|

Welcome to the IADI's e-Newsletter

IADI is pleased to provide the next

issue of its e-Newsletter. The e-Newsletter keeps you up-to-date on

information about IADI activities from January to the end of June

2018, as well as on upcoming IADI activities.

|

|

|

This issue includes:

|

|

|

|

| |

Let me express my sincere

appreciation to all IADI Members, Associates and Partners for your

efforts, and support, in the furtherance of IADI's mission over the

past six months. The IADI Secretariat looks forward to contributing to

the advancement of IADI.

We also look forward to seeing you at

the meetings, including the Annual General Meeting, in Basel,

Switzerland, from 15-19 October 2018, which will encompass the 56th

Executive Council Meeting, the 17th IADI Annual General Meeting,

and the Annual Conference hosted by

IADI.

The entire IADI Secretariat Team wishes you the very

best of success! |

|

| |

David Walker

Secretary

General

International Association of Deposit Insurers |

Election of Mr Giuseppe Boccuzzi as the Vice Chair of

the IADI Executive Council

|

|

|

|

|

|

|

|

The IADI Executive Council elected Mr Giuseppe Boccuzzi as Vice Chair

of the Executive Council (EXCO) of IADI on 30 May 2018 for a one-year

term, at its 55th EXCO Meeting held in Moscow, Russia.

Mr Giuseppe Boccuzzi, Director General of the Interbank Deposit

Protection Fund (Fondo Interbancario di Tutela dei Depositi) of Italy,

has had a long career as an officer at the Bank of Italy in roles

within the banking and financial supervisory area, especially as the

representative to the Basel Committee on Banking Supervision from 2006

to 2008. He also participated in the work of the European Commission

for the preparation of the 94/19/EC Directive on Deposit Guarantee

Schemes, and was appointed to the Financial Stability Forum's Task

Force on Dealing with Weak Banks, in collaboration with the World Bank

and the International Monetary Fund. |

|

|

|

|

|

|

|

|

|

|

Mr Boccuzzi was recently reappointed for a further three-year term as

IADI's Europe Regional Committee Chairperson. In addition, commencing

from early 2018, Mr Boccuzzi led a Working Group which produced the

IADI Code of Ethics and Conduct. |

|

|

|

|

|

|

|

The Vice Chair of the Executive Council will act for the Chair of the

Executive Council in the event of the Chair's absence. When acting for

the Chair, the Vice Chair is primarily responsible for the effective

operation of the Executive Council, and for making presentations and

representing the Executive Council as appropriate. The Vice Chair

assists the Chair in ensuring that the relationship between the

members of the Executive Council and the Secretary General facilitates

IADI fulfilling its mandate. |

|

|

|

|

|

|

|

Mr Boccuzzi stated that he would ensure his commitment and

collaborative experience is dedicated in support of the Chair of the

Executive Council, in the pursuit of IADI's objectives. |

|

|

|

|

|

|

|

|

Announcements regarding Secretariat Members

and Upcoming Recruitments

|

|

|

|

|

|

New Secretariat Members

New Secretariat Members |

|

|

|

|

|

|

|

|

We are pleased to announce the recruitment of Mr Ryan

Defina for the Secretariat position of Senior

Research Analyst and Administrator (SRAA).

Mr Defina will be joining

IADI from the Reserve Bank of Australia, where he worked as a

Senior Statistical Analyst within the Economic Analysis

department. Here he managed the Bank’s data requirements

feeding into monetary policy decision making, along with

fostering statistical capability development and driving

innovation in analytics, business intelligence and data

visualisation. Mr Defina was also the Australian

representative coordinating data submissions to the Bank for

International Settlements. Prior to this, he worked as a

Senior Statistician at the Australian Bureau of Statistics. Mr

Defina holds a Master of Applied Statistics and Bachelor of

Science (Statistics) / Bachelor of Commerce (Actuarial), both

of which were awarded by Macquarie University, Sydney,

Australia.

He will become a

member of our team as per 1 July 2018, for a four-year term,

and we look forward to working with him during the busy IADI

year ahead!

|

|

|

|

Ramadhian Moetomo,

joined the IADI Secretariat in May 2018, and is the first

secondee from the Indonesia Deposit Insurance Corporation

(IDIC). Mr Moetomo began at the IDIC, initially as a Bank

Examiner, in October 2013 and was involved in a number of bank

resolution, mainly for rural banks in Indonesia. Later, in

October 2017, he became a senior member of IDIC's newly

established International Affairs Group, where he attended

discussions amongst financial safety net partners members at a

national level. In addition, he worked alongside the World

Bank and the International Monetary Fund, on projects such as

arranging an international seminar, and the provision of

technical assistance.

Prior to his employment

at the IDIC, Mr Moetomo spent over 16 years working in the

Indonesian banking industry, at banks of various sizes and

within a diverse range of roles. |

|

|

|

Myeonghee Song

joined the IADI Secretariat in April 2018 from the Korea

Deposit Insurance Corporation (KDIC). Her 12 years' experience

at the KDIC covers a breadth of areas including international

affairs, risk management of savings banks, and developing a

differential premium system.

Following the failures of more

than 20 savings banks in Korea in 2011, Ms Song supported the

amendment of the Enforcement Decree of Depositor Protection

Act, facilitating the expansion of KDIC's authority to

encompass independently examine savings banks. Further, she

assisted with publicating a White paper on the causes of

savings banks' insolvency, produced jointly with Financial

Services Commission, Korea. Based upon her experience, she was

assigned on work of Korea's first differential premium system,

in 2014. |

|

|

|

|

|

|

|

New Positions and Recruitment

New Positions and Recruitment

|

|

|

|

|

|

|

|

The Secretariat is currently inviting applications for two

secondee positions of Research Analyst, both of which will be

based at the IADI Secretariat in Basel, Switzerland. Further

details may be obtained by contacting the Secretariat.

In addition, due to an increased contribution to IADI from

the Bank for International Settlements (BIS), we will shortly

be advertising for two new roles at the Secretariat. The roles

are a Finance and Administration Specialist, and a Training

position- further information will be contained within the

upcoming advertisements. |

|

|

|

|

|

|

|

|

Farewell to Departing Secondees

Farewell to Departing Secondees |

|

|

|

|

|

|

|

|

Farewell to Sangjun and Sanj - The Secretariat would like to

express its sincere gratitude to the highly valued staff

members who shall soon end their terms. |

| |

|

|

Sangjun Lee,

of the KDIC, joined as Senior Policy Analyst at the

Secretariat in June 2016. His skills have been applied to,

amongst other areas, the production of presentations for the

Secretary General, the maintenance of the Annual Survey database (and

research based upon it), management of the FSI-Connect learning

module licenses, the IADI external website, and

member-only websites. In addition, Mr Lee has been responsible

for the organisation and coordination of numerous IADI

Training Events and Meetings during his tenure. Ms Myeonghee Song

(above), also of the KDIC, has joined us to continue these

critical activities of the Secretariat and Association.

|

| |

|

|

Sanjeeve

(Sanj) Sharma, originally a secondee from the

Financial Services Compensation Scheme (FSCS), United Kingdom,

began at the Secretariat in September 2014. Initially a

Research Analyst at the Secretariat, Sanj’s role has evolved

to also include aspects of legal, governance, policy,

membership, communications (both internal and external), and

event organisation work. His term will end on 31 August 2018,

with Mr Ramadhian Moetomo (above) assuming the Policy and

Communication Specialist role within the Secretariat.

Sanj’s engagement in such a wide range of the Association’s

activities and the wealth of experience working with so many

IADI Stakeholders over the years are highly appreciated. |

|

|

|

|

|

|

|

Highlights

from the International Conference Jointly hosted by IADI and the State

Corporation

Deposit Insurance Agency of

Russia

|

| |

|

|

|

|

|

During the week of IADI Executive Council-related meetings, an

international conference entitled "Deposit Insurance: Promoting

Accessibility and Convenience" took place in Moscow, Russia, on 31

May 2018. The conference was organised by the State Corporation

Deposit Insurance Agency of Russia and the International Association

of Deposit Insurers (IADI). |

|

|

| |

|

|

The conference was attended by more than 150 participants from 45

jurisdictions, and was addressed by the Governor of the Bank of

Russia, Elvira Nabiullina, and Mr Katsunori Mikuniya, the President

of IADI, Chair of the IADI Executive Council and Governor of the

Deposit Insurance Corporation of Japan (DICJ).

In her welcoming remarks,

Governor Nabiullina pointed out that the focus of the conference was

very timely as modern technologies transform the financial market, and

deposit insurers should be active participants of this transformation.

“The technological decisions that are implemented in the Russian

deposit insurance system should make interaction of the Deposit

Insurance Agency with failed banks’ depositors and creditors more

user-friendly and easy. Deposit insurance payouts, filing of creditor

claims and access to the results of their consideration, receipt of

abstracts from registers of claims, repayment of loans and finding out

the size of indebtedness… - all such actions and requests are

planned to be made in the electronic form”, said Governor Nabiullina.

In his address to the conference

participants, President Mikuniya stressed the important role that IADI

plays in setting standards of deposit insurance and spoke of the

current phase of implementation of IADI's Strategic Goals: promoting

deposit insurance system compliance with the Core Principles;

advancing deposit insurance research and policy development; and

providing Members with technical support to modernise and upgrade

their systems. |

|

|

|

|

|

|

|

A number of distinguished speakers addressed the conference, including

those representing deposit insurers from all over the globe,

international financial organisations, central banks, and private

businesses. The conference participants paid special interest to the

speech of Stephen Murchison, Chair of the Financial Stability Board's

(FSB's) Financial Innovation Network and Advisor to the Governor of

the Bank of Canada, who elaborated on the FSB work on systematisation

and analysis of developments in financial technologies (Fintech),

identification of risks and benefits that arise, and development of

internationally agreed approaches to the regulation of financial

innovations.

During the conference sessions, the participants

discussed a number of emerging issues including the implementation of

new technologies, the development of communication channels for

interacting with banks' depositors and creditors, and the challenges

for deposit insurers arising from Fintech developments that need to be

addressed. The panelists stated that accessibility of services

provided by deposit insurers should be coupled with adequate measures

for ensuring the safety of personal data and minimisation of losses

that depositors could face.

Please kindly note that the

International Conference speakers' biographies and their presentations

may be found at the following site -

www.iadi2018.ru. Further details of the 55th EXCO

meeting may be found in the section 'Additional Events, Training,

Seminars and Conferences (Jan to Jun 2018)', below.

|

|

Click the

image to enlarge

Click the

image to enlarge |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key

Achievements and Updates from the

Council Committees (CCs) and their

Technical Committees (TCs)

|

| |

|

|

|

|

Audit and Risk Council Committee (ARCC) - chaired by

Sonja Lill Flø Myklebust, Norway

Audit and Risk Council Committee (ARCC) - chaired by

Sonja Lill Flø Myklebust, Norway |

|

|

|

-

Audit Plan, Phase II, for the IADI Website Relocation and

Enhancement Project - revised plan agreed upon and the choice of

supplier advised upon.

-

IADI Financial Statements and the Secretariat's Quarterly

Reports on the Statement of Activities and Financial Position

for the FY 2017/2018 from Q2 until the end of Q4 - review has been completed and

recommended to EXCO for approval.

-

The IADI Audited Financial Statements and the

Secretariat’s Report on the Statement of Activities and

Financial Position for FY 2017/2018 – review has been completed

and recommended to EXCO for approval.

-

Investment Guidelines Report (including Investment Guidelines

for FY 2018/19) - review completed and recommended to EXCO for

approval.

-

External Auditor Rotation Policy - the procedure and quotations

have been reviewed and recommended to EXCO for approval.

|

|

|

|

|

|

|

|

Core Principles and

Research Council Committee (CPRC)-

chaired by William Su, Chinese Taipei

Core Principles and

Research Council Committee (CPRC)-

chaired by William Su, Chinese Taipei

|

|

|

|

-

Vice Chairperson- Nikolay Evstratenko of the Deposit Insurance

Agency, Russia, was appointed CPRC Vice Chairperson for a

three-year term.

-

Committee Composition- new members are Fauzi Ichsan (Indonesia),

Katsunori Mikuniya (Japan), Rafiz Azuan Abdullah (Malaysia), and

Diane Ellis (U.S.A.).

-

Research and Guidance Technical Committee (RGTC)- terminated 31

March 2018, and all RGTC subcommittees become CPRC Technical

Committees from 1 April 2018.

-

Islamic Deposit Insurance Technical Committee (IDITC)- committee term

extended and appointed Ronald Rulindo

(Indonesia) as the new chairperson, both for a three-year term,

until the end of fiscal year 2020. Also, the IDITC Business Plan

2018/20 was approved.

-

Islamic Financial Services Board

(IFSB) : IADI and the IFSB are currently working on a Memorandum

of Understanding (MoU) in order to formally agree their

collaboration to jointly develop the IADI-IFSB Core Principles

for Islamic Finance Regulation: Effective Islamic Deposit

Insurance System, with the aim to provide guidance on the matter

specifically to the members of both organisations, and the

deposit insurance sector in general.

Both organisations

will also work together to promote the implementation of prudential

standards to facilitate the development of Islamic deposit

insurance, and enhance awareness through knowledge sharing and

organisation of executive programmes, workshops, seminars, etc.

-

Data and Survey Technical Committee (DSTC)- chaired by Eugenia

Kuria Alamillo, IPAB, México, was extended until the IADI Annual

General Meeting in October 2018, in order to complete the

transition of duties to the IADI Secretariat.

-

Two New Research Projects- established for ‘Risk Management and

Internal Control Systems of Deposit Insurance Systems’ and

‘Differential Premium Systems’, and chaired by Giuseppe Boccuzzi

(FITD, Italy) and Anthony Sinopole (FDIC, U.S.A.) respectively.

-

Further to the two new projects above, drafting continues on

five other research and guidance papers, covering the topics on

Recoveries from Assets of Failed Banks, Purchase and Assumption,

Public Policy Objectives, Financial Inclusion and Innovation,

Deposit Insurers’ Role in Contingency Planning and System-wide

Crisis Preparedness and Management, and Resolution Issues for

Financial Cooperatives (Part II).

-

The following papers have been published, or will be published shortly:

-

Resolution Issues for Financial

Cooperatives: Overview of Distinctive Features and Current

Resolution Tools (Research Paper)

-

Shari’ah Governance for Islamic

Deposit Insurance Systems (Discussion Paper)

-

Deposit Insurance Fund Target

Ratio (Research Paper)

|

|

|

|

|

|

|

|

|

Member Relations Council Committee (MRC)- Acting

Chair is Mohamud Ahmed, Kenya

Member Relations Council Committee (MRC)- Acting

Chair is Mohamud Ahmed, Kenya

(chaired until 31 May 2018 by Kapal

Kumar Vohra, India) |

|

|

|

-

Vice Chairperson- Mohamud Ahmed of the Kenya Deposit Insurance

Corporation, was appointed MRC Vice Chairperson for a three-year

term.

-

Committee Composition- new members

are Alejandro López,

(Argentina), John Chikura (Zimbabwe), and Roberto Tan

(Philippines).

-

IADI Profile document- outlining IADI's governance structure,

activities, Key Membership Benefits, and list of participants has been updated and translated into seven

languages from the English version. Subsequently, the IADI

website has been revised to make the document easier to locate-

it may be found

here.

-

Prioritisation of Membership Benefits and Communications

Initiatives- in efforts led by Michèle Bourque, the then President and

Chief Executive Officer of the Canada Deposit Insurance

Corporation (CDIC) and her colleagues, input was gathered from

an MRC Working Group, the Secretary General, and almost all

Regional Committee Chairpersons, regarding which of the numerous

possible initiatives should have the highest priority. The

following final rankings were identified as top priorities based

on the responses received from all respondents:

-

Ranking No. 1- Intention to review

Membership fee structure

-

Ranking No. 2- Greater use of

Regional Chairpersons

-

Ranking No. 3- Surveying the

specific needs of IADI Members

-

Ranking No. 4(joint)- Expand outreach to prospective Members at all

major IADI conferences, training events, and regional meetings

-

Ranking No. 4(joint)- Raising Awareness on Benefits of IADI experts on

DI, technical assistance, SATAPs, Capacity Building

-

Ranking No. 5- Relations with

"smaller" DIs - Better tailor IADI technical assistance and

capacity building

-

MRC members and the Secretariat

will use the information gathered to prioritise tasks and

cost them, given the level of resources required compared to

those currently available.

-

The Working Group on the Code of

Ethics and Conduct- led by Giuseppe Boccuzzi, of the FITD, Italy

- following consultation with Regional Committee Chairpersons

and their members, the Executive Council approved the new IADI

Code of Ethics and Conduct. The purpose of the Code of Ethics

and Conduct is to preserve and enhance the reputation,

integrity, credibility and image of IADI. It outlines the

values, principles and rules of conduct for IADI, and may be

found

here (log in required to Members only website).

-

New Participants- the MRC is

proud to note the four new participants (two Members and two

Associates), as detailed below.

-

In conjunction with the ARCC, the Finance

Reserve Policy has been reviewed and recommended to EXCO for

approval.

|

|

|

|

|

|

|

|

|

|

|

|

Training and Technical Assistance Council Committee (TTAC)-

chaired by Raúl Castro Montiel, México

Training and Technical Assistance Council Committee (TTAC)-

chaired by Raúl Castro Montiel, México |

|

|

|

Vice Chairperson- Violeta Arifi-Krasniqi of the Deposit

Insurance Fund of Kosovo, was appointed TTAC Vice Chairperson

for a two-year term.

-

Committee Composition- new members are Alejandro

López,

(Argentina), Alex Kuczynski (United Kingdom), Michelle

Rolingson-Pierre (Trinidad and Tobago), Kuanyshbek Abzhanov

(Kazakhstan), and Roberto Tan (Philippines).

-

EXCO approval of the Repository Project- a Working Group, led

by Ms Violeta Arifi-Krasniqi, is developing a repository which

will provide online access for members to the training and

technical assistance materials, fulfilling the TTAC (and IADI)

objective of sharing and exchanging expertise.

-

The Repository will be set as a

tab in IADI members only website storing training and technical

assistance materials from each IADI knowledge event, organised

in the format of conference, workshops or seminar.

-

EXCO approved the Repository Project at its meeting in May

2018, and the Working Group is currently collating relevant

materials from past events, with the aim of implementing the

Repository by the end of Q4 of 2018.

-

The drafting of the Manual for Planning and Conducting

Training and Technical Assistance Workshops (CP Training

Manual) is nearing completion, and now includes a section on

the Lessons Learned and input from the recently-held

Workshops.

-

Technical Assistance Workshops- are being planned in Morocco

and Chinese Taipei in response to requests from the respective

Regional Committee Chairpersons.

-

Core Principles Workshops

are being planned.

-

Expert Training Programme for Assessing Compliance

with the Core Principles- held in Naples, Italy, as described

below.

-

The work of the Training and Conference Technical Committee

(TCTC) currently comprises, amongst others, the CP Training

Manual, facilitating Regional Technical Assistance Workshops

and Core Principles Workshops.

-

The Technical Assistance Technical Committee (TATC) has produced its Final

Report of the special Survey "Information request form for the

IADI Registry of Capacity Building Expertise", and is working

to

develop a Technical Assistance Needs and Methodology to Match

these with Specific Experts, along with a Topical Catalogue

Webpage, which would not only allow for matching of experts

but also sharing of experiences and expertise. It is also

developing an Expert Registry (in partnership with the TCTC).

-

Changes in leadership for both Technical Committees- the

TCTC’s newly-appointed Chairperson is Anthony Sinopole, of the

FDIC, U.S.A., who succeeds Mr Fred Carns (also of the FDIC).

Whilst the TATC’s newly-appointed Chairperson is Karen

Gibbons, of the FSCS, United Kingdom, who succeeds Mr Alex

Kuczynski (also of the FSCS). IADI would like to express its

gratitude to Mr Carns and Mr Kuczynski who are long-standing

supporters and contributors to the Association, and wish both

Fred and Alex well for the future!

|

|

|

|

|

|

|

Executive Councilmembers'

departures since December 2017

|

|

|

|

|

|

The Association wishes to show its appreciation to the former

Executive Councilmembers below, who have departed from the Executive

Council (EXCO) since December 2017. |

|

|

|

|

|

|

András Fekete-Győr, former Managing Director of the

National Deposit Insurance Fund of Hungary (NDIF), was a

long-standing member of EXCO, having served for four terms of three

years each, between 2003 and 2018. Mr Fekete-Győr was involved as

member of a steering group along with the Cross Border Resolution

Group of the Basel Committee in developing the Core Principles for

Effective Deposit Insurance Systems and the related methodology for

assessments. In addition, he facilitated a number of

self-assessments of the Core Principles in Central and Eastern

Europe. Most recently, he was the Vice Chairperson of the Core

Principles and Research Council Committee. The current Designated

Representative for Hungary is Mr András Kómár. |

|

We congratulate Mr Fekete-Győr for his recent appointment as the first

Secretary General of the European Forum of Deposit Insurers (EFDI),

and wish him well in his new role. |

|

|

|

|

|

|

Kapal Kumar Vohra, former Chief Executive Officer,

Deposit Insurance and Credit Guarantee Corporation,

India, had been an Executive Councilmember since November 2015

(formally elected in October 2016). In addition to EXCO, Mr Vohra

had been a member of the former Research and Guidance

Standing Committee (RGC), the Sub-Committee on Resolution Issues for

Financial Co-operatives, the Special Working Group on Technical

Assistance, the Working Group on New Funding Options, had been

a moderator at IADI Conferences and an active participant at a

number of IADI events. |

|

Perhaps most importantly, Mr Vohra had been the Chairperson of the

Member Relations Council Committee (MRC) since its creation in

October 2016. It was under his leadership that the MRC undertook

projects such as, the compilation of an agreed list of Key IADI

Membership Benefits, the Prioritisation of Communications and

Membership Initiatives, a drive to increase the membership of IADI, and

the transition of duties from the Finance and Planning Technical

Committee (FPTC) directly to MRC. |

|

|

|

|

|

|

We would also like to make a special mention of Michèle

Bourque, who has recently ended her term as President and

Chief Executive Officer of the Canada Deposit Insurance Corporation

(CDIC), having been appointed to that position in 2010. Ms Bourque has

supported the Association’s efforts throughout her tenure, including

contributing to the IADI Leadership as an Executive Councilmember for

two consecutive terms of three years, from 2010 until 2016; hosting of

the 38th Executive Council meetings, held in Ottawa, Canada, in

February 2013; her role as the Chairperson of the Regional Committee

of North America (RCNA); and being a member of the Special Working

Group on Governance, established in October 2015, resulting in the

Association’s current governance structure.

Ms Bourque’s support was

demonstrated right until present times where, as a member of the MRC

(and TTAC), she led efforts to research and report upon the

prioritisation of Communications Initiatives and Key Membership

Benefits, as highlighted above. It was under Ms Bourque that the CDIC

celebrated its 50th anniversary, in 2017.

|

|

|

|

IADI would like to offer best wishes for the future to all of

the above. |

|

The IADI Annual Survey and the IADI Secretariat Research Unit

|

|

|

|

|

|

|

We can confirm that validation of 2017 IADI Annual Survey has now

been completed. The Annual Survey had 131 responses, itself a record

number, and was the first to have received responses from all IADI Members.

The detailed findings of the Survey results have been uploaded to

our Members only

website, along with a smaller selection of the findings

posted to our

public website.

The 2018 IADI Annual Survey

was circulated for completion toward the end of May 2018. In order

that we maintain a response from all IADI Members, leading to the

fullest possible dataset, we would be grateful for the return of

your completed survey as soon as possible.

IADI would like to express our

sincere appreciation for your continued support and commitment in

participating in this year's Annual Survey. We highlight the

importance of your cooperation in not only keeping the information

relevant and up-to-date, but also continuing to provide us feedback

on ways to improve the data collection process. Without your

participation, none of this would be accomplished.

Should you have any queries

regarding the IADI Annual Survey, please do not hesitate to contact

us. For questions regarding the survey instructions and filling out

the on-line form once received, you may contact us at IADISurvey@iadi.org |

|

The Annual Survey efforts have been led by

the IADI Secretariat Research Unit (RU), which is

managed by Kumudini Hajra, IADI's Senior Policy and Research Advisor

(SPRA). The RU has been involved in directing or undertaking a number

of other initiatives, such as:

- The Subcommittee on the Deposit

Insurers' Role in Crisis Management and System-wide Crisis

Preparedness. The draft of this paper was submitted for review and

approval by the CPRC in May 2018. Once approved and any comments

incorporated, it will be submitted for review by EXCO.

- The Data Analysis, Collection,

Reporting and Management System (DCARMS). The Project is intended

to create a better, more user-friendly, responsive interface for

those with queries, technical needs, or carrying out research,

with the goal of launching the 2019 Annual Survey using the new

survey tool. EXCO has in-principle approved the Proposal for the

IADI Database Project, which include the following four items:

- Proceeding

with the Request for Quotation (RFQ), with grateful assistance

from the Bank for International Settlements

- Forming

of a project, evaluation, and other teams

- Hiring

on a part-time and temporary basis a business analyst for the

duration of the project and Tableau Consultant, when needed

- CPRC/EXCO to approve the Project and associated costs after

the Evaluation Team makes the finalised proposal

-

Working with the Data and Survey

Technical Committee, in preparation for the transition of its

functions and duties to the RU.

-

Participation by the SPRA in meetings

and conference calls of the Resolution Steering Group (ReSG) and

Cross-border Crisis Management Group (CBCM) of the Financial

Stability Board (FSB) and its Work Stream on Funding in

Resolution. In addition, the SPRA is working with the FSB on its

implementation monitoring project to assess compliance with the

FSB Key Attributes.

-

The SPRA has also given presentations

on the work of the RU at various IADI Executive Council and

Committee meetings, as well as during the IADI Annual General

Meeting (click here for a link to the AGM presentation- eBIS login

required).

|

|

Additional Events,

Training, Seminars and Conferences (Jan 2018 - Jun 2018)

|

|

|

|

|

54th

EXCO Meeting and Joint FSI-IADI Conference- Basel, Switzerland

54th

EXCO Meeting and Joint FSI-IADI Conference- Basel, Switzerland

The 54th Executive Council (EXCO) Meeting and associated

Committee Meetings were hosted by IADI on 29-30 January 2018 in Basel,

Switzerland. During the EXCO Meeting, the Chair of the Working Group

on the Code of Ethics and Code of Conduct gave a presentation on the

aims, structure and content of the newly-created Code, which was then

approved and adopted by the EXCO Members. Following this, the

President of IADI and EXCO Chair, Katsunori Mikuniya, presented a

paper on IADI's New Funding Options, in line with the Association's

Strategic Goals and Business Plan 2017/2020, and proposed to set up a

Working Group in order to sort out relevant key issues following an

insightful discussion amongst the EXCO Members. |

Click the

image to enlarge |

|

The IADI and

the BIS's Financial Stability Institute (FSI) co-hosted their eighth

joint conference on bank resolution, crisis management and deposit

insurance on 31 January - 2 February 2018 in Basel, Switzerland. The

conference was hosted by IADI President and EXCO Chair Katsunori

Mikuniya and Fernando Restoy, Chairman of the FSI. Distinguished

speakers and panels from a variety of fields had a wide-ranging

discussion and shared their views on the main conference theme:

resolution frameworks, global resolution standards, interaction

between banking supervision, resolution and deposit insurance, lessons

learned from previous bank failures and future challenges.

|

|

Keynote speakers were Mark Branson (Chief Executive Officer of the

Swiss Financial Market Supervisory Authority and Chair of the

Financial Stability Board Resolution Steering Group), and Paul Tucker

(Chair of the Systemic Risk Council and Senior Fellow at the Center

for European Studies at Harvard University), with the closing remarks

given by Agustín Carstens (BIS General Manager). The event was

attended by close to 250 central bankers, banking supervisory

officials and deposit insurers representing 130 financial authorities

in around 80 jurisdictions worldwide. |

|

|

|

|

Europe Regional Committee (ERC) Annual Meeting and

International Conference- Naples, Italy

Europe Regional Committee (ERC) Annual Meeting and

International Conference- Naples, Italy

|

Click the

image to enlarge |

|

The IADI Europe Regional Committee (ERC) held its Annual

Meeting and International Conference on 22-23 March 2018 in Naples,

Italy, hosted by the Interbank Deposit Protection Fund, Italy. The

Conference, based on the theme "Resolution and Deposit Guarantee

Schemes in Europe: Incomplete Processes and Uncertain Outcomes",

provided an updated picture of the Resolution processes in Europe

from the point of view of banks and authorities. The purpose of the

conference was to provide an update and state-of-the-art picture of

the Resolution processes in Europe. The event was attended by close to 150

participants, consisting of Deposit Insurers, International and

Italian Banking Institutions, and Academics. |

|

|

|

|

Expert Training Workshop- Naples, Italy

Expert Training Workshop- Naples, Italy

|

The IADI hosted its Experts Training Workshop for Assessing

Compliance with the IADI Core Principles for Effective Deposit

Insurance Systems (the Core Principles) on 26-27 March 2018 in

Naples, Italy. Twenty highly qualified senior staff

nominated by IADI Members in every region were selected to participate in training

by ten Core Principles Experts.

|

|

|

In-depth discussions were held on a number of

technical topics surrounding compliance assessment methodology, based

upon case studies conducted by IADI over the last six years. They also

dealt with special issues, including the application of Core

Principles for private deposit insurance systems; FSB Key Attributes;

and the Deposit Insurer's role in resolution regimes.

The Expert Training Program is designed to lead to recognised experts of

the Core Principles, who may be utilised by World Bank and

International Monetary Fund in assessing a jurisdiction's financial

stability. These recognised experts could also assist with conducting

Self-Assessment Technical Assistance Program (SATAP) reviews;

conducting IADI workshops on Core Principles overviews and peer

reviews; and conducting FSB peer reviews. |

|

|

|

|

16th Annual APRC Meeting and APRC International Conference-

Hanoi, Vietnam

16th Annual APRC Meeting and APRC International Conference-

Hanoi, Vietnam

|

Click the

image to enlarge |

|

The IADI Asia-Pacific Regional Committee (APRC) held its Annual

Meeting and International Conference on 16-18 April 2018 in Hanoi,

Vietnam, hosted by the Deposit Insurance of Vietnam. During the

Conference, entitled "Small and Medium-sized Insured Institutions -

What We Can Do for Them", participants shared their experience and

best practices on their functions and mandates, specifically

addressing critical issues pertaining to small and medium-sized

insured institutions. They also discussed the application of the Core

Principles and the implementation of IADI's Self-Assessment Technical

Assistance Program (SATAP) in various countries. Around 230

participants from 23 jurisdictions attended this event. |

|

|

|

|

3rd America's Deposit Insurance Forum and Regional Committee

Meeting and Technical Assistance Workshop

3rd America's Deposit Insurance Forum and Regional Committee

Meeting and Technical Assistance Workshop

-

Mexico City, Mexico

|

|

|

Three IADI Regional Committees, namely the Latin America, Caribbean,

and the North America Regional Committees, came together to hold their

third “Americas’ Deposit Insurance Forum” and Regional Committee

Meetings, in Mexico City, Mexico, on 23-26 April 2018, hosted by

Mexico’s Instituto para la Proteccion al Ahorro Bancario (IPAB). With

the theme of “Bank Resolution and Crisis Management: Beyond the Core

Principles”, the Forum aimed to share experiences in the areas of

deposit insurance, banking resolutions and crisis management. Numerous

sessions - several of which included an interactive component - covered

investment policy and funding, safety-net cooperation and governance,

resolution planning and toolkits, resolution case studies, and a

workshop on IADI Core Principle Self-Assessments.

Over 90 participants

from over 20 jurisdictions attended this event, and IADI is pleased to

report that the Forum and individual sessions were highly rated by

participants. |

|

|

|

|

11th EARC Annual Meeting and the International Seminar,

Conference and Technical Assistance Workshop

11th EARC Annual Meeting and the International Seminar,

Conference and Technical Assistance Workshop

- Istanbul, Turkey

|

Click the

image to enlarge |

|

The IADI Eurasia Regional Committee (EARC) held its 11th Annual

Meeting, International Conference, and Technical Assistance Workshop

(TAW), on 7-9 May 2018 in Istanbul, Turkey, hosted by the Savings

Deposit Insurance Fund (SDIF), Turkey. The Conference, based on the

theme “Crisis Management: Traditional vs New Approaches”, was an

insightful forum for sharing jurisdictions’ current frameworks and

further approaches on how to prepare and deal with a crisis

resulting from financial instability. The TAW's focus and agenda was

tailored to address the specific training gaps and needs of the

regional members, in implementing the IADI Core Principles, as well as

proposed action plans to enhance the current crisis management

structures within their jurisdictions. The events were attended by

numerous participants, consisting of Deposit Insurers, International

and Turkish Banking Institutions, and Academics. |

|

|

|

|

55th EXCO Meeting and International Conference- Moscow,

Russia

55th EXCO Meeting and International Conference- Moscow,

Russia |

The 55th IADI Executive Council (EXCO) Meeting and associated

Committee Meetings were hosted by the State Corporation Deposit

Insurance Agency (DIA, Russia) from 28 May to 1 June in Moscow,

Russia. During the EXCO Meeting, new Member and Associate

applications from Uganda, Rwanda and Cambodia were approved. The

meeting also included reports on the IADI's financial statements for

FY 2017/18, research plans and papers, membership relations, and

technical assistance and training initiatives. The Europe Regional

Committee appointed a new chairperson, and the Asia-Pacific Regional

Committee amended their Terms of Reference.

|

Click the

image to enlarge |

|

Following the Meetings, an

International Conference on the theme of "Promoting Accessibility and

Convenience" was held, where discussions took place on how new

technological innovations affect financial services and improve the

operational effectiveness of deposit insurance systems, as well as the

convenience of a deposit insurer's services. The events were

attended by over 130 participants from nearly 50 jurisdictions,

including high-level Central Bank officials, and national and

international media organisations. More details of the International

Conference may be found in the relevant section of this Newsletter,

above. |

|

|

|

|

Non-IADI events attended by the

IADI Secretariat members

Non-IADI events attended by the

IADI Secretariat members

In addition to playing a key role in the events above, the

Secretariat and, especially the Secretary General and the Senior

Policy and Research Advisor (SPRA), have been consolidating the

profile of IADI by actively participating in events organised by

partner organisations. For example, the Secretary General met with

European Bank for Reconstruction and Development directors to discuss

future collaboration in the region and provided a lecture to the Bank

of England on deposit insurance and financial stability issues. He

also presented to the Bank of England’s ‘Masters in Financial

Stability Programme’ on deposit insurance, financial stability and

moral hazard. Both of these events took place during the first Quarter

of 2018. |

|

New IADI Participants

|

|

|

|

|

|

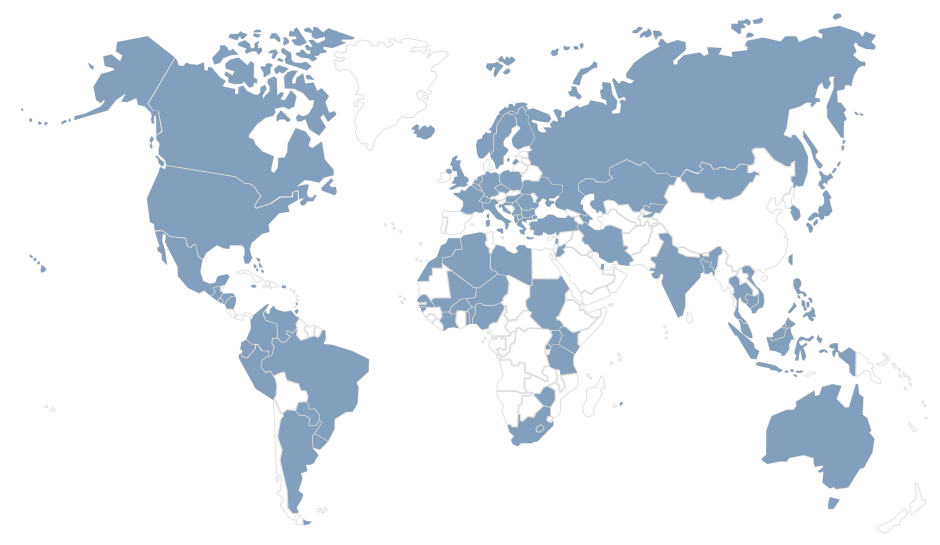

Join us in welcoming newest participants, all of whom were approved

by EXCO using correspondence votes in April and May 2018, with

ratification approvals given at the EXCO meeting in Moscow, Russia,

held on 30 May 2018. |

|

|

|

|

|

|

-

Deposit Protection Fund of Uganda - new Member

The Deposit Protection Fund of Uganda (DPFU) was incorporated in

February 2016 by virtue of an Act of the Ugandan Parliament, Part

XII of the Financial Institutions (Amendment) Act No. 2 of 2016. The

Scheme has a pay-box mandate, and is government legislated and

administered. It covers a total of 33 institutions comprising,

commercial banks, credit institutions, and micro-finance deposit

taking institutions. With the Fund’s six full time employees, the

coverage limit applicable is 3,000,000 Ugandan Shillings - around 823

USD (exchange rate as of May 2018) - per depositor, per institution, and

it targets to commence deposit

reimbursement within 90 days of a bank’s failure. It is funded via

an ex-ante method, using a hybrid of differential and flat rates.

The DPFU was represented in its application by Ms Julia

Oyet, the Fund’s Chief Executive Officer.

Please note that

the Deposit Protection Fund of Uganda was previously within Uganda’s

Central Bank, and the Member application was triggered following the

transition of the Fund into a newly-created legal entity, separate

from the Central Bank.

- Bank of Uganda - Transition from

Member to Associate

As stated above, the Deposit

Protection Fund of Uganda was previously within Uganda’s Central

Bank (the Bank of Uganda) and is now a separate legal entity.

However, despite this development, the Bank of Uganda remains ‘part

of the financial safety net and has a direct interest in the

effectiveness of a deposit insurance system’, and therefore fulfils

the criteria to be an Associate member of IADI.

It its

Associate application, the Bank of Uganda was represented by Mr

Charles Owiny Okello, Director, Non-Bank Financial Institutions

Department, at the Bank of Uganda.

- Deposit Guarantee Fund of Rwanda

- new Member

The Deposit Guarantee Fund (DGF) of

Rwanda was incorporated in November 2016 by the Law determining the

organisation and functioning of deposit guarantee fund for banks and

microfinance institutions (No 31/2015 of 05/06/2015). The Scheme has

a pay-box mandate, is government legislated and administered, and is

within the Central Bank.

It covers 17 institutions

comprising every bank and microfinance institution licensed by the

National Bank of Rwanda. The coverage limit applicable is 500,000

Rwandan Francs - around 588 USD

(exchange rate as of May 2018) - per depositor, per institution, and

it targets to commence deposit reimbursement within 60 days of a bank’s

failure. It is funded via an ex-ante method, using a flat rate

system- in addition, there is provision for emergency funding from

the National Bank of Rwanda, should the fund be insufficient for the

reimbursement of insured depositors.

The DGF of Rwanda

Member application was formally signed by the Hon. John Rwangombwa,

Governor of National Bank of Rwanda (BNR), and submitted by Mr

Olivier Ngenzi, Manager of the Deposit Guarantee Fund.

- National Bank of Cambodia - new

Associate

The National Bank of Cambodia (NBC) was

established in December 1954, pursuant to the Law on the

Organisation and Conduct of the National Bank of Cambodia. The IADI

Executive Council agreed that the NBC satisfied the definition of an

Associate and approved its participation in the Association.

The Associate application was submitted on behalf of the NBC's

Governor, Cheav Chanto.

|

|

|

|

|

|

We thank the above

entities for their applications and look forward to working more

closely with them, as part of the global IADI community. As at the end of June 2018,

IADI's membership included 107 participants, including 83 Members,

10 Associates and 14 Partners.

for the full IADI Members and Participants list

for the full IADI Members and Participants list |

|

|

|

|

|

|

|

Key Achievements and

Updates from various Regional Committees

|

|

|

|

|

|

A number of major events have been hosted by IADI Regional

Committees since the last Newsletter, as described above, and have

included Annual Meetings by the nearly all of the Regional

Committees. |

|

|

|

|

|

|

Asia-Pacific Regional Committee

(APRC)

Asia-Pacific Regional Committee

(APRC)

- The Asia-Pacific Regional Committee (APRC) Revises its Terms

of Reference, Approved by the Executive Council

The APRC, under the new

Chairpersonship of Mr William Su, revised its Terms of Reference

(TORs) in order to implement the Strategic Priorities and Action

Plans Committee’s action plans approved by the APRC and to

enhance its sustainability and continuity. Major revisions

created a standing position of the APRC Vice Chairperson, as

well as establishing technical committees (TCs). The revised

TORs were approved by the IADI EXCO in May 2018.

- APRC Appoints its Vice Chairperson and Chairpersons

of Technical Committees (TCs) and Approves of the Compositions of Two

TCs

Subsequent to an

Expression of Interest (EOIs) process open to all regional members,

the APRC appointed the following:

-

APRC Vice Chairperson :

Roberto B. Tan of the Philippine Deposit Insurance Corporation, for

a three-year term.

-

Chairperson of the APRC Research Technical

Committee : Rafiz Azuan Abdullah of the Malaysia Deposit Insurance

Corporation, for a two-year term.

-

Chairperson of the APRC

Training and Assistance Technical Committee : Sung Wook Youn of the

Korea Deposit Insurance Corporation, for a two-year term

-

Membership compositions of the above two Technical Committees.

|

|

|

|

|

|

|

Europe Regional Committee (ERC)

Europe Regional Committee (ERC)

- ERC Appoints its Chairperson and Vice Chairperson

During the ERC’s

Annual Meeting, held in Naples, Italy, in March 2018, the ERC

appointed the following:

ERC Chairperson – Giuseppe

Boccuzzi of the Interbank Deposit Protection Fund, Italy, was

re-appointed as ERC Chairperson for a three-year term. This

was approved by EXCO at its recent meeting.

ERC Vice Chairperson- Sonja Lill

Flø Myklebust of the Norwegian Banks’ Guarantee Fund was

appointed as ERC Vice Chairperson.

ERC Regional Research Paper

Produced by an ERC Subgroup, the

paper, entitled “Mind the Gap!”, is a comparative analysis

between the IADI Core Principles and the European Deposit

Guarantee Scheme Directive (DGSD). It has been uploaded to the

IADI website and may be found

here.

|

|

|

|

|

|

|

Middle East and North Africa

Regional Committee (MENA)

Middle East and North Africa

Regional Committee (MENA)

- Facilitated cooperation and promoted dialogue among members,

non- member jurisdictions, and other IADI Committees

Examples include MENA members

participating in the training programs offered by the training

institute of the Korea Deposit Insurance Corporation (KDIC) and

the 10th Deposit Insurance Corporation of Japan (DICJ)

Roundtable meeting.

- Outreach activities undertaken towards non-member

jurisdictions

Outreach activities have been undertaken by the Committee towards

non-member jurisdictions:

-

The MENA Chairperson has been in

contact with the Iraq Central Bank, who intends to establish a

Deposit Insurance System(DIS) and will visit the Jordan

Deposit Insurance Corporation (JODIC) to gain specific

knowledge.

-

Contact maintained with the

Qatar Central Bank (currently an IADI Associate), the DIS of Tunisia, and Bahrain, who have

DISs, along with the United Arab of Emirates, who intend to

establish a DIS.

- Training Initiatives

The MENA coordinated with the

Training and Conference Technical Committee (TCTC) to provide

assistance in the development of effective technical assistance

workshops. This resulted in the Moroccan Deposit Insurance Fund

providing assistance to a MENA regional member on the topic of an

effective payout system, and the Deposit Insurance Fund of Libya

organising training courses in collaboration with the Banking

Studies Institute covering the topics of deposit insurance and

Core Principles, in the second quarter of 2018.

- The World Bank

-

The World Bank organised a workshop on “Recovery and

Resolution Planning” in March 2018, which was attended by

the Savings Deposit Insurance Fund of Turkey (SDIF).

-

Bank Al-Maghrib and the Ministry of Finance (Treasury) have

benefited from World Bank Technical Assistance in banking

resolution as the Moroccan authorities plan to designate

Bank Al-Maghrib as a Resolution Authority.

|

|

|

|

|

Upcoming Annoucements for

the IADI Annual General Meeting

|

|

|

|

|

|

|

15-19 October 2018 | Basel, Switzerland

- To be hosted by the

IADI Secretariat

The 17th IADI Annual General Meeting (AGM), Annual Conference,

56th and 56th bis EXCO Meeting, and related meetings will be held

at the Bank for International Settlements (BIS), Basel,

Switzerland, from 15-19 October 2018.

|

|

|

|

|

|

|

|

|

|

|

|

Theme of Conference

The theme for this year's

Annual Conference event will be ‘Deposit Insurance and Financial

Stability: Recent Financial Topics.’

Financial stability, deposit

insurance and related topics will be discussed from the

perspective of global financial institutions and those of deposit

insurers. |

|

|

|

|

Workshop: Introduction to the IADI Core Principles (The

‘CP 101 Workshop’)

In addition to the Annual

Conference, IADI is this year holding a one-and-half day long

Workshop on its standard, the Core Principles for Effective

Deposit Insurance Systems (the Core Principles or CPs). The CPs

were originally published in June 2009, with a revised version

published in November 2014. The revised Core Principles

strengthened the deposit insurance standards in several areas

including reimbursement speed, coverage, funding and governance,

adding more guidance on the deposit insurer's role in crisis

preparedness and management. The updated document also reflects

the greater role played by many deposit insurers in resolution

regimes while continuing to accommodate a diverse range of deposit

insurance systems.

There are 16 individual Core

Principles, covering a range of aspects of a Deposit Insurance

System, each of which will be spoken about by prominent speakers/experts from the deposit insurance arena around the world. As well

as these presentations and approaches to the assessment of

compliance, the Workshop will include the opportunity for

participants to discuss the use of the CPs and their challenges,

during roundtable discussions.

The descriptions of the CPs

and approaches to their assessment will be designed to be

primarily at a working level. |

|

|

|

|

Election of the EXCO Councilmembers

As per our Statutes, the AGM

will vote to elect Executive Councilmembers for their desired

terms. The announcement for submitting an Expression of Interest

(EOI) from amongst the Designated Representatives to serve on the

Executive Council, which, outlines the process for candidates

wishing to stand for election will be circulated around 16 August

2018. Candidates should submit their EOIs no later than 7

September 2018 (for self-nominations) or 14 September 2018 (for

Member nominations).

The overview of the EOIs

received will be posted on the IADI internal website on 18

September, at least 30 days prior to the election. The election

will be presided over by the Secretary General via secret

balloting at the AGM and the results announced during the AGM on

18 October 2018.

In order to ensure

widespread representation of membership in the Council, Designated

Representatives of all IADI Members are welcome to stand for 2018

Election. Due to the expiry of Councilmembers’ terms, and the

limit on participation on the EXCO of six years (as per the

Association’s By-Laws), there will be four or five positions

vacant at this year’s election.

Please note that this year

there will be no regional reserved positions coming available, as

all regions will continue to be represented.

Click here to see the current composition of the Executive

Council |

|

|

|

|

|

|

|

|

|

|

|

Advice to book accommodation as soon as possible

To facilitate your travel

arrangements, the IADI Secretariat and BIS have reserved a block

of rooms for delegates at competitive rates at hotels close to the

BIS. However, as the city of Basel often has popular cultural or

trade events taking place throughout the year, and access secured

to a limited number of rooms, it is important to reserve your

hotel promptly. The preferred rates will be available at the

hotels soon.

Rooms at one of the chosen

hotels may be reserved during registration for the

event. |

|

|

|

|

|

|

|

|

|

|

|

Requirements to enter Switzerland

Citizens of certain

countries and territories need a visa to visit or transit through

Switzerland.

To find out if participant needs a

visa to enter Switzerland, please click

here.

If a visa is required, it is strongly suggested to begin the process as soon

as possible to avoid delays. It is the sole responsibility of the

participant to obtain a visa.

An invitation letter for visa purposes may be requested

during the registration process.

|

|

|

|

|

|

|

|

|

|

|

|

Anticipated opening date of registration- and link to site

Further information on the

AGM, Annual Conference, the Core Principles Workshop, EXCO and

related meetings, including useful information on the Conference

agenda, accommodation rates and details of how to register may be

found on the 17th AGM Website -

which is

anticipated to launch in mid-July 2018 (TBC).

As the events will be held at the BIS, there will be no registration fee

for attendance. |

|

|

|

|

|

|

|

Forthcoming

events (July to December 2018, plus advance notice of events in 2019)

|

|

|

|

|

|

|

4th Malaysia Deposit Insurance Corporation (MDIC)

4th Malaysia Deposit Insurance Corporation (MDIC)

- Africa

Open House

1-2 August 2018 | Kuala Lumpur, Malaysia

To be hosted by the

Malaysia Deposit Insurance Corporation and Africa Regional

Committee

For IADI Members and other interested parties, especially in the

region of Africa

|

|

|

|

|

|

|

|

|

|

|

|

Middle East and North Africa Regional Committee (MENA)

Annual

Middle East and North Africa Regional Committee (MENA)

Annual

Meeting and Conference

TBC September 2018

| Morocco

To be hosted

by the Moroccan Deposit Insurance

Corporation (SGFG) and MENA Reginal Committee

|

|

|

|

|

|

|

|

|

|

|

|

Africa Regional Committee (ARC) Annual

Meeting and

Africa Regional Committee (ARC) Annual

Meeting and

International Conference: ‘Financial Stability, System-wide Crises

Preparedness and Effective Bank Resolution’

25 – 28 September 2018 | Lagos, Nigeria

To be hosted by the ARC and the

Nigeria Deposit

Insurance Corporation (NDIC)

|

|

&n &n |

|

|

|

|

|

|

|

|

|

17th IADI Annual General Meeting, Annual Conference, and ‘Core

17th IADI Annual General Meeting, Annual Conference, and ‘Core

Principles (CPs) 101 Workshop’,

56th and 56th bis Executive Council,

Regional, Council Committee, and Technical Committee

Meetings

15 – 19 October 2018 |Basel, Switzerland

To be hosted by

IADI, the IADI President, and IADI Secretariat

The event website, including the agenda,

details of accommodation, and registration pages may be found

TBC.

|

|

|

|

|

|

|

|

|

|

|

|

FDIC 101: An Introduction to Deposit Insurance, Bank

Supervision,

FDIC 101: An Introduction to Deposit Insurance, Bank

Supervision,

and Resolutions

5 – 9 November 2018

|Arlington, Virginia, USA

To be hosted by the

Federal Deposit

Insurance Corporation

FDIC 101 is a 5-day program designed to provide

participants with an overview of the governing policies and

procedures used by the FDIC to support its mandates. Information

regarding the previous FDIC101 session may be found

here.

Interested

organisations should email

FDIC101@fdic.gov to request a registration form, which must be

completed and returned by 3 August 2018.

|

|

|

|

|

|

|

|

|

|

|

|

Asia-Pacific Regional Committee (APRC)

Regional Workshop

Asia-Pacific Regional Committee (APRC)

Regional Workshop

27 – 29 November

2018 |

Taipei City, Chinese Taipei

To be hosted by the

IADI

Training and Technical Assistance Council Committee (TTAC), the

APRC and the

Central Deposit Insurance Corporation (CDIC)

|

|

|

|

|

|

|

|

|

|

|

|

Additionally, below is advance notice of further events

scheduled to take place in 2019:- |

|

|

|

|

|

|

|

|

|

57th Executive Council and Related Meetings

57th Executive Council and Related Meetings

February 2019 | Almaty, Kazakhstan

To be

hosted by the IADI and the

Kazakhstan Deposit Insurance Fund

(KDIF)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

58th Executive Council and Related Meetings, and IADI 5th

Biennial

58th Executive Council and Related Meetings, and IADI 5th

Biennial

Research Conference

May 2019 | Basel, Switzerland

To be hosted by

the IADI

|

|

|

|

|

|

|

|

|

|

|

|

|

|

18th IADI Annual General Meeting and Annual

Conference

18th IADI Annual General Meeting and Annual

Conference

59th and 59th bis Executive Council, Regional,

Council Committee,

and Technical

Committee Meetings

October 2019 | Victoria Falls, Zimbabwe

To be hosted by the

Deposit Protection Corporation (DPC), Zimbabwe, IADI President,

and IADI Secretariat

(Further information for the

registration of these events is to be posted on the IADI website

in due course.)

|

|

|

|

|

|

|

|

|

|

|

Bank for International

Settlements – Annual General Meeting 2018 and Annual Report 2017/2018

|

|

|

|

|

|

|

The host organisation of IADI, the Bank for International

Settlements (BIS), held its 88th Annual General Meeting (AGM) on

24 June 2018. A panel discussion took place during the AGM,

involving a number of heads of Standard Setting Bodies and

addressing two topics: (1) implementation progress for recently

finalised standards (e.g. core principles) and related policies;

and (2) any standard setting activities related to technological

advancements and cyber-risks. The presentation given by IADI’s

Secretary General Walker may be found

here (log in to the Members only site may be required).

The BIS now publishes separately its Annual Report (BIS

activities and financial performance) and Annual Economic

Report (commentary on the global economy). Both the

Annual Economic Report and the Annual Report- which

this year contains a chapter on Cryptocurrencies- were released

immediately following the BIS Annual General Meeting.

Links to the BIS Annual Report and BIS Annual

Economic Report may be found

here. |

|

|

|

|

|

|

|

New postgraduate degree, MSc

Banking, Regulation and Financial Stability, commencing September 2018- Prof Schaek

|

|

|

|

|

|

|

On behalf of Dr Klaus Schaek, Professor of Banking and Finance,

and member of IADI’s Advisory Panel, we would like to announce the

commencement of a new postgraduate degree in the area of Banking,

Regulation and Financial Stability. The programme, which will take

place at the University of Bristol, United Kingdom, is now open

for applications and is due to take its first cohort in September

2018, with Dr Schaek as the Programme Director.

This is an innovative MSc

(Master of Science),

designed to be far beyond a traditional banking and finance

degree; and shall be the only one of its kind in the UK with a

distinctive focus on banking regulation, supervision, compliance

and risk management. The programme, Dr Schaek states, is excellent

preparation for careers in banking and financial services. It will

also appeal to recent graduates who are already working in

financial services and wish to specialise in banking and financial

regulation, as well as those who intend to continue to PhD

research in this area.

For further information, including relevant contact details and

programme content, please click here:

MSc Banking, Regulation and Financial Stability | Study at Bristol

| University of Bristol.

In addition, candidates

offered a position on the programme will automatically be

considered for a scholarship, as long as the academic excellence

criteria are met- please see here:

http://www.bristol.ac.uk/efm/courses/postgraduate/academic-excellence-awards/ |

|

|

|

|

|

|

|

|

The International Association of Deposit Insurers (IADI) was

formed in May 2002 to enhance the effectiveness of deposit insurance

systems by promoting guidance and international cooperation. Members

of the IADI conduct research and produce guidance for the benefit of

those jurisdictions seeking to establish or improve a deposit

insurance system. Members also share their knowledge and expertise

through participation in international conferences and other forums.

The IADI currently represents 83 deposit insurers, 10 Associates and

14 Partners. The IADI is a non-profit organisation constituted under

Swiss Law and is domiciled at the Bank for International Settlements

in Basel, Switzerland.

|

|

|