|

.

ABOUT

IADI

Homepage

Statutes &

Bylaws

Organisational

Chart

Participants list

Members' Only

Site

Upcoming

Events Calendar

Events Archive

Join

IADI

RESEARCH

& GUIDANCE

Published Papers

Research Topics

Public Consultation Projects

Advisory Panel

Core

Principles for Effective DISs

Handbook for the Assessment of Compliance with the Core Principles

for Effective DISs

PUBLICATION

SERIES

Annual

Report

(2016/17 Annual Report)

Newsletters

Press

Releases, Speeches and IADI Articles

ANNUAL

SURVEY

Past Survey

Results

USEFUL

LINKS

Bank for International

Settlements

European Forum of Deposit

Insurance

Financial Stability

Board

International Monetary

Fund

World Bank

---------------------------------------- |

|

INTERNATIONAL ASSOCIATION OF DEPOSIT

INSURERS

C/O

Bank For International

Settlements

Centralbahnplatz

2

CH-4002 Basel, Switzerland

Tel:

+41 61 280 99

33

Fax: +41 61 280 95 54

Email:

Service.IADI@bis.org

Editor

:

David Walker

Secretary

General

Tel:

+41 61 280 99

50

Fax: +41 61 280 95 54

Email:

David.Walker@iadi.org

Kim

Peeters White

Deputy

Secretary

General

Tel:

+41 61 280 99

33

Fax: +41 61 280 95

54

Email:

Kim.PeetersWhite@iadi.org |

| If you would like to subscribe to the IADI Newsletter,

please send an email to webmaster@iadi.org |

|

|

Welcome

to the IADI's e-Newsletter

IADI is pleased to provide the next

issue of its e-Newsletter. The e-Newsletter keeps you up-to-date on

information about IADI activities from July to December 2017, as well

as on IADI upcoming activities.

|

|

|

The issue includes:

|

|

|

|

| |

Let me extend my sincere appreciation to IADI Members, Associates and Partners for your support of IADI’s agenda this past year.

The IADI Secretariat looks forward to contributing to the advancement of IADI in 2018.

We also look forward to seeing you at the 54th Executive Council meetings, and 8th Joint Financial Stability Institute (FSI)/ IADI Conference, on ‘Bank Resolution, Crisis Management and Deposit Insurance’

from 29 January to 2 February 2018, in Basel, Switzerland.

Happy holidays from your IADI Secretariat team. |

|

| |

David Walker

Secretary General

International

Association of Deposit

Insurers |

Highlights from the 16th Annual General Meeting

|

|

Hosted by the Autorité des marchés financiers (AMF), IADI held their 16th

Annual General Meeting (AGM), Annual Conference, 53rd EXCO and 53rd bis

EXCO meetings in Québec City, Quebec, Canada, on 8-13 October 2017. |

|

|

|

|

|

|

|

IADI Elected Katsunori Mikuniya as its New President and Chair of the Executive Council

IADI Elected Katsunori Mikuniya as its New President and Chair of the Executive Council |

|

|

|

|

|

|

|

|

|

During the elections held during IADI’s AGM on 12 October 2017, the Governor of the Deposit Insurance Corporation of Japan (DICJ), Katsunori Mikuniya, was elected to serve as its President and as the Chairman of its Executive Council for a three-year term. He succeeds Thomas M. Hoenig, Vice Chairman of the Federal Deposit Insurance Corporation (FDIC, USA), who served as President for a two-year term.

Governor Mikuniya expressed gratitude to the Members for his election, stating, “I am honoured to have been selected to serve as President of IADI, which is recognised as the global standard-setting body for deposit insurance by all the major public international financial institutions, including the Financial Stability Board, the Basel Committee for Banking Supervision, the International Monetary Fund and the World Bank. IADI’s fundamental mission is to contribute to financial stability through enhancing the effectiveness of deposit insurance systems, by promoting guidance and international cooperation.” |

|

|

|

|

|

|

|

|

|

He went on to recognise the outgoing IADI President, Mr Hoenig, for his contribution and dedication over the past two years, in making great strides to achieve the Association’s Strategic Objectives. During his tenure, Mr Hoenig spearheaded the Association's efforts to create four Council Committees and led the expansion of the Secretariat's resources, by selecting the current Secretary General David Walker, and overseeing the hiring of members of the Research Unit. Further, the Updated Handbook for Assessing Compliance with the Core Principles was published, and the Association developed a new strategy for training and technical assistance that included region-specific Technical Assistance Workshops.

Governor Mikuniya concluded his remarks by asserting that IADI provided deposit insurers with the necessary guidance and technical proficiency to upgrade their systems in order to make an even greater contribution to financial stability, though deposit insurers must remain vigilant in recognising risks that may threaten financial stability.

A link to the Press Release regarding the Annual General Meeting may be found

here. |

|

|

|

|

|

|

|

|

|

Elections for the Executive Council Composition and EXCO

Councilmembers Departures Since

October 2016 Elections for the Executive Council Composition and EXCO

Councilmembers Departures Since

October 2016 |

|

|

|

|

|

|

|

In addition to the election of Mr Mikuniya during the AGM, the Members elected an Association Treasurer and seven (7) Members’ Designated Representatives to the Executive Council to fill the vacancies that had arisen, as follows;

|

|

|

|

|

|

|

|

As Councilmembers

As Councilmembers |

|

|

|

• Rafiz Azuan Abdullah- Malaysia Deposit Insurance Corporation

•

Diane Ellis- Federal Deposit Insurance Corporation

(USA)

•

Gregor Frey- esisuisse (Switzerland)

•

Fauzi Ichsan - Indonesia Deposit Insurance Corporation

•

Alex Kuczynski- Financial Services Compensation Scheme (United Kingdom)

•

Alejandro López- Seguro de Depósitos Sociedad Anónima (Argentina)

•

Michelle Rolingson-Pierre- Deposit Insurance Corporation, Trinidad and Tobago |

|

|

|

|

|

|

|

As Treasurer

As Treasurer |

|

|

|

• John M. Chikura- Deposit Protection Corporation, Zimbabwe

|

|

|

|

They shall act in the best interests of the Association and shall each serve for a three-year term, effective from the date of the AGM. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Rafiz Azuan Abdullah |

Diane Ellis |

Gregor Frey |

Fauzi Ichsan |

| |

|

|

|

|

|

|

|

| Alex Kuczynski |

Alejandro López |

Michelle Rolingson-Pierre |

John M. Chikura |

|

|

|

|

|

|

|

|

The remaining Councilmembers are:

• Mohamud Ahmed -

Kenya Deposit Insurance Corporation

• Violeta Arifi-Krasniqi -

Deposit Insurance Fund of Kosovo

• Giuseppe Boccuzzi -

Interbank Deposit Protection Fund (Italy)

• Patrick Déry -

Autorité des marchés financiers (Quebec, Canada)

• Nikolay Evstratenko -

State Corporation Deposit Insurance Agency (Russian Federation)

• András Fekete-Györ -

National Deposit Insurance Fund of Hungary

• Bumgook Gwak -

Korea Deposit Insurance Corporation

• Zaher Hammouz -

Palestine Deposit Insurance Corporation

• Marija Hrebac -

Croatian Agency for Deposit Insurance and Bank Resolution

• Umaru Ibrahim -

Nigeria Deposit Insurance Corporation

• Hugo Libonatti - Corporación de Protección del Ahorro Bancario (Uruguay)

• Raúl Castro Montiel - Instituto para la Protección al Ahorro Bancario (México)

• Sonja Lill Flø Myklebust -

The Norwegian Banks' Guarantee Fund

• İlhami Özturk -

Savings Deposit Insurance Fund (Turkey)

• Zdzisław Sokal -

Bank Guarantee Fund (Poland)

• William Su -

Central Deposit Insurance Corporation (Chinese Taipei)

•

Kapal Kumar Vohra - Deposit Insurance and Credit Guarantee

Corporation (India)

| |

|

|

|

|

|

|

Having served on the Executive Council (EXCO) since the last AGM, in October 2016, the individuals below have retired from EXCO. The participation of these individuals in the leadership of IADI will be greatly missed. Each has served diligently to advance the Association’s mission and objectives.

• Jorge Castaño - Fondo de Garantías de Instituciones Financieras (Colombia)

•

John M. Chikura- Deposit Protection Corporation (Zimbabwe)

•

Thierry Dissaux- Fonds de Garantie des Dépôts et de Résolution (France)

•

Yee-Ming Lee- Malaysia Deposit Insurance Corporation

•

Noel Nunes- Deposit Insurance Corporation, Trinidad and Tobago

•

Hiroyuki Obata- Deposit Insurance Corporation of Japan

•

Cristina Orbeta- Philippine Deposit Insurance Corporation

•

David Salamanca- Fondo de Garantias de Instituciones Financieras (Colombia)

• Roberto Tan- Philippine Deposit Insurance Corporation

|

|

|

|

|

|

|

A link to the Press Release regarding the Annual General Meeting, and

its elections, may be found

here. |

|

|

|

|

|

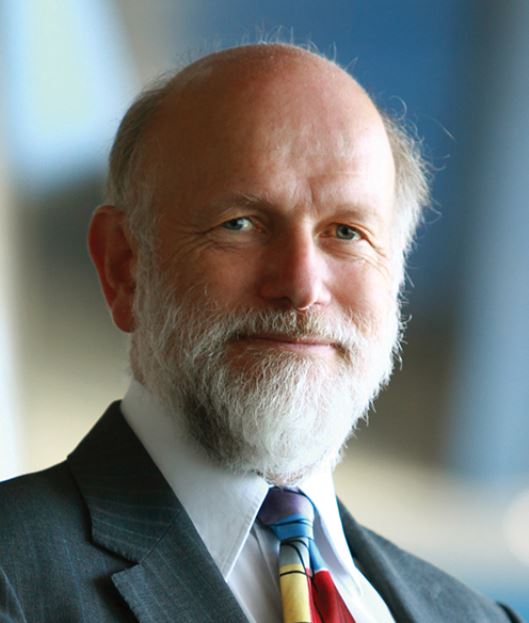

Message from the IADI Secretary General, David Walker

|

|

|

|

|

|

|

|

The past six months have seen significant new developments and accomplishments in IADI. On 12 October 2017, the Governor of the Deposit Insurance Corporation of Japan (DICJ), Katsunori Mikuniya, was elected to serve as our President and as the Chairman of the IADI Executive Council for a three-year term. We also said goodbye to our previous IADI President, Thomas Hoenig, who during his term of office spearheaded the Association’s governance reforms and oversaw the development of a new training and technical assistance strategy, the development of a research unit and an

Updated Handbook for Assessing Compliance with the IADI Core Principles. In addition, IADI welcomed our re-elected Treasurer John Chikura and seven IADI Members'

Designated Representatives to fill vacancies in the Executive Council.

|

|

|

|

|

|

|

|

|

|

|

On all fronts we continue to make progress in advancing IADI’s strategic goals, such as improving the delivery of IADI’s training, technical assistance, and capacity building services, the advancement of IADI’s policy and research efforts, and member outreach. The IADI Training and Technical Assistance Committee (TTAC), collaborated with the Secretariat in its planning and facilitation for the five Regional Technical Assistance Workshops (TAWs), which were held in Morocco, Italy, Brazil, Indonesia and Kazakhstan. Additionally, the TAWs provided an opportunity for outreach to organisations that are not yet IADI Members. Also, IADI finalised its Hosting Policy for Executive Council and Annual General Meetings, aimed at establishing protocols for the planning and execution of such meetings. |

|

|

|

|

|

|

|

Outreach efforts by the Secretariat and Association representatives to

promote collaboration of deposit insurance systems, and encourage wide

international contact among deposit insurers and other interested

parties, resulted in IADI welcoming one new Member, in addition to

interest shown by a several other prospective Members, during the

reporting period. As of the end of November 2017, IADI had 106

participants, comprising 84 Members, 8 Associates and 14 Partners. The

Secretariat is also working closely with the Member Relations Council

Committee (MRC) to develop more effective means to attract new members

and to enhance the understanding of the benefits provided to existing

Members, Associates and Partners. |

|

|

|

|

|

|

|

In addition to the successful execution of the

fourth Biennial Research Conference in June 2017, the Secretariat Research Unit continued to work in collaboration with IADI’s Core Principles and Research Council Committee (CPRC) in strengthening the Association’s information and database on deposit insurance systems around the world. The 2017 Annual Survey was launched in September 2017 and builds upon the 2016 Annual Survey, which included 124 responses from deposit insurance organisations around the world. |

|

|

|

|

|

|

|

The support of the BIS has been integral to IADI’s success. As well as hosting the Association and contributing to its operations, the Secretariat partners with the Financial Stability Institute (FSI) to provide online tutorial subscriptions to FSI Connect for our Members, and jointly host conference and training events. The FSI and IADI jointly held an early supervisory intervention and deposit insurance meeting in September 2017 with 44 participants from deposit insurance resolution authorities and supervisors. Further, in January 2018, FSI and IADI will jointly host the eighth Bank Resolution, Crisis Management, and Deposit Insurance Conference, in Basel. |

|

|

|

|

|

|

|

During the new year, we look forward to working with the IADI

Membership, the President and Executive Council, the Secretariat staff

and secondee-sponsoring organisations to promote more effective

deposit insurance systems and to contribute towards global financial

stability. |

|

|

|

|

|

|

|

|

Highlights from the 16th IADI

Annual Conference

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

HHosted by the Autorité des marchés financiers (AMF),

during the 50th anniversary of the establishment of the Québec deposit insurance system, IADI held its 16th Annual Conference in Québec City, Canada, on 11-12 October 2017, and was attended by over 230 participants, representing around 70 jurisdictions worldwide.

The IADI Annual Conference, lasting one and half days, had the theme “Deposit Insurance for All – Adapting the Core Principles to Different Structures, Mandates and Types of Institutions”, and featured presentations and panel discussions by top policymakers, deposit insurers, industry members and prominent academics to discuss, debate and provide insights on the adaptation for financial cooperatives of the international standards and resolution tools developed after the financial crisis for traditional banks.

A keynote address was provided by Mr Thomas Hoenig (IADI President and Chair of the Executive Council, and Vice Chairman of the Federal Deposit Insurance Corporation (FDIC), USA). Mr Hoenig emphasised that, whilst deposit insurance serves a most useful purpose, the side effects of moral hazard may be mitigated if the insurers and supervisors involved insisted on good oversight through sound bank supervision, reliable capital standards, and insurance pricing that holds banks accountable for the risk profile they choose.

Mr Louis Morisset, President and Chief Executive Officer / Président-directeur general

of AMF, stressed that through its membership in IADI, the AMF contributes locally acquired expertise, especially by having one of the largest cooperative financial groups in the world present in Québec. It also helps foster a better understanding by the international community of how bank resolution tools can be adapted to financial cooperatives.

Conference attendees were also privileged to be addressed by Mr Carlos J. Leitao, Québec Minister of Finance, who provided an overview of the important legislative reforms pertaining to the Québec financial sector and the new tools that the AMF will have to fulfill its mission more effectively. Keynote addresses were also provided by Mr Martin Gruenberg (Chairman of the FDIC, and former IADI President) and Mr Jean-Pierre Sabourin (Founding President of IADI, and Former Chief Executive Officer, Malaysia Deposit Insurance Corporation).

IADI wishes to expresses its appreciation to AMF, Louis Morisset; Patrick Déry, Superintendent, Solvency, and the Designated Representative of AMF, along with Julien Reid, Senior Director, Financial Institutions Oversight, Resolution and Deposit Insurance, and all AMF employees, for their excellent hosting and organisation of the Annual Conference, Annual General Meeting, and Executive Council Meetings.

A link to the Annual Conference presentations may be found

here,

along with the

Press Release. |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Key Achievements and Updates from the

Council Committees (CCs) and their

Technical Committees (TCs)

|

| |

|

|

|

|

Audit and

Risk Council Committee (ARCC) - chaired by by Sonja Lill Flø Myklebust, Norway Audit and

Risk Council Committee (ARCC) - chaired by by Sonja Lill Flø Myklebust, Norway |

|

|

|

-

Audit Plan for the IADI Website Relocation and Enhancement Project- Phase II of the Audit Plan is currently being revised.

-

IADI Financial Statements and the Secretariat’s Quarterly Reports on the Statement of Activities and Financial Position for the FY 2017/2018- continue to be reviewed, whenever produced.

-

Audited Financial Statements for FY 2016/2017- approved at the AGM held in October 2017.

-

Policy Matrix on Delegation of Powers in IADI Operations- revised by Secretariat and reviewed for consistency with the revised governance framework, and finance and accounting policies, procedures and practices.

-

Technical Committee on Risk Management under ARCC- establishment of this TC is being considered.

|

|

|

|

|

|

|

|

Core Principles and Research Council Committee (CPRC)-

chaired by William Su, Chinese Taipei

Core Principles and Research Council Committee (CPRC)-

chaired by William Su, Chinese Taipei |

|

|

|

-

Research and Guidance Technical Committee (RGTC)- chaired by Yvonne Y. Fan, CDIC, Chinese Taipei - drafting continues on six research and guidance papers, covering the topics on Recoveries from Assets of Failed Banks, Bail-in and Deposit Insurance, Deposit Insurance Fund Target Ratio, Purchase and Assumption, Public Policy Objectives, and Financial Inclusion and Innovation.

-

Islamic Deposit Insurance Technical Committee (IDITC)- chaired by Rafiz Azuan Abdullah, MDIC, Malaysia- drafting continues on the Core Principles for Islamic Deposit Insurance Systems, with input from Shari’ah scholars as required.

-

Data and Survey Technical Committee (DSTC)- chaired by Eugenia Kuria Alamillo, IPAB, México- discussions are ongoing regarding transition of duties to the IADI Secretariat from this interim Technical Committee. New IADI data management and survey tools are being built.

-

EXCO approval received for the release of two draft papers for full public consultation. These are (1) a research paper on Resolution Issues for Financial Cooperatives - Overview of Distinctive Features and Current Resolution Tools; and (2) a discussion paper on Shari’ah Governance for Islamic Deposit Insurance Systems.

-

CPRC approval of two research topics, namely, Risk Management and Internal Control Systems of Deposit Insurance Systems, and Differential Premium Systems, for the fiscal year of 2018.

|

|

|

|

|

|

|

|

|

|

|

Member Relations Council Committee (MRC)- chaired by Kapal Kumar Vohra, India

Member Relations Council Committee (MRC)- chaired by Kapal Kumar Vohra, India |

|

|

|

-

Membership Benefits document- outlining benefits of membership for new and existing Members- drafted by IADI Secretariat in conjunction with the MRC, and is currently being finalised.

-

Communications Strategy Implementation Plan- building on the efforts of the former Standing Committee to revise the Communications Plan, the MRC is prioritising

various communications initiatives.

-

Working Group on the Code of Ethics and Conduct- led by Giuseppe Boccuzzi, of the FITD, Italy- drafting continues following

consultation with all Regional Committee Chairpersons and their members.

|

|

|

|

|

|

|

|

|

|

|

|

Training and Technical Assistance Council Committee (TTAC)-

chaired by Raúl Castro Montiel, México

Training and Technical Assistance Council Committee (TTAC)-

chaired by Raúl Castro Montiel, México |

|

|

|

-

Policy on Hosting IADI Annual General and Executive Council Meetings and Conferences (Hosting Policy)- approved by EXCO.

-

Expert Training for Assessing Compliance with the Core Principles- a programme of intensive courses for highly qualified senior staff from IADI Members is being developing, with a first session scheduled for March 2018 (invitation only).

-

Regional Technical Assistance Workshops (TAWs)- first held in March 2017, TAW agendas are specifically designed to address the training and technical assistance of the region in which they are held. By the end of 2017, at least one TAW would have been held in every region.

-

Technical Committees - the Training and Conference Technical Committee (TCTC, chaired by Fred Carns, FDIC, USA) and Technical Assistance Technical Committee (TATC, chaired by Alex Kuczynski, FSCS, United Kingdom) have been established or reconstituted with new/revised memberships. An initial activity planned by the TATC is the enhancement of the Register of Experts, which will specify the areas of expertise held by individual Member, and which may be utilised whenever IADI receives a request for particular expertise.

|

|

|

|

|

|

|

|

|

|

The IADI Annual Survey 2017 and the IADI

Secretariat Research Unit

|

|

|

|

|

|

|

In September 2017, IADI launched its seventh Annual Survey of Deposit Insurance Systems worldwide, which is the most comprehensive source of such data.

We would like to express our sincere appreciation to those that have completed and made their IADI Annual Survey submissions to date, for their continued support and commitment to this endeavour.

We are also happy to announce the release of the 2016 IADI Annual Survey results. The data received has been thoroughly validated and a number of modifications to the final dataset have been introduced to make it more user-friendly. The

15 Key DIS Features and the accompanying

press release are available on the IADI website and the full data set is available on the Members’ Only Site (eBIS). Should you have any questions regarding the Annual Survey findings, please do not hesitate to contact us.

|

|

|

|

|

The Annual Survey efforts have been led by the IADI Secretariat Research Unit (RU), which is managed by Kumudini Hajra, IADI’s Senior Policy and Research Advisor (SPRA). The RU has been involved in directing or undertaking a number of other initiatives, such as:

-

The Subcommittee on the Deposit Insurers’ Role in Crisis Management and System-wide Crisis Preparedness,

held its third meeting on 4-5 December 2017, in Basel, to discuss the first draft of the paper. A questionnaire was circulated to the IADI Members on 30 June 2017, to which 52 IADI Members responded and, in addition, case studies have been prepared

by 10 Members. The Secretariat is grateful to all contributing Members.

-

Drafting a Request for Quotation (RFQ) for the Data Analysis, Collection, Reporting and Management System (DCARMS)- a system intended to create a better, more user-friendly, responsive interface for those with queries, technical needs, or carrying out research.

-

Working with the DSTC, in preparation for transition of its functions and duties to the RU.

-

Participation by the SPRA in meetings and conference calls of the Resolution Steering Group (ReSG) and Cross-border Crisis Management Group (CBCM) of the Financial Stability Board (FSB) and its Work Stream on Funding in Resolution. In addition, the SPRA is working with the FSB on its implementation monitoring project to assess compliance with the

FSB Key Attributes.

-

Attendance by the SPRA at the Annual General Assembly of the European Forum of Deposit Insurers (EFDI) in Oslo, Norway, in September 2017, giving a presentation on IADI activities whilst there. The SPRA has also given presentations on the work of the RU at various IADI meetings, for example, at EXCO, CPRC, and DSTC meetings, as well as the IADI AGM (click here for a link to the AGM presentation).

|

|

|

Additional Events, Training, Seminars and Conferences (July

to December 2017)

|

|

|

|

|

|

|

Asia-Pacific Regional Committee (APRC) Annual Meeting, Regional Technical Assistance Workshop (TAW) and International Conference

- Yogyakarta, Indonesia

From 17-20 July 2017, the APRC was hosted by the Indonesia Deposit Insurance Corporation (IDIC) in Yogyakarta, Indonesia. The APRC Regional TAW took place on 17-18 July 2017 and aimed to upgrade the participants in three main resolution topics: Dealing with Problem Banks; Financial Safety Net Arrangements; and Resolution Funding. Following the APRC Annual Meeting, the APRC International Conference, entitled ‘Reforming Deposit Insurance – How Far Have We Gone?’ was held on 19 July 2017. The Conference (which was open to all IADI participants) included discussions on reforming deposit insurance systems post the previous financial crises, particularly DIS mandate expansion and how to strengthen a DIS’ capacity responding to the dynamic situation of a financial system. It also included lessons learned from transformation of DISs around the globe, the experience sharing of Bank Restructuring Programmes from past financial crises, and how to prepare for a future crisis by establishing sound coordination among financial safety net members. |

|

|

|

|

|

|

Caribbean Regional Committee (CRC) International

Workshop and Simulation Exercise - Montego Bay, Jamaica

The Caribbean Regional Committee (CRC) organised a ‘Bank Resolution Workshop and Simulation Exercise’- hosted by the Jamaica Deposit Insurance Corporation (JDIC) in Montego Bay, Jamaica, on 17-21 July 2017. The sessions, which were held over five days and facilitated by subject matter experts from the U.S. Department of the Treasury’s Office of Technical Assistance (US OTA), worked within the delegates to go through the entire timeline of a bank resolution. They comprised, problem bank identification, supervision and monitoring, onsite asset valuation, insured deposits compensation, least costs tests, right through to the Purchase and Assumption Process and dealing with receivership claims. |

|

|

|

|

|

|

Eurasia Regional Committee (EARC) International Technical Seminar and Conference – Almaty, Kazakhstan

The 10th Eurasia Regional Committee (EARC) Annual Meeting & International IADI Technical Seminar-Conference on the ‘Core Principles for Effective Deposit Insurance Systems and Islamic Deposit Insurance’

was hosted by the Каzakhstan Deposit Insurance Fund (KDIF), in Almaty, Kazakhstan, on 4-6 September 2017. The sessions were moderated and presented by key prominent individuals from the areas of deposit insurance, international financial institutions, and central banks. The topics covered during the three-day event focused on the Core Principles (CPs) and how they related to the resolution of problem banks, the CPs and Islamic deposit insurance systems, as well as discussions regarding the practical issues of problem bank resolution and liquidation. |

|

|

|

|

|

|

Joint Financial Stability Institute FSI-IADI Policy Implementation Meeting

- Basel, Switzerland

The FSI and IADI jointly held their first Policy Implementation Meeting (PIM) on ‘Early Supervisory Intervention, Resolution and Deposit Insurance’ in Basel, Switzerland, on 12-13 September 2017. The PIM program, attended by 40 supervisors and deposit insurer resolution authorities, gave an opportunity for heads of departments at supervisory and deposit insurer/resolution authorities to explore the practical and critical implementation challenges and coordination issues related to the concept of ‘early intervention and resolution’. Those attending were mid-to-high level practitioner deposit insurers with bank resolution mandates (e.g. Canada, Chinese Taipei, Colombia, Italy, Japan, Kenya, Korea, Malaysia, Mexico, Nigeria, Philippines, Poland, USA) and, due to its success, future PIM events are being planned. |

|

|

|

|

|

|

Africa Regional Committee (ARC) Annual Meeting and Annual Conference

- Victoria Falls, Zimbabwe

ARC Annual Meeting and Annual Conference was year held on 6-8 November 2017, at Victoria Falls, Zimbabwe, and was hosted by the Deposit Protection Corporation, Zimbabwe. The Conference, with the theme ‘Deposit Protection and Financial Technology Linked Deposits’, shared views on the growth of financial technology (FinTech) services in Africa and their challenges to DISs, FinTech-related experiences and initiatives from members, and the role of Deposit Insurance in Financial Inclusion.

|

|

|

|

|

|

|

Middle East & North Africa Regional Committee (MENA) Seminar on the IADI Core Principles -

Tunis, Tunisia

MENA Seminar on the IADI Core Principles was held in late November 2017, in Tunis, Tunisia. Reflecting MENA’s commitment to the efforts in assisting countries in the region to be familiar with the IADI Core Principles, the workshop’s primary purpose was to provide a focus on the Core Principles and especially on the implementation issues regarding the legal and operational point of view, while taking into account each jurisdiction’s particular characteristics. The MENA Committee and the Central Bank of Tunisia worked together in organising this event, which was attended by both IADI Members and those not currently IADI Members. |

|

|

|

|

|

|

Subcommittee on the Deposit Insurers’ Role in Crisis Management and System-wide Crisis Preparedness

- Basel, Switzerland

Meeting of the Subcommittee on the Deposit Insurers’ Role in Crisis

Management and System-wide Crisis Preparedness was held on 4-5

December 2017, in Basel, Switzerland, and hosted by the IADI

Secretariat. |

|

|

|

|

|

|

Nigeria Deposit Insurance Corporation (NDIC) Academy - in Abuja, Nigeria

The Nigeria Deposit Insurance Corporation (NDIC) Academy, based in Abuja, Nigeria, designed and held eight courses for member jurisdictions during the reporting period, all of which were free of charge. The Academy groups its curricula into five ‘schools’ namely, Bank Supervision, Bank Failure, Resolution, Deposit Insurance Consumer Protection, Information Technology and Management Development and has facilities such as - classrooms, syndicate rooms, a mini gym, an online library, a creche, an ICT Centre, a restaurant and boarding partner hotels. An array of courses are offered, tailored to the needs of various DIS agencies; all being designed and delivered in collaboration with local and international Regulatory and Supervisory agencies. Further information may be found on the

NDIC Academy’s website or within its

brochure. |

|

|

|

|

Asia-Pacific Regional Committee (APRC) New Chairperson

The Association congratulates members of the Asia-Pacific

Regional Committee (APRC) for the selection of

William Su, Central Deposit Insurance Corporation, Chinese Taipei,

as their Chairperson for a two-year term. Ratification of this

selection will be sought during the Executive Council’s next meeting,

in January 2018.

Mr Su

succeeds Hiroyuki Obata, who recently retired from his position as

Deputy Governor of the Deposit Insurance Corporation of Japan (DICJ).

Mr Obata had chaired the APRC since 2011, during which time he

led a number of initiatives to strengthen deposit insurance systems,

as well as increase co-operation both within the region and with

regions across the globe. For example, one of the most recent

initiatives led by Mr Obata was the Strategic Priorities and Action

Plans Committee (SPAC) initiative, to develop the implementation

strategies for achieving the region’s action plans to enhance the

effectiveness of the APRC and to add further value to its members.

The Association thanks Mr Obata

for his outstanding service and dedicated commitment to advancing the

objects of the Association, and wishes him every success and happiness

for the future. |

|

|

|

|

Non-IADI events attended by the IADI Secretariat members

In addition to playing a key role in the events above, the

Secretariat and, especially the Secretary General and the Senior

Policy and Research Advisor (SPRA), have continued consolidating the

profile of IADI by actively participating in events organised by

partner organisations. For example, the SPRA has participated at the

European Forum Deposit Insurer’s (EFDI’s) Annual General Assembly in

Oslo, Norway, and in a number of Financial Stability Board’s (FSB’s)

meetings and discussions such as the Resolution Steering Group

meetings, in addition to Cross-border Crisis Management Group meetings.

The Secretary General made a presentation and moderated a session on deposit insurance at a conference held in Cape Town, South Africa, sponsored by the South African Reserve Bank and World Bank, which focussed on bank resolution and deposit insurance. The panel of the moderated session included John

M. Chikura, of the Deposit Protection Corporation of Zimbabwe, and Umaru Ibrahim, of the Nigeria Deposit Insurance Corporation. The Secretary General also spoke on deposit insurance and development of Financial Institutions at a World Bank Symposium in Kuala Lumpur, Malaysia, in September 2017, and to the Federal Financial Institutions Examination Council (FFIEC) in Washington D.C., USA, in August 2017.

|

|

Key

IADI Membership Benefits

|

| |

|

|

|

|

Since inception in May 2002, IADI has continually strived in its efforts to ‘share deposit insurance expertise with the world’, and in doing so has grown from the 25 founding Members to over 100 participants, in addition to having become a recognised

international standard setter and evaluator.

Below are just some of the many benefits of membership of IADI. If you are a prospective, or existing, Member and wish to discover more about these, and other benefits, we invite you to contact the

IADI Secretariat. |

|

|

|

-

IADI is an

international standard-setting body, with our standards recognised and utilised around the world and by international organisations;

-

Participate in developing IADI Core Principles, standards, guidance and assessment methodologies to enhance the effectiveness of deposit insurance systems;

-

Share expertise and information on deposit insurance issues through training, development and educational programs;

-

Participate in Capacity Building, Conferences, Executive Training and E-learning;

-

Engage in Regional Technical Assistance Workshops, to address Member challenges, capacity building, and help in improving compliance with the IADI Core Principles for Effective Deposit Insurance Systems;

-

Access to, and cooperation with, other international organisations, particularly those involved in issues related to financial markets and the promotion of financial stability (e.g. the Financial Stability Institute, IMF, World Bank, etc);

-

Participation in joint IADI and Financial Stability Institute (FSI) conferences and the FSI-Connect e-learning tool;

-

Access to IADI’s Member-only web site, including comprehensive data on deposit insurers from

IADI Annual Surveys for benchmarking and other purposes;

-

Create awareness for, and highlight the importance of, deposit insurance in maintaining financial stability among safety-net partners and deposit taking institutions within a Member’s jurisdiction;

-

Access to ongoing, timely IADI research on emerging trends in deposit insurance and deposit taking institution resolution;

-

Provision of IADI guidance on assessing compliance with the Core Principles and unique

Member-only access to the Self-Assessment Technical

Assistance Program (SATAP), of importance in

preparation for IMF/ World Bank FSAPs, Technical Assistance and

FSB Peer Reviews.

|

|

|

|

|

The IADI Secretariat can place you in direct contact with the Chairperson of the IADI Regional Committee in your region to provide you with additional information and assistance. |

|

|

|

|

|

|

|

New IADI Participants

|

|

|

|

|

|

Join us in welcoming IADI’s

new Member, the West African Monetary Union Deposit Insurance Fund

|

|

|

|

|

|

|

-

West African Monetary Union Deposit Insurance Fund

The

West African Monetary Union Deposit Insurance Fund / Fonds de Garantie des Dépôts dans l’Union Monétaire Ouest Africaine (FGD-UMOA) was incorporated on 21 March 2014. It was created by the West African Monetary Union Central Bank as an Economic and Financial International Institution, with a legal personality and financial autonomy. Significantly for IADI, this member comprises eight (8) different jurisdictions which use the same currency and central bank, these jurisdictions being, Bénin, Burkina Faso, Côte d’Ivoire, Guinée Bissau, Mali, Niger, Sénégal, Togo.

As membership is mandatory for commercial banks and micro-finance institutions in all eight jurisdictions, the fund covers approximately 120 banks and 56 microfinances in total. The coverage limit provided is 1,400,000 XOF (approx. 2,500USD) for bank depositors and 300,000 XOF (approx. 530 USD)

for micro-finance accounts- equating to 87% of bank depositor accounts, and 95% of micro-finance accounts, being fully covered by the fund. The mandate for the fund is a pay-box, with the use of ex-ante funding and a flat-rate premium system.

The West African Monetary Union Deposit Insurance Fund was represented in its application by its General Manager, Mr Habib Soumana. Ratification of the Fund’s approval to become an IADI Member was made by the Executive Council in October 2017, in Québec City, Canada. IADI looks forward to working closely with, and supporting, the West African Monetary Union Deposit Insurance Fund!

|

|

|

|

|

|

|

|

|

|

|

As at the end of November 2017, IADI’s membership stood at 106 participants, including 84 Members, 8 Associates and 14 Partners.

for the full IADI Members and Participants list.

for the full IADI Members and Participants list. |

|

|

|

|

|

|

|

Forthcoming Events (January

to end June 2018, plus advance notice of events in 2018)

|

|

|

|

|

|

|

54th Executive Council Meetings

29 – 30 January 2018 | Basel, Switzerland

To be hosted by the IADI

Secretariat

Registration for these events (including the agenda, and accommodation and visa application assistance) is now open and may be found

here.

** Please note, if attending both the 54th EXCO Meetings and the 8th Joint FSI-IADI Conference immediately proceeding it, please book your hotel accommodation for the

entire duration of your stay when registering for the 54th EXCO Meetings.

|

|

|

|

|

|

|

|

|

|

|

|

8th Joint Financial Stability Institute (FSI) - IADI Conference on “Bank Resolution, Crisis Management and Deposit Insurance”

31 January – 2 February 2018 | Basel, Switzerland

To be hosted by IADI and the

Financial Stability Institute (FSI)

One of IADI’s flagship events, featuring prominent speakers from the banking industry, regulatory and deposit insurance/ resolution authorities, and academia, this Conference will look at progress in implementing effective resolution and deposit insurance regimes, the current state of early supervisory intervention, and recovery and resolution planning.

Registration for this Joint Conference (including the agenda, and accommodation and visa application assistance) is

open

until 12 January 2018 and may be found

here.

|

|

|

|

|

|

|

|

|

|

|

|

Europe Regional Committee (ERC) Annual Meeting and International Conference

22 – 23 March 2018 | Naples, Italy

To be hosted by the ERC and the Interbank Deposit Protection Fund (Italy)

|

|

|

|

|

|

|

|

|

|

|

|

Expert Training for Assessing Compliance with the Core Principles (By Invitation Only)

26 – 27 March 2018 | Naples, Italy

To be hosted by the FITD and

IADI’s Training and Technical Assistance Council Committee (TTAC)

|

|

|

|

|

|

|

|

|

|

|

|

16th Asia-Pacific Regional Committee (APRC) Annual Meeting and International Conference

16 – 18 April 2018 | Hanoi, Vietnam

To be hosted by the APRC and the

Deposit Insurance of Vietnam

|

|

|

|

|

|

|

|

|

|

|

|

Third Americas’ Deposit Insurance Forum, Regional Technical Assistance Workshop, and Annual Meetings of the Latin America Regional Committee (LARC), Caribbean Regional Committee (CRC), and Regional Committee of North America (RCNA)

April 2018 | México

To be hosted by the

IADI TTAC and

Instituto para la Protección al Ahorro Bancario (IPAB, México)

|

|

|

|

|

|

|

|

|

|

|

|

11th Eurasia Regional Committee (EARC) Annual Meeting and the International Seminar and Conference

7 – 9 May 2018 | Istanbul, Turkey

To be hosted by the

IADI TTAC and

Savings Deposit Insurance Fund (Turkey)

|

|

|

|

|

|

|

|

|

|

|

|

55th Executive Council Meetings

28 May – 1 June 2018 | Moscow, Russian

Federation

To be hosted by the IADI Secretariat and the

Deposit Insurance Agency (Russian Federation)

Please note, we anticipate a number of IADI participants will require visas for entry to the Russian Federation and are advised to begin their visa applications as soon as possible. Further details and assistance will be provided upon opening of registration for these events, in the coming months.

|

|

|

|

|

|

|

|

|

|

|

|

Additionally, below is advance notice of further events

scheduled to take place in 2018:- |

|

|

|

|

|

|

|

|

|

17th IADI Annual General Meeting and Annual Conference

56th and 56th bis Executive Council, Regional, Council Committee and Technical Committee Meetings

14 – 19 October 2018 | Victoria Falls, Zimbabwe

To be hosted by

Deposit Protection Corporation, Zimbabwe

|

|

.JPG) |

|

|

|

|

|

|

|

Acknowledgement and Celebrations of Members’ Anniversaries

In Memoriam

|

|

|

|

|

|

|

|

It is with deep regret that we note the passing of Professor David G. Mayes, who died in November 2017, following a short illness. Most recently, he was Professor of Banking and Financial Institutions at the University of Auckland, New Zealand, prior to which he had been Advisor to the Board at the Bank of Finland, and Chief Manager and Chief Economist at the Reserve Bank of New Zealand, following spells in universities, research institutes and public sector institutions. Since completing his doctorate on European integration in 1971, he authored almost 50 books and nearly 300 academic articles, publishing widely in the areas of finance, deposit insurance, cross-border issues and disruptive technologies. In addition, Professor Mayes advised over 20 central banks during his career.

|

|

|

|

|

|

|

|

|

|

|

The Association would like to place on record our sincere gratitude to Professor Mayes, who had been a committed and active member of IADI’s Advisory Panel since its inception. We would also like to offer our sincere condolences to Professor Mayes’ wife, family and friends. |

|

|

|

|

|

|

|

|

|

The International Association of Deposit Insurers (IADI) was formed in May 2002 to enhance the effectiveness of deposit insurance systems by promoting guidance and international cooperation. Members of the IADI conduct research and produce guidance for the benefit of those jurisdictions seeking to establish or improve a deposit insurance system. Members also share their knowledge and expertise through participation in international conferences and other forums. The IADI currently represents 84 deposit insurers, 8 Associates and 14 Partners. The IADI is a non-profit organisation constituted under Swiss Law and is domiciled at the Bank for International in Basel, Switzerland.

|

|

|