to

provide Member’s with training support to modernise and

upgrade their deposit insurance systems. This includes

supporting the STTAA’s work on IADI’s Self-Assessment and

Technical Assistance Program (SATAP) and working closely with

the Financial Stability Institute (FSI) to conduct

conferences, meetings and other joint training initiatives on

deposit insurance and bank resolution issues and expanding

other elements of IADI’s existing training. In addition, he

will help undertake the implementation of the core curriculum

and a programme for addressing the IADI Core Principles for

compliance gaps in Member systems.

|

|

Farewell to former Secretariat member

Ms Myeonghee Song finished her

secondment to the IADI Secretariat and returned to the Korea

Deposit Insurance Corporation (KDIC) in August 2020. Myeonghee

joined the Secretariat in April 2018 as the Senior Policy

Analyst. Among her diverse responsibilities, Myeonghee played

a key role especially in organising and coordinating numerous

IADI events with high level of expertise and versatility in

dealing with many professional BIS in-house applications such

as CEM Portal and eBIS. More recently, in response to the

extraordinary circumstances related to Covid-19, she played a

leading role in developing a procedure for organising IADI’s

official meetings in a virtual form (Webex), in close

conjunction with the BIS.

She was also responsible for the management of IADI

public website, Members-only site and FSI-Connect e-learning

module, providing technical assistance and guidance through

active communication with IADI Members.

Mr Keehyun Park, also of the KDIC, has taken over her

role to continue these critical activities of the Secretariat

and Association.

We wish to thank Myeonghee for her great efforts

and wish her the very best in her future endeavours.

|

|

|

|

|

Executive Council approval of new/renewed Chairpersons for

the Council and Regional Committees

Update from the

Strategic Planning Working

Group

|

|

Since July 2020, the Strategic Planning Working

Group (SPWG), and the Fee Subgroup reporting to it, achieved important

steps towards completing their respective mandates.1

1 The mandate of the SPWG will be to conduct

analysis and make recommendations in two specific areas:

Mandate A

i. Strategic Goals, activities and

deliverables for the next strategic planning cycle (i.e. 2022-26), and

ii. Organisational capacity, internal processes,

human and financial resources needed to accomplish the new Strategic

Plan.

Mandate B

i.

Review the current DFM in consideration of other criteria which could

be utilised to differentiate Members into appropriate annual

fee

categories.

The Fee Subgroup reporting to the SPWG is responsible

for providing possible annual fee options to the SPWG (focusing on

Mandate B)

As planned, compositions of the SPWG and the Fee

Subgroup were finalised by an EOI process. Regional balance, mandate,

size and current annual fee level are well represented into both

groups. Mr Patrick Déry (Autorité des marchés financiers (AMF),

Québec, Canada), the SPWG Leader, nominated Mr Julien Reid (AMF,

Québec, Canada) to act as Project Manager for the SPWG and the Fee

Subgroup (Ref. Figure 1 and Figure 2). Also, Mr Déry nominated Mr

Carlos Colao (Fondo de GarantÌa de Depósitos de Entitades de Crédito

(FGD), Spain) to act as Fee Subgroup Leader.

|

SPWG Leader |

Project Manager for the

SPWG |

Fee Subgroup Leader |

|

|

|

Patrick Déry

Autorité des

marchés

financiers

(Québec,

Canada) |

Julien Reid

Autorité des marchés

financiers

(Québec,

Canada) |

Carlos Colao

Fondo de Garantía de

Depósitos de Entidades

de Crédito

(Spain) |

|

|

|

The SPWG and the Fee Subgroup held monthly

meetings with their respective groups in the past few months. These

meetings were followed by Reaching out and Debriefing Sessions

accessible to all IADI Members. The aim of those sessions is for the

SPWG Leader and the Fee Subgroup Leader to present and explain the

work accomplished as well as the work to come in order to ensure

transparency and uniformity in the message among IADI Members. It is

also an opportunity for Members to give their views on the addressed

topics.

Work accomplished by the SPWG

Work accomplished by the SPWG

During the last few months, the SPWG

worked on four pillars to be used to develop a strategic map, which

will serve as the basis for the next Strategic Plan 2022-2026.

Members’ expectations, the first pillar,

originate mainly from the results of a Survey on IADI Member’s View of

its Strategic Goals and Differentiated Fee Model. This survey obtained

one of the highest levels of Member engagement for an IADI survey,

with a response rate of 73%. According to the Survey, the Strategic

Plan 2022-2026 should be in continuity of the current Strategic Plan.

Also, the current fee model should be maintained with some

improvements.

The second pillar is the contribution of SPWG

members and Council Committees. They were invited to brainstorm on the

following three strategic questions: (1) What should we continue?, (2)

What should we do more?, and (3) What should we drop?

The SWOT analysis, which consists of addressing

strengths, weaknesses, opportunities and threats of the IADI, is the

third pillar. This analysis was developed based on inputs from 32

respondents.

The fourth pillar is the benchmarking with other

standard setters, namely IAIS and IOSCO. This exercise highlighted the

need to add a new goal in the next strategic plan that could be

written as follow “Enhancing IADI’s governance to operate efficiently

and transparently”. 95% of SPWG members agreed to present this

recommendation to the EXCO.

Lastly, SPWG members

used those four pillars to build their respective Strategic Map. All

Maps are going to be analysed

to articulate the broadest consensus in terms of activities to follow

in coming years and will be discussed during the next SPWG Monthly

Meeting to be held on 16 December 2020.

Work accomplished by the Fee

Subgroup

Work accomplished by the Fee

Subgroup

During the last few months, the Fee Subgroup

worked on developing fee model options taking into account: a) the

views expressed by the Members in the SPWG kick off survey (which

mainly supported the current fee model with some improvements); b)

direct input received by its Members under the light of the basic

principles: simplicity, transparency, fairness and sustainability,

and; c) the results of the benchmark analysis with other standard

setters.

In this respect, the SPWG approved two major

working lines proposed by the Fee Subgroup, which are currently being

carried out. A first one, focused on making some modifications to the

current fee model (GDP and GDP per capita); and, a second one, based

on variations of the current fee model with the inclusion of

parameters such as DIS covered deposits. Moreover, the Fee Subgroup

continues to gather comments from Members for the potential inclusion

and validation of other parameters.

Next Steps

Next Steps

In coming months, both groups will continue to

work hard to consolidate ideas into proposals for the development of

the new Strategic Plan 2022-2026 and for the revised Fee Model. These

proposals will be submitted to EXCO for approval during the 66th EXCO

Meeting. The approved proposals will be used as pillars for

establishing the next Strategic Plan to be submitted at the AGM in

2021.

Figure 1:

SPWG's composition (22 members)

|

Member |

DIO and

jurisdiction |

Regional

Committee |

| Ex Officio |

|

|

| 1. Patrick Déry (Leader) |

AMF (Québec-Canada) |

RCNA |

| 2. Sonja Lill Flø Myklebust |

NBGF (Norway) |

ERC |

| 3. Yvonne Fan |

CDIC (Chinese Taipei) |

APRC |

| 4. Mohamud Ahmed |

KDIC (Kenya) |

ARC |

| 5. Diane Ellis |

FDIC (USA) |

RCNA |

| 6. Umaru Ibrahim |

NDIC (Nigeria) |

ARC |

| 7. Seongbak Wi |

KDIC (Korea) |

APRC |

| 8. Eloise Williams Dunkley |

JDIC (Jamaica) |

CRC |

| 9. Giuseppe Boccuzzi |

FITD (Italy) |

ERC |

| 10. Svitlana Rekrut |

DGF (Ukraine) |

EARC |

| 11. Hugo Libonatti |

COPAB (Uruguay) |

LARC |

| 12. Zaher Hammuz |

PDIC (Palestine) |

MENA |

| 13. Chantal Richer |

CDIC (Canada) |

RCNA |

| Via EOI |

|

|

| 14. Nikolay Evstratenko |

DIA (Russian Federation) |

APRC, EARC, ERC |

| 15. Vusilizwe Vuma |

DPC (Zimbabwe) |

ARC |

| 16. Carlos Colao |

FGD (Spain) |

ERC, LARC |

| 17. Sven Stevenson |

DNB (The Netherlands) |

ERC |

| 18. Thi Thanh Binh Phan |

DIV (Vietnam) |

APRC |

| 19. Lana Soelistianingsih |

IDIC (Indonesia) |

APRC |

| 20. Piotr Tomaszewski |

BFG (Poland) |

ERC |

| 21. Alejandro

J. López |

SEDESA (Argentina) |

LARC |

| 22. Mohamed Mahraoui |

MDUC (Morocco) |

ARC, MENA |

| Project

Manager |

|

|

|

Julien Reid |

AMF

(Québec-Canada) |

RCNA |

Figure 2:

Fee Subgroup's composition (19 members)

|

Member |

DIO and

jurisdiction |

Regional

Committee |

|

Via EOI |

|

|

| 1. Carlos

Colao (Leader) |

FGD (Spain) |

ERC, LARC |

|

Ex Officio |

|

|

| 2.

Abdulrasheed Abdulraheem1) |

NDIC (Nigeria) |

ARC |

| 3. Jose Villaret Jr.2) |

PDIC (The Philippines) |

APRC |

| 4. Eloise Williams Dunkley |

JDIC (Jamaica) |

CRC |

| 5. Gregor Frey3) |

esisuisse (Switzerland) |

ERC |

| 6. Natalia Rudukha4) |

DGF (Ukraine) |

EARC |

| 7. Hugo Libonatti |

COPAB (Uruguay) |

LARC |

| 8. Zaher Hammuz |

PDIC (Palestine) |

MENA |

| 9. Rishanthi Pattiarachchi5) |

CDIC (Canada) |

RCNA |

|

Via EOI |

|

|

| 10. Michel Cadelano |

FGDR (France) |

ERC |

| 11. Vusilizwe Vuma |

DPC (Zimbabwe) |

ARC |

| 12. Rose Kushmeider |

FDIC (USA) |

RCNA |

| 13. Maarten Lombaert |

Belgian DGS (Belgium) |

ERC |

| 14. Cristina Olmedo |

COSEDE (Ecuador) |

LARC |

| 15. Suleyman

Alharahsheh |

JODIC (Jordan) |

MENA |

| 16. Elif Kosoglu |

SDIF (Turkey) |

EARC, ERC, MENA |

| 17. Artur Radomski |

BFG (Poland) |

ERC |

| 18. Alejandro

J. López |

SEDESA (Argentina) |

LARC |

| 19. Vincente Vargas Gonzalez |

IPAB (Mexico) |

LARC, MENA |

|

Observer

Advisory Panel |

|

|

| Jean Roy |

HEC Montréal (Québec-Canada) |

|

| Project

Manager |

|

|

|

Julien Reid |

AMF

(Québec-Canada) |

RCNA |

|

|

|

|

- 1)

Delegation from Mr Umaru Ibrahim, NDIC

(Nigeria), in his capacity as Chair of the ARC

- 2) Delegation from Mr

Seongbak Wi, KDIC (Korea), in his capacity as Chair of the APRC

- 3) Delegation from Mr

Giuseppe Boccuzzi, FITD (Italy), in

his capacity as Chair of the ERC

- 4) Delegation from Ms Svitlana

Rekrut, DGF (Ukraine), in her capacity

as Chair of the EARC

- 5)

Delegation from Ms Chantal Richer, CDIC (Canada), in her

capacity as Vice Chair of the RCNA

|

|

|

Key

achievements and updates from the

Council Committees and their Technical

Committees

|

| |

|

|

|

|

Audit and Risk Council Committee (ARCC) - chaired by

Sonja Lill Flø Myklebust, Norway

Audit and Risk Council Committee (ARCC) - chaired by

Sonja Lill Flø Myklebust, Norway |

|

|

|

-

Audited Financial Statements for FY 2019/20: Approved at the AGM held by correspondence in November 2020, and ratified at the EGM held on 8 December 2020.

-

Secretariat Report on the Financial Statements for FY 2020/21 Q1 and Q2: Review completed and the report was approved by EXCO.

-

Appointment of External Auditor for FY 2020/21 ending 31 March 2021: Recommended to EXCO that AGM appoint PricewaterhouseCoopers (PwC) as External Auditor and it was approved at the AGM held by correspondence in November 2020, and ratified at the EGM held on 8 December 2020.

-

IADI Risk Management and Internal Control Framework: Reviewed and approved the updated risk analysis performed by the IADI Secretariat.

-

Accounting principles and audit procedures: Recommended that EXCO consider change/ replacement of the current principles and procedures (in progress).

-

At the request of the SPWG, the ARCC has documented and presented a SWOT analysis of IADI.

|

|

|

|

|

Core Principles and

Research Council Committee (CPRC) -

chaired by Yvonne Fan, Chinese Taipei

Core Principles and

Research Council Committee (CPRC) -

chaired by Yvonne Fan, Chinese Taipei

|

|

|

|

-

Recruitment of Senior Policy and Research Advisor (SPRA)

and Core Principles Compliance Assessment Advisor (CPCAA): CPRC

Chairperson jointly worked with the Search Committee and Secretary

General on selection process. The CPCAA took office in September

2020.

-

Guidance Paper on Risk

Management and Internal Control System of Deposit Insurers

was published in November 2020.

-

Guidelines for the Development of IADI Research, Guidance

and the Core Principles: Work currently underway for its revision.

This revised version of the Guidelines aims at enhancing the

quality and streamlining the processes of developing IADI research

papers.

-

Other papers are being

developed at the following CPRC Technical Committees:

-

Islamic Deposit Insurance Technical Committee: The

IADI-IFSB Core Principles for Effective Islamic Deposit

Insurance Systems (CPIDIS) is being finalised for publication.

Research Paper on Shariah Approaches on Resolution of Islamic

Banks is still a work in progress.

-

Resolution Issues for Financial Cooperatives

Technical Committee (RIFCTC): Currently in the process of

finalising the Guidance Points.

|

|

|

|

|

|

|

Member Relations Council Committee (MRC) - chaired

by Mohamud Ahmed Mohamud, Kenya

Member Relations Council Committee (MRC) - chaired

by Mohamud Ahmed Mohamud, Kenya |

|

|

|

-

Secretariat Report on the Financial

Statements for FY 2019/20 Q1 and Q2, and Cash Management Report

per 30 September 2020: Review completed and the report was

approved by EXCO.

-

IADI Business Plan and Budgets: Reviewed

the draft Business Plan 2020/23 and draft Budgets (FY 2020/21

and FY 2021/22). The Business Plan and Budgets were approved at

the AGM.

-

The EXCO approved the following application:

- Arab Monetary Fund

(AMF) as a Partner in September 2020

-

Due to the extraordinary circumstances related to

Covid-19 pandemic, many IADI in-person events were cancelled or

postponed, and are now being provided in a virtual form. Despite

this challenging situation for outreach activities across all

regions, some potential jurisdictions showed their interests in

joining the IADI. The MRC will continue to support efforts to

expand and maintain membership of the Association in conjunction

with Regional Committees and the Secretariat.

|

|

|

|

|

|

Training and Technical Assistance Council Committee (TTAC)

-

Chaired by Diane Ellis, United States

Training and Technical Assistance Council Committee (TTAC)

-

Chaired by Diane Ellis, United States

|

|

|

|

The TTAC in coordination with the Capacity

Building Technical Committee (CBTC) and the Training and Capacity

Building Unit (TCBU), reports the following activities:

-

Expert Training: The Expert Training Strategy

(Strategy), which was approved by the Committee in February

2019, is a proposal to develop a structured program for training

IADI Members and their staffs in the Core Principles. The

strategy outlines a four-staged process for an IADI Member to

gain expertise in the Core Principles and become capable of

leading Self-Assessment Technical Assistance Program (SATAP)

reviews, supporting TAWs, and supporting or participating in the

IMF/World Bank FSAP reviews.

The Core Principles

Practitioners Workshop (first stage of the Strategy) Working Group

Terms of Reference (ToR) was approved by TTAC in May. The working

group subsequently began meeting in September and is in process of

building the content for the workshop. IADI expects to hold the

first Practitioners Workshop in 2021.

-

IADI SATAP: The SATAP provides an assessment of an

IADI Member’s deposit insurance agency (DIA). The purpose of

the Program is for the review team to work closely with the

DIA to identify gaps in its system relative to IADI Core

Principles and outline possible steps to address those gaps.

The CBTC and the Senior

Training and Technical Assistance Advisor (STTAA)

received official requests for a SATAP review (including a

completed self-assessment) from two jurisdictions. The review

team has been formed for one jurisdiction and is moving

forward as planned with the offsite work. The other

jurisdiction is working with the TCBU to finalize the

additional documents required to begin reviewing their

submitted self-assessment.

-

In July, TTAC approved the Guidance on Conducting

Self-Assessments of Compliance with the Core Principles paper.

The purpose of this guidance is to encourage IADI Members to

perform a self-assessment of compliance with the IADI Core

Principles, and to inform Members of the resources available

to help them in this endeavour.

As an assessment tool, the CPs can be used to

identify gaps in the regulations and policies governing

deposit insurance systems, and for evaluating the practices of

deposit insurers. In addition, self-assessments are a good

diagnostic element in preparation for third-party reviews,

including IADI SATAP evaluations, peer-reviews and thematic

assessments conducted by the FSB, or IMF and World Bank

Financial Sector Assessment Program (FSAP) evaluations.

|

|

|

Update from the IADI Secretariat Research Unit and the

2020 Annual Survey

|

|

Response to the Covid-19 crisis

Response to the Covid-19 crisis

The IADI Secretariat and Research Unit (RU) have worked on a

number of initiatives in response to recent developments in the global

economy relating to Covid-19. A briefing

note has been prepared titled “Ensuring Business

Continuity and Effective Crisis Management Activities for Deposit

Insurers”.

On the 26th of March 2020, IADI distributed a survey to the

membership on the impact of the Covid-19 pandemic crisis on their

financial sector and the measures taken by regulatory authorities and

deposit insurers to address the crisis. A summary

of key results from the IADI Covid-19 survey is now available and

the full set of Survey responses can be found here.

Additional Covid-19 statistical

resources available on the IADI eBIS website include:

-

Results from the Bank Guarantee Fund

(Poland) questionnaire to all IADI Members on policy responses to

the Covid-19 pandemic crisis.

-

Results from the IADI Asia-Pacific Regional Committee survey

of its Members on the topic of Covid-19 implications and

responses.

The IADI Research Unit will

facilitate a follow up survey on Covid-19, currently scheduled for

January 2021. This survey collection will seek to reveal

developments that may have emerged since the initial response of

deposit insurers to the Covid-19 pandemic. A summary of results

and full survey data file will be made available to all IADI Members

for their benefit.

CP monitoring and compliance assessment

CP monitoring and compliance assessment

The CPCAA joined the RU in

September 2020 and initiated work in areas such as:

- The development of processes and procedures for

implementing a CP thematic assessment programme, a more formalised

measure, to monitor, collect and analysis information on Members’

compliance levels of CPs in order to help identify any strengths

and gaps in Member deposit insurance systems and obtain a global

compliance picture.

-

The programme will complement existing self-assessments,

IADI SATAP, FSAPs and other means of assessing gaps between

existing and desired outcomes. Results of the new programme will

be used to provide input to the CPRC, TTAC and their supporting

Technical Committees and help target IADI researches, guidance and

training and technical assistance initiatives to assist Members to

improve their systems.

-

A draft “Overview of other Financial Sector

Standard-Setting Body assessments & IADI Core Principles

Compliance Assessment Framework” was completed and presented to

TTAC and CPRC for initial comments and feedback in November 2020.

-

A more detailed proposal with proposed assessment

methodology and procedures will be presented for review and

discussion in Q1 2021.

Research Initiatives

Research Initiatives

The RU published

IADI Brief No. 4 titled Depositor Preference and Implications for

Deposit Insurance. This note explores the different types of

depositor preference, the advantages and disadvantages of depositor

preference and the issues arising in the context of depositor

preference that are relevant for deposit insurers.

IADI Brief No. 5 titled The

Geographic Dynamics of Deposit Insurance is being reviewed by the CPRC

and is expected to be published in early 2021. Further papers in

the series are being prepared, with the next two topics focussing on

the potential of machine learning for deposit insurers, along with the

evolution of deposit insurer resolution toolkits.

A research plan has been developed

for review by the CPRC on determining gaps in deposit insurance

reimbursement practices and procedures. To complement this work,

a member survey facilitating the collection of relevant data items is

underway.

Other research and policy

initiatives in progress by the RU, include a draft paper on digital

stored value products (developed jointly with the Alliance for

Financial Inclusion). There has also been considerable

engagement with the CPRC and Islamic Financial Services Board on

developing IADI Core Principles for Islamic Deposit Insurance Systems.

2021 IADI Research Conference

2021 IADI Research Conference

The International Association of Deposit Insurers (IADI)

invites research papers for its Sixth Biennial Research Conference to

be hosted by the Bank for International Settlements in Basel,

Switzerland and held virtually during the week of 10-14 May 2021.

The theme for the Research Conference is “Navigating the

New Normal for Financial Stability, Deposit Insurance and Bank

Resolution”. This year’s theme takes into account how international

crises continue to shape the landscape for financial stability,

deposit insurance and bank resolution. A decade past the global

financial crisis, the world’s financial system is in the midst of a

new series of shocks and challenges emanating from the Covid-19

pandemic.

This IADI Biennial Research Conference will provide a forum

to take stock of and explore the implications of these developments as

well as examine other issues influencing financial stability, deposit

insurance and bank resolution.

Research papers and panel presentations will be posted on

the IADI Members Only website, accessible to registered participants

only, subject to the permission of authors, Research Conference

proceedings will be published.

To find the details, please see the

News section of IADI public website.

2020 IADI Annual Survey

2020 IADI Annual Survey

The 2020 Annual Survey went live in July 2020. This

included an amended questionnaire designed to better capture

contemporary issues in global deposit insurance. All IADI Members,

Associates, Partners and stakeholders were encouraged to participate

in this important exercise. The IADI Annual Survey forms the most

comprehensive source of deposit insurance information globally, and is

utilised extensively for research initiatives and policy decision

making. We extend our appreciation to IADI Members, Associates and

Partners for their continued support to the IADI data and research

initiatives. Results were published on 30 November 2020.

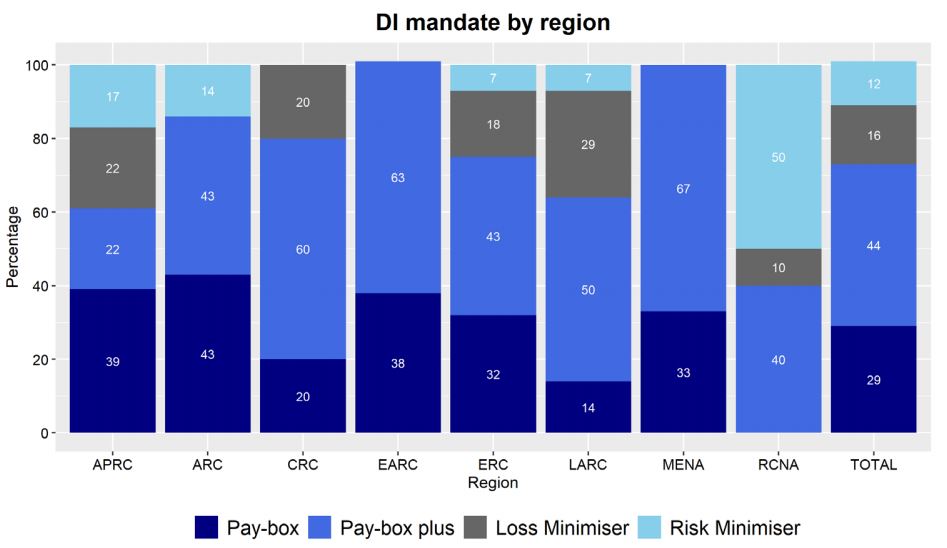

Overall, the survey results show that jurisdictions

continue to strengthen their deposit insurance systems and are moving

towards greater compliance with the IADI Core Principles for Effective

Deposit Insurance Systems.

To find the details, please see

the 15

Key features (available on the IADI

public website), full

data (eBIS sign-in is required), and the press

release.

2020 IADI

Chart Pack

2020 IADI

Chart Pack

The inaugural IADI Chart Pack was

published earlier in 2020. This new product offers a snapshot of the

key characteristics of deposit insurance systems from around the

world.

The IADI

Chart Pack is arranged into four themes focusing on deposit

insurer structure, coverage and funding, reimbursement and resolution

activities, public awareness and financial inclusion.

The full IADI

Chart Pack is available on IADI’s website, including French and

Spanish translations. Any queries regarding the IADI Chart Pack and

deposit insurance database can be addressed to Ryan Defina of the

IADI

Secretariat Research Unit.

Call for Paper Proposals

Call for Paper Proposals

The IADI has recently circulated

a call for proposals for external research and policy papers. This

provides an opportunity for academics and policy makers to submit

their research proposals for topics relevant to deposit insurance and

financial stability. Selected proposals will receive funding and

support from IADI.

|

|

Update from the

IADI Secretariat

Training and Capacity Building Unit

|

|

Expert Training Working Group

Expert Training Working Group

During the second semester of 2020, the Expert Training Strategy

has shown important results. Five Expert Training Working Group

(ETWG), the second stage of the Strategy, pilot test training sessions

have taken place during the second semester of 2020 and will allow

IADI to expand its roster of experts 2.5 times, from 6 to 21 experts

by 2021.

With this expanded number of

experts, IADI aims to continue supporting the assessment of compliance

with the Core Principles by having at least one expert per Regional

Committee. This will also contribute to the development of other

requirements such as thematic reviews, regional training initiatives

and other capacity building activities.

Remote Training Guidance

Remote Training Guidance

The Covid-19 pandemic created areas

of opportunity for IADI in terms of developing new mechanisms to

deliver capacity building. The STTAA developed Remote Training

Guidance detailing the different types of training that can be

conducted virtually, tools available for virtual training, and issues

and benefits that are unique to virtual training. IADI has placed a

priority on being responsive with virtual solutions to address member

needs on the training side.

FSI-Connect Tutorials

FSI-Connect Tutorials

The major update of two suites of

tutorials, the Core Principles for Effective Deposit Insurance Systems

and Reimbursing Depositors, is in progress. The full update is

expected to conclude mid-January 2021.

Virtual Events

Virtual Events

The Latin America Regional

Committee (LARC) held a webinar, hosted by COSEDE (Ecuador), which

focused on Core Principle 15. The

presentations covered, among other issues; the essential elements for

the effective payment of deposit insurance and the capacity to carry

out the reimbursement process quickly, pre- and post-closing

activities, scenarios and simulations and ex-post review of the

bankruptcy of a financial institution. More than 170 participants

attended the virtual event.

The FSI and IADI jointly hosted a webinar on the “ongoing and expected

impact of the Covid-19 crisis on resolution authorities and deposit

insurers” on 22 and 24 September. The four sessions, held across two

days, focused on risks to the banking sector and impact of the

Covid-19 pandemic on deposit insurers and resolution authorities, as

well as on the heightened contingency planning and preparedness

measures implemented as a result. Over 400 participants attended the

virtual event, with 250 from the IADI community.

The Asia Pacific Regional Committee (APRC) held a virtual event,

hosted by the Korea Deposit Insurance Corporation (KDIC) on “A Deep

Dive into the Differential Premium System”. The presentations focused

on implementation of differential premium systems. The webinar was

attended by more than 94 participants from the Asia Pacific Regional

Committee.

Upcoming Virtual Events

Upcoming Virtual Events

The Middle East and North Africa

Regional Committee is planning to host a virtual event on 21 January

2021 on IADI Core Principle 4 : Coordination and cooperation between

deposit insurers and other safety-net players in normal times and in

crises. More details will be made available in

December 2020.

|

|

Additional events, seminars and conferences

(July to December 2020)

|

|

|

|

|

IADI-LARC WEBINAR FOR THE AMERICAS: Core Principle 15: payout

time, process, and information

requirements,

31 July, Virtual

IADI-LARC WEBINAR FOR THE AMERICAS: Core Principle 15: payout

time, process, and information

requirements,

31 July, Virtual |

|

A webinar themed “Core Principle No. 15:

Payout Times, Processing and Information Requirements” was

held on 31 July 2020, among more than 170 participants from

deposit insurers of 22 countries were part of this event. The

webinar was organised by the Deposit Insurance, Liquidity Fund

and Private Insurance Fund Corporation (COSEDE) of Ecuador in

collaboration with the IADI Secretariat and with the support

of the Latin American Regional Committee (LARC), and addressed

topics related to the essential elements for the effective

payment of deposit insurance and the capacity to carry out the

reimbursement process quickly were covered, including pre- and

post-closing activities, scenarios and simulations, ex-post

review of the bankruptcy of a financial institution, among

others of great interest and relevance for deposit insurers

worldwide.

The webinar had the participation of

David Walker - Secretary General of IADI, who discussed the

standards, data and new developments around the deposit

insurance payment; Ruben Lechuga Ballesteros and Vicente

Vargas Gonzalez from the Bank Savings Protection Institute

(IPAB) of Mexico who shared the experience of the deposit

insurance payment during the pandemic, the case of Banco

Ahorro Famsa; Galo Cevallos and Tyler Cavaness from the U.S.

Federal Deposit Insurance Corporation (FDIC) who addressed

issues related to the FDIC's experience in the processes that

take place before, during and after the forced liquidation of

a financial institution and the deposit insurance payment

process; Luis Velasco of COSEDE presented Ecuador's experience

in the SATAP Program (Self-Assessment Technical Assistance

Program) in the area of deposit insurance payment, its action

plan and challenges. The event was moderated by Juan Carlos

López of FOGAFIN of Colombia.

The webinar made possible the exchange

of experiences and knowledge, and also to learn from

first-hand strategies to achieve payments in 7 business days

or less.

|

The 18th APRC Annual Meeting, 25 August, Virtual

The 18th APRC Annual Meeting, 25 August, Virtual |

|

On 25 August, Korea Deposit Insurance

Corporation (KDIC) virtually hosted the 18th IADI APRC Annual

Meeting, which was attended by approximately 60 participants

from 18 organisations.

Regarding approval items, Mr Rafiz

Abdullah was reappointed by the APRC as the Research Technical

Committee (RTC) Chairperson for a 2-year term. The hosting

terms of APRC events were approved; host CEO Dialogue annually

and Study Visit biennially.

Regarding reporting items, Mr Chayong

Yoon gave a report on APRC events and activities during the

period May – August including KDIC-PIDM APRC Webinar, IDIC

Multilateral Meeting, and PIDM-SEACEN Webinar. Mr Jose

Villaret reported on the publication of the 4th issue of APRC

Net and Outreach activities. For the APRC RTC, Mr Abdullah

gave an update on the on-going initiatives including MOU

Template, Cross-Border Cooperation Paper, and Fintech Paper.

Mr Abdullah also identified potential research topics based on

the APRC Survey result. For the APRC Training and Assistance

Technical Committee (TATC), Mr Taewook Chang reported on

current TATC initiatives including technical assistances and

shared repository. Lastly, Mr Chang reported on Strategic

Planning Working Group (SPWG) and Fee Subgroup activities.

There was also a discussion session on

establishing new Strategic Plan and revising the current fee

model. APRC members provided their opinions on the matter.

Members identified areas of improvement for the Strategic

Plan; enhance research particularly on resolution, provide

members with better benefits such as training and technical

assistance. Members also commented that other parameters for

the fee model should be considered; parameters that better

reflect the nature of organisations, such as deposit insurer’s

mandate.

|

CDIC Global Knowledge-Sharing Initiative, 8-10 September,

Virtual

CDIC Global Knowledge-Sharing Initiative, 8-10 September,

VirtualThe Canada Deposit

Insurance Corporation (CDIC) organized a virtual event

entitled “CDIC Global Knowledge Sharing Initiative” from

September 8-10, 2020 for the IADI community. The event was

offered as part of CDIC’s technical assistance program to

assist other deposit insurers who are seeking to develop or

enhance their deposit insurance systems.

The first day explored CDIC’s

differential premium system and fund management and investment

practices. The next day discussed the Corporation’s public

awareness campaign and communication strategy with depositors

in a resolution scenario. The last day centered on CDIC’s

corporate risk management framework which includes the

enterprise risk management function, contingency plan testing

programs, and corporate strategy. In order to enrich the

learning experience of the participants, there was a Question

& Answer session each day and supplemental resources were

provided through a temporary event website. The number of

participants was also limited to 150.

Presentation decks of the webinar can be

found in the

IADI Repository of Knowledge Events

on the Members’ Only website (login to eBIS required).

|

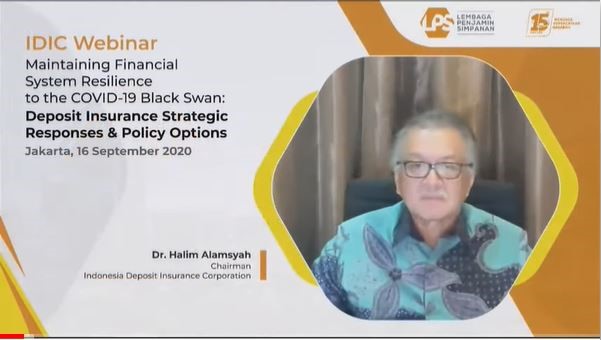

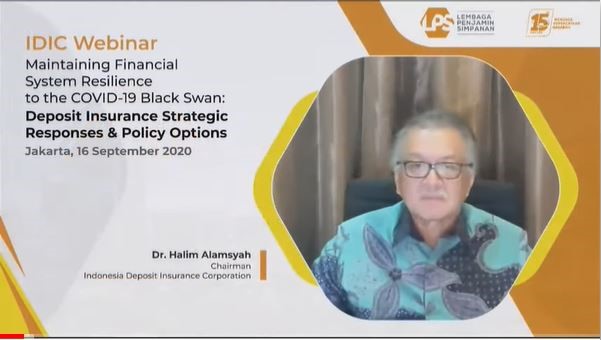

IDIC International Webinar 2020 on

“Maintaining Financial System Resilience to the COVID-19 Black

Swan: Deposit Insurance Strategic

Responses and Policy Options”, 16 September, Virtual

IDIC International Webinar 2020 on

“Maintaining Financial System Resilience to the COVID-19 Black

Swan: Deposit Insurance Strategic

Responses and Policy Options”, 16 September, Virtual |

|

The

Indonesia Deposit Insurance Corporation (IDIC) held its annual

International Seminar as a webinar this year entitled

"Maintaining Financial System Resilience to the COVID-19 Black

Swan: Deposit Insurance Strategic Responses & Policy Options"

on the 16 September 2020. This event was attended by 362

participants on Webex Event, 165 viewers on YouTube live

streaming, and was subsequently published by 25 publishers on

online news, social media, and electronic media. The

Indonesia Deposit Insurance Corporation (IDIC) held its annual

International Seminar as a webinar this year entitled

"Maintaining Financial System Resilience to the COVID-19 Black

Swan: Deposit Insurance Strategic Responses & Policy Options"

on the 16 September 2020. This event was attended by 362

participants on Webex Event, 165 viewers on YouTube live

streaming, and was subsequently published by 25 publishers on

online news, social media, and electronic media.

As

various experts in the field, from the World Bank Group,

Federal Deposit Insurance Corporation (FDIC), and Deposit

Insurance Agency (DIA) of Russia, were brought together to

deliver a series of presentations and panel discussions, this

webinar invoke discussions on the latest global economic

conditions and responses or state policies to COVID-19 in

order to maintain financial system stability and coordination

between financial system safety net institutions during this

challenging time, particularly from a deposit insurance

corporation or resolution authority’s perspective. As

various experts in the field, from the World Bank Group,

Federal Deposit Insurance Corporation (FDIC), and Deposit

Insurance Agency (DIA) of Russia, were brought together to

deliver a series of presentations and panel discussions, this

webinar invoke discussions on the latest global economic

conditions and responses or state policies to COVID-19 in

order to maintain financial system stability and coordination

between financial system safety net institutions during this

challenging time, particularly from a deposit insurance

corporation or resolution authority’s perspective.

|

2020 NDIC International Virtual Conference.

22-23 October, Virtual

2020 NDIC International Virtual Conference.

22-23 October, Virtual |

|

The

Nigeria Deposit Insurance Corporation (NDIC) held its 2020

International Virtual Conference with the theme: “Financial

System Stability, Fintech & Emerging Risks: Challenges for

Bank Supervisors” from 22-23 October 2020. The objective of

the Conference was to promote knowledge and experience sharing

amongst key stakeholders on Fintech as well as to provide

opportunity to promote broad discussion on policy options to

address emerging risks and opportunities associated with

Fintech. The

Nigeria Deposit Insurance Corporation (NDIC) held its 2020

International Virtual Conference with the theme: “Financial

System Stability, Fintech & Emerging Risks: Challenges for

Bank Supervisors” from 22-23 October 2020. The objective of

the Conference was to promote knowledge and experience sharing

amongst key stakeholders on Fintech as well as to provide

opportunity to promote broad discussion on policy options to

address emerging risks and opportunities associated with

Fintech.

The 2-Day event had a total of 540

participants out of which 95 were international participants

from 34 countries which are Angola, Azerbaijan, Bahamas,

Canada, Chinese Taipei, Colombia, France, India, Indonesia, Ghana, Italy,

Jamaica, Kazakhstan, Kenya, Mexico, Malaysia, Morocco,

Pakistan, Philippines, Senegal, Serbia, Spain, South Africa,

Switzerland, Tanzania, Thailand, Trinidad & Tobago,

Tunisia, Turkey, Uganda, Ukraine, United Kingdom, United

States of America and Zimbabwe. Local participants at the

event were drawn from the NDIC, Central Bank of Nigeria (CBN),

Securities & Exchange Commission (SEC), National Pension

Commission (PENCOM), Independent Corrupt Practices Commission

(ICPC), Economic and Financial Crimes Commission (EFCC),

Nigerian Financial Intelligence Unit (NFIU), Chartered

Institute of Bankers of Nigeria (CIBN) and Nigerian

Universities. Facilitators were drawn from the NDIC; CBN; Bank

for International Settlements (BIS), Switzerland; Ernst and

Young, India and Central Deposit Insurance Corporation (CDIC), Chinese Taipei.

Ten (10) papers were presented during

the 2-day virtual conference. The papers were on Prudential

Regulation and Financial System Stability in Nigeria: Pre,

During & Post COVID-19; Fintech in Banking: Past, Present &

Future; How BigTech and Asian Banks are re-inventing Banking;

Restructuring Options of Troubled Bank: Implication of

Technical and Financial Assistance to Eligible Financial

Institutions; Deposit like products and Deposit Insurance in

Nigeria: Supervision and Challenges; The use of Fintech,

Regtech and Suptech as Early Warning Signals in the Banking

System; Overview of Chinese Taipei’s Digital Finance and CDIC’s

Suptech Experience; Consumer Protection in the emerging

Fintech Era; Consumer Protection in the emerging Fintech Era;

and Cyber risk: threats, trends and implication for banking.

|

APRC Webinar on Differential Premium System,

6 November, Virtual

APRC Webinar on Differential Premium System,

6 November, Virtual |

|

On

6 November, Korea Deposit Insurance Corporation (KDIC) hosted

APRC webinar. The webinar was titled “A Deep Dive into the

Differential Premium System (DPS)”, aiming to provide

opportunity for APRC members to share experiences and insights

on DPS. Around 120 participants from APRC member organizations

attended the event. On

6 November, Korea Deposit Insurance Corporation (KDIC) hosted

APRC webinar. The webinar was titled “A Deep Dive into the

Differential Premium System (DPS)”, aiming to provide

opportunity for APRC members to share experiences and insights

on DPS. Around 120 participants from APRC member organizations

attended the event.

In his opening remark, APRC Chairperson

and KDIC Chairman Seongbak Wi said that the training event was

a timely opportunity to share knowledge on the topic with APRC

members as many training opportunities within the region,

including the technical assistance and Technical Assistance

Workshop (TAW) were either postponed or cancelled this year

with the outbreak of Covid-19. In this light, KDIC prepared

the webinar on DPS, a topic which was in highest demand in the

APRC technical assistance survey conducted in 2019.

Distinguished speakers who shared

country cases and experiences on DPS were the following: Mr

Rafiz Abdullah, Chairperson of IADI APRC Research Technical

Committee (RTC) and CEO of Malaysia Deposit Insurance

Corporation (PIDM); Dr Pyeonghoon Chang, Senior Research

Fellow of Office of Risk Analysis and Pricing, KDIC; and Ms

Lisa Hsi, Director of Business Department, Central Deposit

Insurance Corporation (CDIC). The speakers discussed how the

differentiated premium system work in their respective

jurisdictions, their experiences in implementing the scheme,

as well as other issues to consider.

Finally, the webinar ended with an

insightful closing remark from Mr Rafiz Abdullah. He commented

that the webinar was a good opportunity for members to

exchange views and learn from each other, and added that these

opportunities must continue to effectively deal with various

emerging risks.

|

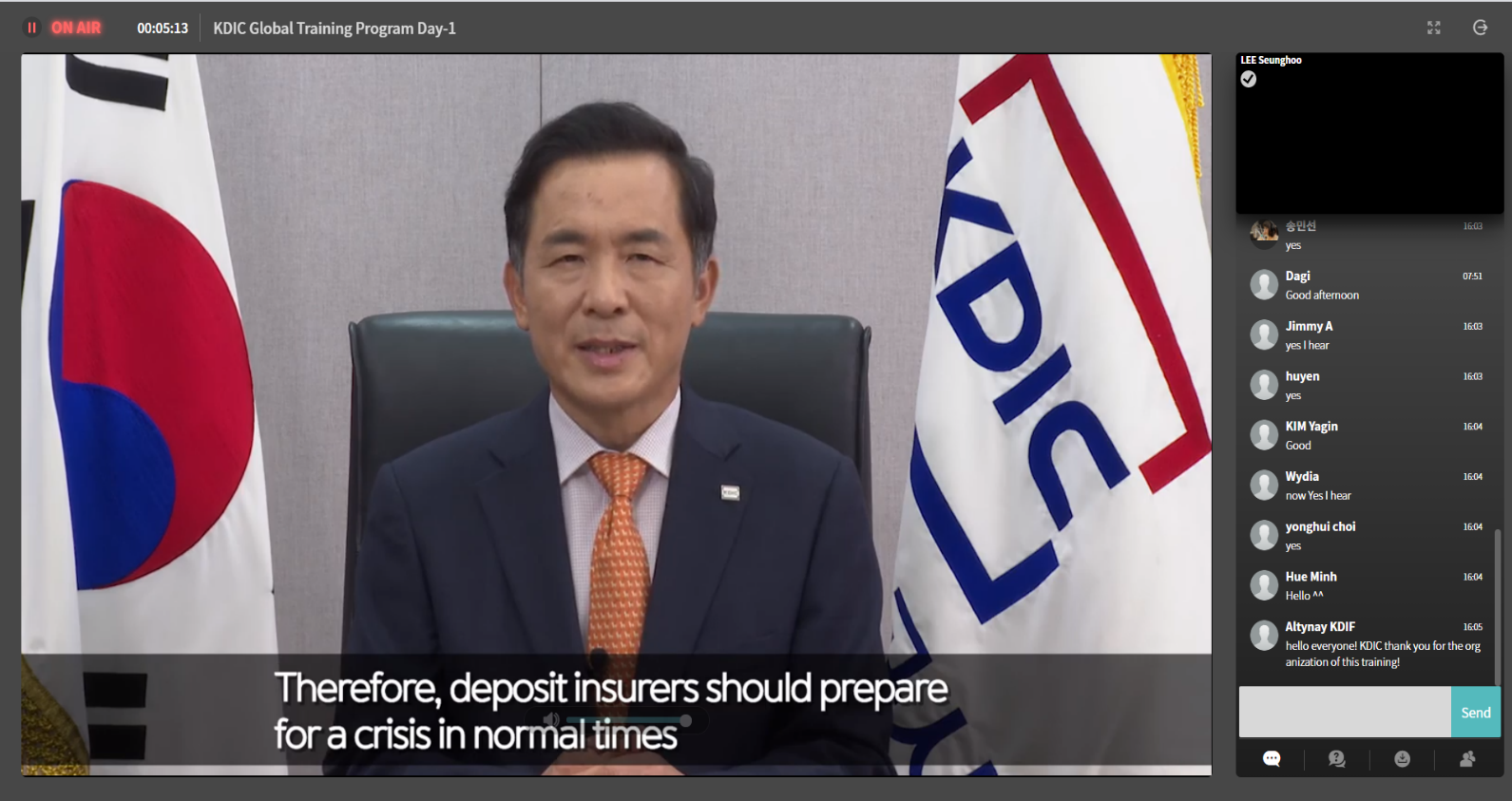

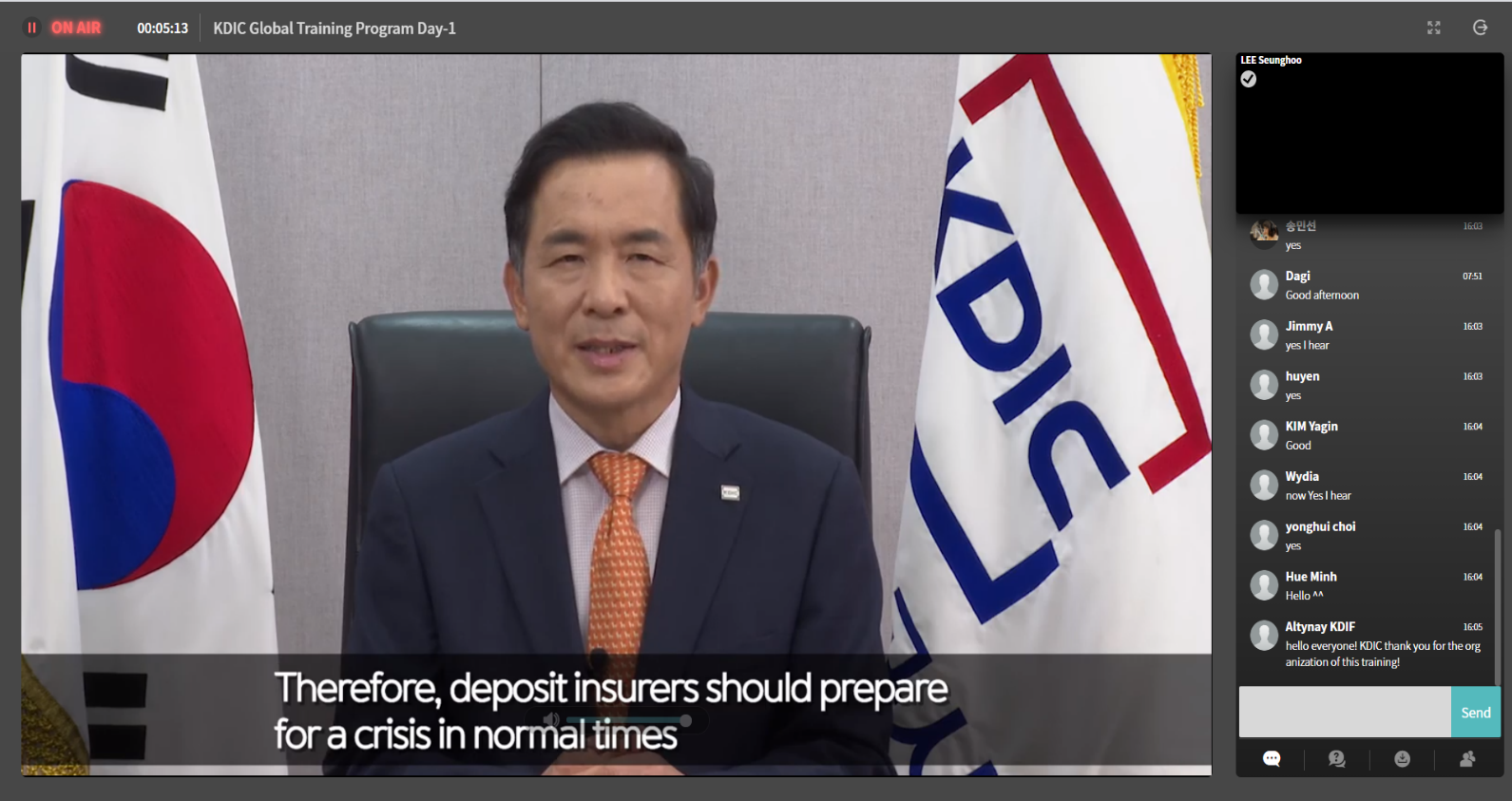

KDIC Global Training Program, 24-26 November, Virtual

KDIC Global Training Program, 24-26 November, Virtual

|

|

The Korea Deposit Insurance Corporation (KDIC) held

the “2020 KDIC Global Training Program” from 24 to 26 November

2020 virtually. A total of 200 officials from 22 jurisdictions

attended this program. The aim of this program is to improve

the participants’ practical knowledge and skills in crisis

management and resolution.

The course covered various topics and cases in the

field of crisis management and resolution, including KDIC’s

responses to COVID-19 pandemic and deposit insurance payout.

Through the Q&A session and online practice for assessing

deposit insurance payouts, the participants actively

participated in the program. An expert from Fintech Center

Korea and Sogang Business School, Prof Yoo-Shin Jung, was

invited as a speaker, and he delivered a the special lecture

titled “Korean Fintech Innovation and Its Impact on Korean

Financial Market.” During the break, the participants were

invited to take a virtual tour by watching four videos (KDIC

Head Office, KDIC Global Academy, Korean Cultural Experiences

and Chungju Emotional Starlight Tour). Virtual excursion

videos can be found on the KDIC YouTube Channel. (Please click

here.)

|

|

IADI-LARC WEBINAR: FinTech Activities and the Impact

of COVID-19, 9 December, Virtual

IADI-LARC WEBINAR: FinTech Activities and the Impact

of COVID-19, 9 December, Virtual

|

|

A webinar themed ““FinTech Activities and the Impact

of COVID-19: Specific concerns and challenges from a deposit

insurance perspective” was held on 9 December 2020 with more

than 80 participants drawn primarily from the Americas region

but also from IADI Members across the globe. The webinar was

hosted by the Corporación de Protección del Ahorro Bancario

(COPAB), Uruguay on behalf of the LARC.

Diane Ellis, Chairperson of the IADI FinTech

Technical Committee and Director, Division of Insurance and

Research – Federal Deposit Insurance Corporation, highlighted

the major objectives of the Technical Committee for providing

IADI Members with up to date information on the rapid changing

financial technology and its impact on deposit insurance. Diane Ellis, Chairperson of the IADI FinTech

Technical Committee and Director, Division of Insurance and

Research – Federal Deposit Insurance Corporation, highlighted

the major objectives of the Technical Committee for providing

IADI Members with up to date information on the rapid changing

financial technology and its impact on deposit insurance.

Carlos Cantu, Economist of the Bank for International

Settlements Representative Office for the Americas, presented

on the paper “Fintech in Latin America: landscape, prospects

and challenges”. He highlighted that Fintech has shifted from

Asia to other regions in the world, including Latin America

where investment in these firms, services and products is

increasing. He mentioned the major trends and challenges for

financial regulators, as well as the impact of Covid-19 on the

growth of these products and services in the region.

Daniel Lima, Chief Executive Officer – Fundo

Garantidor de Créditos (FGC), Brazil indicated that some

reasons behind the rise of Fintech in Brazil include; unbanked

population, poor financial planning and inadequate credit card

utilization. He highlighted that in the past almost all banks

and other credit institutions were covered by FGC guarantee,

and that the contagion rate in these new payment companies’

environment can be much greater than that observed in banks,

and could heighten systemic risk.

Sunday Oluyemi the Director Research, Policy and

International Relations, NDIC, Nigeria, touched on the impact

of Covid-19 including increase in non-performing loans,

worsening liquidity positon in the banking sector, increase in

cyber fraud and increase in Fintech. He also touched on the

concerns for deposit insurers emanating from Fintech and

Covid-19.

|

|

|

|

|

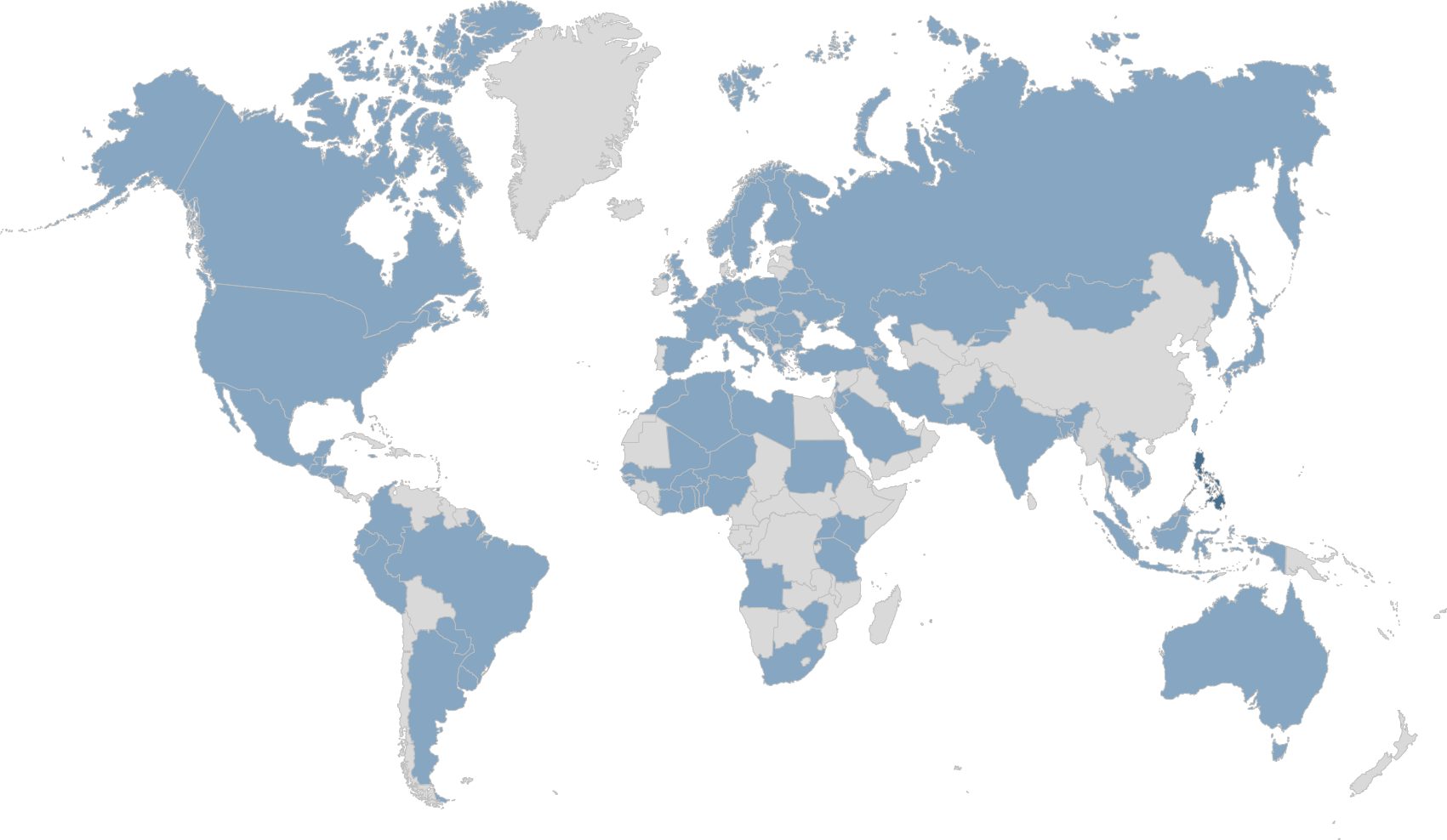

New IADI Participants

|

|

Join us in welcoming a newest participant, who was approved by

EXCO in the second half of this year.

Arab Monetary Fund: Partner

Arab Monetary Fund: Partner

Arab

Monetary Fund (AMF) is a Regional Arab

Organisation founded in 1976, and has started operations in

1977. Its mission is to lay the monetary foundations of Arab

economic integration and accelerating the process of economic

development in all Arab countries, and its vision is to be a

pioneer Arab regional development institution in the field of

economic, financial and currency reforms programs to achieve

sustainable growth in the Arab region.

AMF

consists of 22 Member countries: Jordan, United Arab Emirates,

Bahrain, Tunisia, Algeria, Djibouti, Saudi Arabia, Sudan,

Syria, Somalia, Iraq, Oman, Palestine, Qatar, Kuwait, Lebanon,

Libya, Egypt, Morocco, Mauritania, Yemen and Comoros.

We thank the AMF for its application and look forward to

working more closely with them, as part of the global IADI

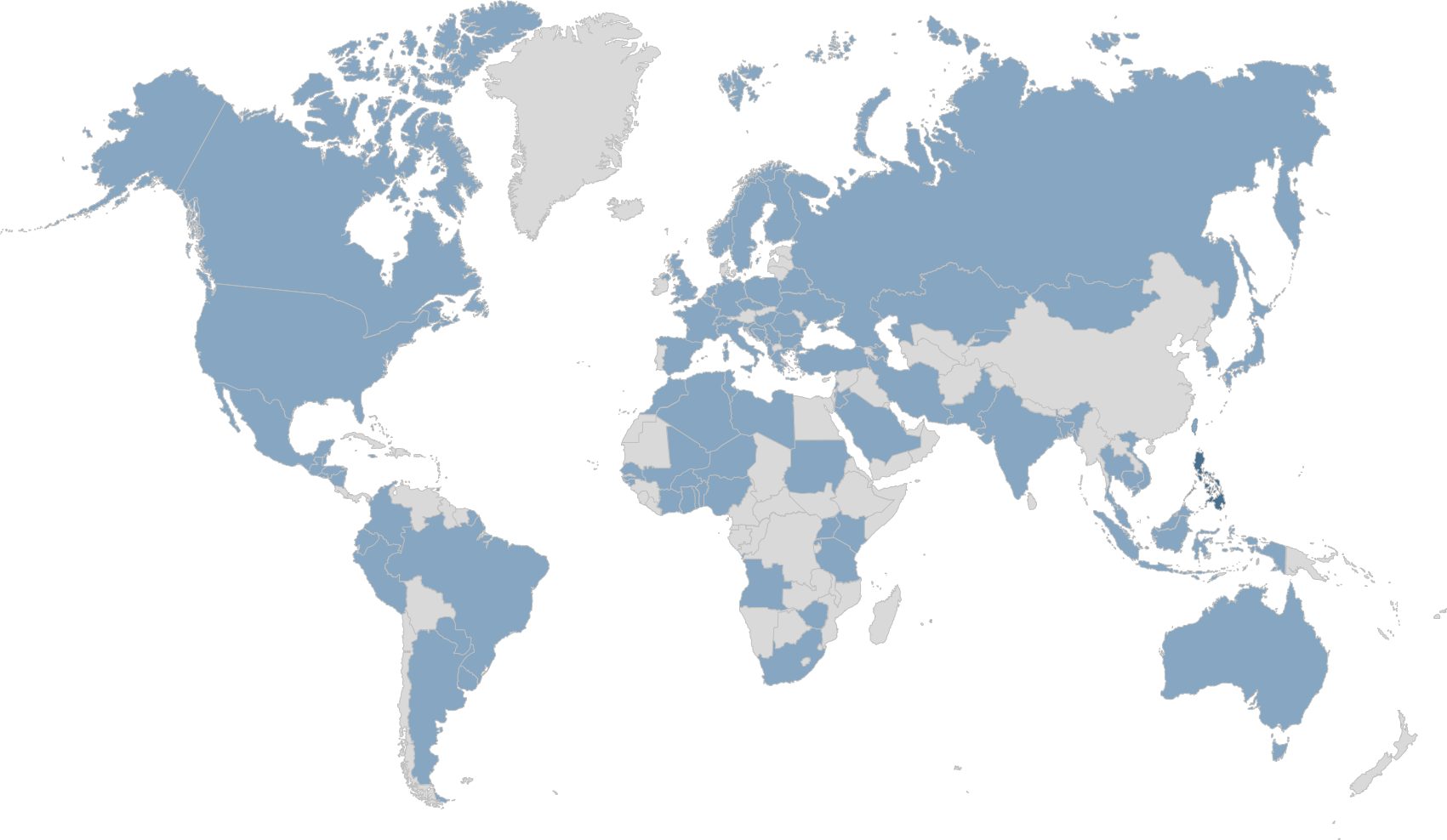

community. As at the end of November 2020, IADI's membership

included 110 participants, including 86 Members, 8 Associates

and 16 Partners. |

|

|

|

|

Forthcoming

events

New

books and papers

|

•

BANKING CRISES IN ITALY 2014-2020: Lessons Learned and Open Issues

(Le crisi bancarie in Italia (2014-2020): Insegnamenti e riflessioni

per la regolamentazione) (ed.

Bancaria Editrice), Giuseppe

Boccuzzi, December 2020

(English version will be available soon.)

•

IADI Guidance Paper, Risk Management and Internal Control System of

Deposit Insurers, November 2020

•

IADI Briefs No 4, Depositor Preference and Implications for Deposit

Insurance, October 2020

•

FSB Report, The Use of Supervisory and Regulatory Technology by

Authorities and Regulated Institutions: Market developments and

financial stability implications, October 2020

•

CGAP Working Paper,

Open Banking: How to Design for Financial Inclusion. Working Paper,

Ariadne Plaitakis and Stefan Staschen, October 2020

•

World Bank and CCAF,

The Global Covid-19 FinTech Regulatory Rapid Assessment Study,

World Bank Group and the University of Cambridge, October 2020

•

CGAP Technical Guide,

How to Build a Regulatory Sandbox: A Practical Guide for Policy

Makers,

Ivo Jenik and Schan Duff, September 2020

•

CPMI Working Paper,

Payment aspects of financial inclusion in the fintech era,

April 2020

•

World Bank Working Paper,

How Regulators Respond to Fintech: Evaluating the Different

Approaches -

Sandboxes and Beyond,

April 2020

•

CGAP Technical Note,

Nonbank E-Money Issuers vs. Payments Banks: How Do They Compare?

Denise Dias and Stefan Staschen, December 2019

|

|

|

|

The International Association of Deposit Insurers (IADI) was

formed in May 2002 to enhance the effectiveness of deposit insurance

systems by promoting guidance and international cooperation. Members

of the IADI conduct research and produce guidance for the benefit of

those jurisdictions seeking to establish or improve a deposit

insurance system. Members also share their knowledge and expertise

through participation in international conferences and other forums.

The IADI currently represents 86 deposit insurers, 8 Associates and 16

Partners. The IADI is a non-profit organisation constituted under

Swiss Law and is domiciled at the Bank for International Settlements

in Basel, Switzerland.

|

|

|

|

|

| |

During the elections held during IADI’s

AGM, the General Director of the State Corporation “Deposit Insurance

Agency” (DIA Russia), Yury Isaev, was elected to serve as its

President and as the Chair of its Executive Council for a two-year

term. He succeeds Katsunori Mikuniya, Governor of the Deposit

Insurance Corporation of Japan (DICJ), who served as President for a

three-year term.

During the elections held during IADI’s

AGM, the General Director of the State Corporation “Deposit Insurance

Agency” (DIA Russia), Yury Isaev, was elected to serve as its

President and as the Chair of its Executive Council for a two-year

term. He succeeds Katsunori Mikuniya, Governor of the Deposit

Insurance Corporation of Japan (DICJ), who served as President for a

three-year term.